5 Key Guidelines for Trading Stock Chart Channels Stock Trading To Go

Post on: 16 Март, 2015 No Comment

The beauty of technical analysis is that as we learn, our new skills build upon each either. Having examined stock chart trendlines in a previous article, we now turn to a variation of trendlines—trading channels.

A channel is the combination of an existing trendline and a new, parallel line known as the channel line. Normally, the share price will oscillate between the trendline and the parallel line, enabling investors to create profitable trades. As long as the price remains range-bound, we can buy at the lower end of the channel and sell at the higher end. For a deeper understanding of channels and their implications, follow these five guidelines:

1. Direction – Like trendlines, stock chart channels can be upward sloping, downward sloping, or horizontal. Also, we may see all three patterns on one chart. In the chart of the S&P Homebuilders Index (XHB) we have drawn three channels (black—parallel, red—down, and blue—up). The existing trendline is the solid line, and the dashed line represents a parallel channel line. Within this range each channel offered multiple opportunities to profit.

2. Increased profits – Trading a channel will lead to greater profits than simply trading with the trend. Baidu (BIDU) has been in a consistent uptrend since its January low. An investor who correctly called the bottom, bought the shares, and still holds this position would have a gain of 93%. While this performance is impressive, a channel trader who bought at the lower band (green arrows) and then sold at the upper band (black arrows) would see a total profit of 125%.

3. Channel failures – If a stock price fails to reach the channel line, it indicates the possibility of the channel failing. As shown with Cliff Natural Resources (CLF), the black circle indicates a rally that failed to reach the channel line and ultimately violated the horizontal trendline, leading to lower prices.

4. Channel breakouts – A move through the channel line indicates the underlying trend is strengthening. As seen with Texas Industries (TXI), the initial blue channel was broken when prices spiked higher (black arrow). This developed a more pronounced uptrend (green line) that has continued to power the stock higher.

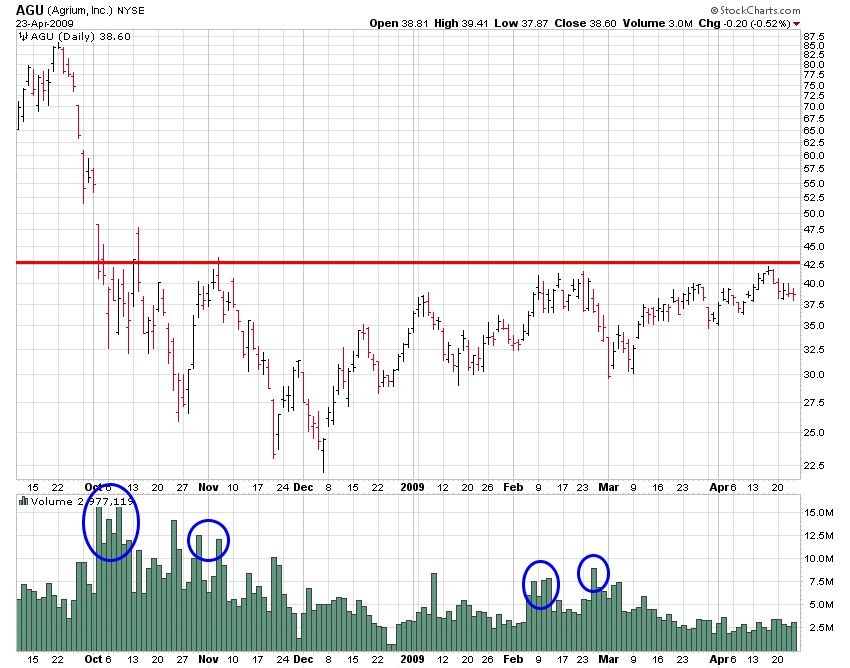

5. Measurement – The width of the channel indicates how far prices should move when the channel is violated. With Potash (POT), a wide $12 channel had guided the price higher. When the shares spiked lower through the channel (red circle), they dropped $20 from the initial channel violation and $10 from where the shares closed that day. Using the channel width as an estimate of a downside target allowed traders to set profit targets for this trade.

Successfully trading channels is an excellent way to stay ahead of the market. Following these guidelines increases the odds of success.

Sean Hannon, CFA, CFP is a professional fund manager.

Further Education, Technical Analysis: