401K Investment Alternatives Money Smart Life

Post on: 9 Апрель, 2015 No Comment

June 4, 2011

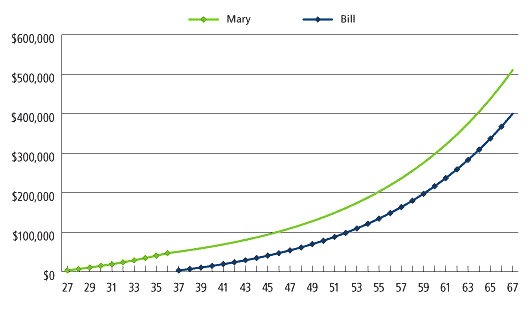

Investing for retirement is critical if you dont want to rely on Social Security alone to make ends meet in retirement. Setting aside some money today will allow it to grow over time into a much larger amount thanks to compound interest.

One of the most popular types of investment accounts to use for retirement is an employer-sponsored 401k plan. Using a 401k for retirement is usually an simple option. You fill out a form at work and the money comes out of your paycheck every time you get paid. You dont have to actively think about investing, and some employers automatically enroll employees to invest 3% of their pay.

But what if you are not a fan of your 401k? What if your employer doesnt offer a match, or your investment options are poor? Here are a few alternatives to investing in a 401k. (If you are self employed you have other options that arent included here but will be covered in a future post).

Tax-Deferred: Traditional IRA

A traditional IRA is a tax-deferred individual retirement account. These accounts fall under IRS rules for IRAs, meaning you can contribute up to $5,000 per year (or $6,000 if you are over age 50) toward your retirement. You get a tax deduction today, and pay income tax when you hit retirement and start pulling funds out. Your ability to contribute is determined by whether or not your income goes over specific IRS benchmarks. You wont be able to set aside as much money for retirement as you would in a 401k, but you gain the freedom of being able to choose exactly what investments you want to use.

- Upside: tax-deferred like a 401k, ability to choose investments

- Downside: cant contribute as much as 401k, may be limited if your income is very high

Tax-Free at Retirement: Roth IRA

Like a Traditional IRA, a Roth IRA is an account you can open at the brokerage or investment house of your choosing. You get to select the investments you want, and your ability to invest is limited by how high your income is. However, Roth IRAs are after-tax investments. You wont get a tax break today like you do with a Traditional IRA or 401k. If you think you are going to be in a higher tax bracket in retirement then it makes sense to pay tax today. Once you pay tax on the funds used to invest in a Roth IRA, you never pay income tax on then again. Another big perk: you can withdraw your contributions (not your investment earnings) at any time without tax or penalty.

- Upside: tax-free retirement, can withdraw contributions at any time, ability to choose investments

- Downside: no tax break, cant contribute as much as a 401k, may be limited if your income is very high

Tax-Free at Retirement: Roth 401k

Maybe you like your employers 401k plan, but you would rather pay tax today to avoid paying higher taxes during retirement. Many employers are now offering a Roth 401k option. Its got the same high contribution limit of a regular 401k with the tax status of a Roth IRA. You pay tax today on the funds that are invested, and never again. You will have to stick with the 401ks investment options so you lose freedom there but you wont have to go through the steps of opening up an account elsewhere. Just simply change where the contributions go to with your Human Resources department.

- Upside: high contribution limit, tax-free retirement

- Downside: no tax break, must choose from plans investment options

Taxable Investment Accounts

A last option is to go to a brokerage firm and open up a normal investment account. You will pay taxes on the money today and in retirement as well. Theres no retirement status associated with the money, so you can add to it and withdraw whenever you want. You will also pay each time you trade an investment. (This could be seen as an upside or downside depending on what you think of the cost structures of other investment options.)

- Upside: ability to choose investments

- Downside: no tax break, no retirement status, funds can be withdrawn at any time

Retirement Plan Factors

Before abandoning your work 401k, consider these factors:

- Matching contributions: Before you abandon your 401k (or Roth 401k) consider if you get a match on your investment contribution at work. Even the poorest of investment options are worth sticking with up to the employer match, because a match is like a 100% return on your investment.

- Income taxes: Decide where you stand on taxes. Do you want a tax break today? Then a 401k or Traditional IRA is the best option for you. If youre not concerned with that then a Roth IRA or Roth 401k is an option.

- Investment costs: A big factor is knowing how much your investments are costing you. It is much easier to see the total cost of your investments when you control the account as you do with a Traditional or Roth IRA. Employer-sponsored 401k plans have hidden administrative fees that are hard to track.

Last updated by Kevin .

Will this article help you save or earn more money. Get others like it simply by entering your email address below. Your email is used only for delivering daily money tips and you can opt out of delivery at any time. Click here to see all your free subscription options.