401K Information from MetLife

Post on: 8 Май, 2015 No Comment

Many Americans today are living longer, healthier lives, which could mean your finances may need to accommodate extra years of retirement. It’s up to you to make yours a comfortable retirement. In most instances, Social Security alone will not provide you with as much money as you were earning before you retired. That’s where a 401(k) comes in.

A 401(k) plan* (named after a section of the federal tax code) is an employer established plan somewhat similar to an Individual Retirement Account (IRA). Both plans are designed primarily as retirement savings plans. A 401(k) plan is generally funded with your before-tax salary contributions and, oftentimes, matching contributions from your employer. Your contributions, employer contributions (if any) and any growth in your 401(k) plan are tax-deferred until you withdraw the money. Once money is in your 401(k) plan, you generally cannot make withdrawals before age 59½, except for special circumstances. Many employers, however, include loan provisions in their plans.

Benefits from Investing in a 401(k) plan

Your contributions, any employer contributions, and any earnings on your 401(k) account grow tax-deferred; which means they are not taxed until they are withdrawn. Consequently, you have more dollars working for you, and your account balance may grow more quickly.

Your current gross income is reduced by the amount you contribute. Contributions are usually made pre-tax, which means you are not subject to Federal (or most state) income tax on your contributions to the plan until the money is withdrawn, typically at retirement. You may be in a lower tax bracket at that time; if so, you would pay less tax. This also means you have more money in your account working for you. Contributions are subject to Social Security and Medicare taxes.

Automatic payroll deductions make saving for retirement easy. You’re less likely to miss money you never see.

You can control your own account. Unlike traditional pension plans, 401(k) plans often allow participants to choose how to invest their contributions. Participants can be as aggressive or as conservative as they wish in selecting investment options offered under the plan.

The plan is portable. When you leave your current employer, you can have the option of rolling your money in a 401(k) plan over into an IRA (Individual Retirement Account) or a new employer’s plan or withdrawing the money. Keep in mind, however, that withdrawing money before age 59½ can mean you will pay taxes on the withdrawal and, generally, an early withdrawal penalty of 10 percent if the money is not rolled over or directly transferred to an IRA or another qualified retirement plan on a tax-deferred basis.

You can invest in professionally managed funds at no minimums. Retail financial service providers may impose minimum investment requirements. With a 401(k) plan you can get started investing a little at a time.

You may be able to borrow from your 401(k) plan. Many plans have loan features that let you withdraw money (without taxes or penalties) as a loan to yourself. You may be able to pay the loan back automatically through payroll deduction, and the loan interest goes into your own 401(k) plan, too.

Your employer may contribute matching funds on a portion of your savings. If so, you reap an instant benefit from contributing to your 401(k) plan. For example, if your employer contributes 50 percent of the amount you contribute, you would receive an additional $50 added to your account for every $100 you contribute, up to the plan limits.

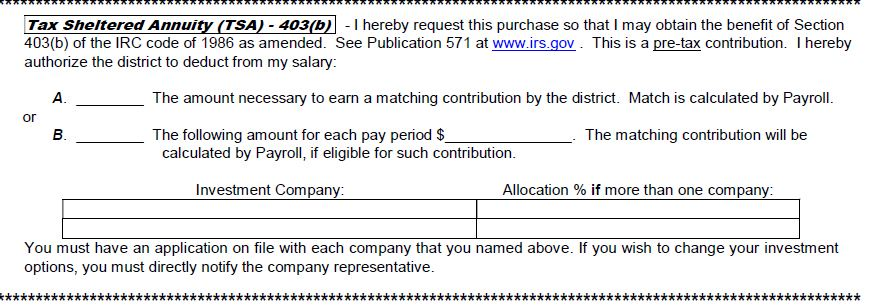

* Employees of most tax-exempt organizations (except for state and local governments and their agencies) are eligible for a 401(k) plan. Many tax-exempt organizations, however, such as hospitals, social service agencies, libraries, K-12 public schools, colleges and universities are covered under another plan, the 403(b). If such a tax exempt organization employs you, you might want to read the Life Advice® article, 403(b) Plans.