5 Myths of Volatility Options

Post on: 16 Март, 2015 No Comment

Key Points

- Volatility options are very different from regular index options—proceed with caution. These products are gaining popularity among retail traders. We tackle five common myths about volatility options.

Previously, I’ve written about the CBOE Volatility Index® (VIX®)—covering its introduction in 1993, the formula change in 2003, the introduction of futures on the VIX in 2004 and finally options on the VIX in 2006.

I’ve also discussed how different VIX options are from other exchange-traded options. Oftentimes the (historical) volatility of volatility can reach exceptionally high levels when the markets go through periods of instability. The VIX ($VIX) tends to be very sensitive to quick reversals in the market.

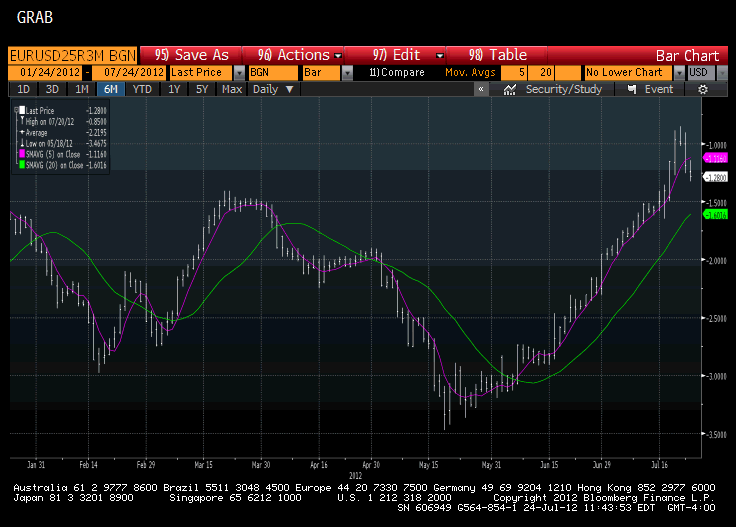

For example, we can see that the 20-day historical volatility of the VIX (represented by the blue line in the chart below) was over 200% in 2008, 2010, and 2011, compared to its lows of around 50% during this time period. This is considerably higher than the volatility of virtually any stock in the marketplace.

The VIX Itself Has Been Volatile

Source: StreetSmart Edge® as of November, 2012.

High volatility and changes in volatility create all sorts of risks, but they can also create opportunities for using volatility options to hedge against (or speculate on) sharp swings in the marketplace. As a result, the volume of options traded on the VIX has grown tremendously every year since they were introduced.

Even though the VIX is primarily an institutional product, retail volume of VIX options has been rising steadily as well. However, the unique nature of volatility options continues to cause problems for retail options traders. Let’s tackle five common myths.

Myth 1: Because the VIX is an index, volatility options on the VIX are priced just like any other index option

Not true. These volatility options are intended to reflect the expected volatility level at option expiration, not the current volatility. The value of a VIX option is an estimate based on S&P 500 (SPX) options prices.

While this methodology may cause the options to increasingly reflect the spot volatility index quote ($VIX) as they approach expiration, they typically won’t match the spot volatility quote until they are just about to expire. As a result, despite the significant volatility spikes that may occur in the market, volatility options generally reflect a much different level of volatility than you might expect—possibly half as much or twice as much.

Additionally, since volatility tends to revert to its long-term mean over time, even when volatility spikes sharply it isn’t likely to remain that high for long. In other words, when the markets are temporarily more volatile than normal, the most likely development is for them to settle down. Likewise, when the markets are unusually quiet, the odds are pretty good that volatility will pick up in the near future.

Myth 2: I trade volatility options, but I don’t have a futures account and don’t trade futures, so I don’t have to pay attention to the futures market

You should. Volatility options are not futures options, but as noted above VIX options are based on a future volatility level rather than the spot index ($VIX) quote. Therefore a better gauge for pricing VIX options may be to view the VIX futures contract for the same or next expiration month rather than the current cash VIX index. Unlike options, futures contracts do not include any time value. Instead, they are priced based on the cost of carry, which is the aggregate value of dividends and interest rates from the current date until expiration.

The best source for volatility futures quotes may be directly on the CBOE Futures Exchange (CFE). Quotes on this website are free, but typically delayed by 10 minutes. Symbols and expiration dates are different for futures than for securities, so below is a brief explanation of futures symbology.

Futures symbols

Format: Commodity symbol / expiration month + year digit

Example: VIX/Q3 is the VIX futures contract that expires in August 2013