5 Things Sirius XM Holdings In You to Know (SIRI)

Post on: 26 Май, 2015 No Comment

Source: Sirius XM.

Late last month, Sirius XM Holdings ( NASDAQ: SIRI ) posted another quarter of strong results. The only game in town when it comes to satellite radio is more popular than ever, armed with a record 26.3 million subscribers.

Sirius XM is thriving in a time when the competitive marketplace seems to be intensifying. A growing number of streaming options and more automakers embracing the connected car inevitability that makes it seamlessly easy to stream music apps seem to be making life interesting for the satellite radio giant, but it’s been able to navigate the challenges with ease in recent years.

Sirius XM had some interesting nuggets in the earnings call that followed its quarterly report. Let’s dive into a few of them.

Revenue and subscriber growth aren’t the only metrics to watch

Our scalable business model with high variable margins is unmatched in media. — CEO Jim Meyer

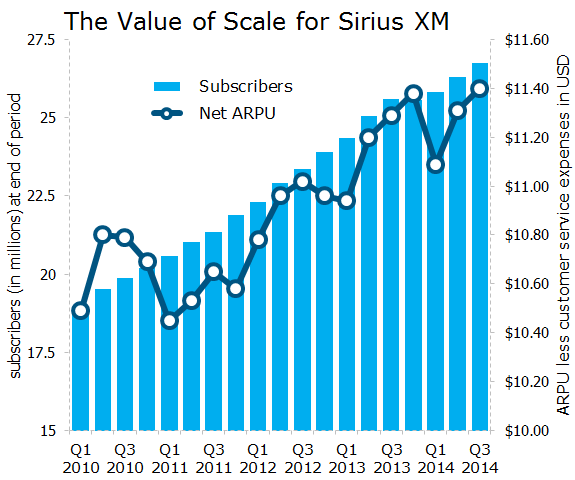

Most people flock to the 5% in subscriber growth that Sirius XM has generated over the past year, and the rising average revenue per subscriber that resulted in a 10% uptick on the top line. Revenue and subscriber growth are easy to understand, and they do represent the best metrics for measuring satellite radio’s popularity.

However, smarter investors are more excited by the company’s profitability and free cash flow that continue to move at a faster clip than its member tally or revenue. This is a business with high fixed costs — satellites aren’t cheap — but low variable costs. Expanding revenue doesn’t create a commensurate spike in expenses beyond the royalties that Sirius XM shells out. It’s why free cash flow soared 42% in the quarter to a record $335 million. This is why even a Sirius XM growing its revenue at an 8%-10% clip could still deliver much stronger bottom-line growth.

Revenue and subscriber counts matter as a metric of customer migration, but it’s ultimately free cash flow and other efficiency measuring sticks that determine how much money it can use to buy back shares or invest in more content.

Conversion rates are slipping as the quality of car buyers diminish

Our new car penetration this year is about 70% which has never been higher. As sales climb back to record levels, we are, however, seeing the mix of leases at an all time high, and average credit scores have dropped considerably. — Meyer

We’ve been seeing conversion rates trend lower in recent quarters. A couple of years ago, 46%-48% of car buyers with factory-installed satellite receivers would stay on as paying customers. Now we’re down to 42%.

Sirius XM is saying that cash-strapped buyers are accounting for a growing share of folks driving off the lot with new cars, having to settle for leases instead of outright purchases. When disposable income is tight, premium radio becomes a luxury. The good news here is that Sirius XM points out that absolute conversions are still at record levels. In other words, Sirius XM is making it up in volume.

The used car market opportunity continues to develop — slowly

Conversion rates in the second owner business continue to run in the low 30s. — Meyer

If 42% sounds bad for the rate of folks sticking around as paying customers in new cars, you’re not going to like that less than a third of the people buying used cars with existing receivers are signing on as paying subscribers.

The good news on that front is that this is incremental. There weren’t a lot of secondhand cars with Sirius or XM receivers a few years ago, but with 70% of all new cars now hitting showrooms with access we’re starting to see more trade-ins. Sirius XM has also struck deals with 13,000 dealerships to collect contact info of used car buyers to market the dormant receivers. At the end of the day, the percentage of new Sirius XM subscribers coming from second market vehicles has grown from 19% two years ago to 27% today.

Sirius XM still has a ton of shares outstanding, but it’s working on it

Since late in 2012, we have returned approximately $3.75 billion to shareholders via a special dividend and share repurchases. Since the share repurchase program began, we have retired approximately 950 million shares or more than 14% of the company’s then outstanding shares. Since the beginning of the second quarter alone, we have retired more than 6% of the company’s shares outstanding. — CFO David Frear

The one downer in the success that Sirius XM has had over the years is that it has more shares outstanding than only a handful of other companies. There are a lot of reasons for that. As a stand-alone company, Sirius Satellite Radio saw its share count bloat as the profitless company resorted to dilutive tactics to stay afloat. Merging with XM Satellite Radio doubled its share count in 2008, and getting bailed out by John Malone a year later resulted in a 40% preferred share stake that made its effective share count balloon even more.

The end result is that profitability doesn’t amount to much on a per-share basis. Sirius XM is doing its part, taking advantage of its expanding free cash flow and improving credit rating to eat into its massive outstanding share count.

Satellite radio could be just the beginning

Meyer was asked if Sirius XM had plans to contact its growing subscriber base to offer more than just premium audio.

Do we have any plans today that we’re ready to announce? No. Are we actively looking at that? All the time. — Meyer

Meyer didn’t say much, but in doing so he said a lot. Naysayers argue that satellite radio will never be the kind of money maker that satellite television has been. That may be true, but we’ve already seen Sirius XM successfully increase its rate twice over the past three years. Sirius XM has already made a meaty acquisition in the connected vehicles business.

As its subscriber base grows so will the opportunities to make more money. Analysts are asking, and Meyer is conceding that his company is looking at that bar-raising aspect all the time.

There’s a potentially bigger auto trend opportunity than satellite radio

A major technological shift is happening in the automotive industry. Most people are skeptical about its impact. Warren Buffett isn’t one of them. He recently called it a real threat to one of his favorite businesses. An executive at one automotive giant called the technology fantastic. The beauty for investors is that there is an easy way to ride this megatrend. Click here to access our exclusive report on this stock.