401K Hidden Fees

Post on: 16 Август, 2015 No Comment

I’m not a huge fan of writing about taxes. Most readers arent big fans of reading about taxes. I can’t lie, so unfortunately this post is about taxes. Please don’t go. I promise this is very important information and it will not delve into the dark abyss know as our tax code.

This year, 2012, a new law goes into effect. It surrounds 401k hidden fees and is found in ERISA section 408(b)(2). (I promise that is the end of the tax code talk.)

This law has the following new guidelines for plan fiduciaries (they are the ones administering the plan):

- Give workers quarterly statements of plan fees and expenses deducted from their accounts .

- Give workers core information about investments available under their plan including the cost of these investments .

- Use standard methodologies when calculating and disclosing expense and return information to achieve uniformity across the spectrum of investments that exist in plans.

- Present the information in a format that makes it easier for workers to comparison shop among the plan’s investment options.

- Give workers access to supplemental investment information in addition to the basic information required under the final rule.

Investment Information

There are two of the bullet points I want to discuss. The first is about the investment information. I hope that this information is going to be provided in easy to understand, straight-forward terms. I have had basically every member of my family, most of my friends, and my girlfriend ask me for investment help and when I show up, they drop their 401k plan information and tell me they are lost. They don’t understand it. And based on the questions I see on internet forums, I suspect many others don’t as well. If it were more straight-forward we might have more people investing for their retirements at a young age. people actually saving for retirement. or at least do a better job at creating a diversified portfolio .

Plan Fees and Expenses

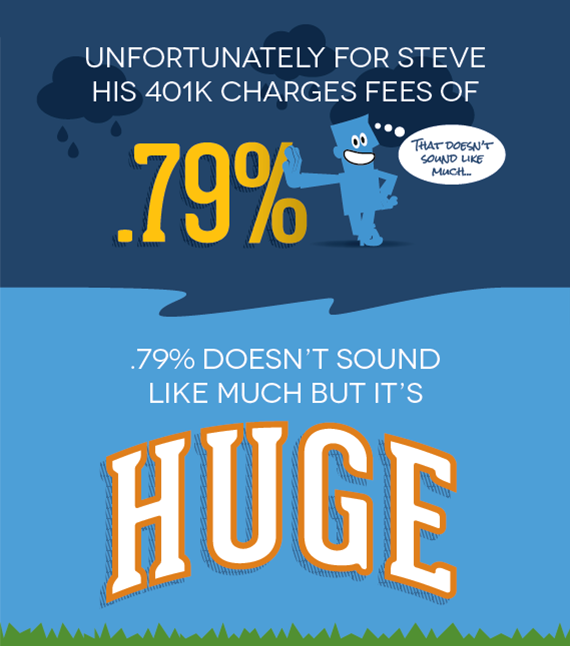

The other point I want to discuss is the quarterly statement of plan fees and expenses deducted from participants accounts. This is big. As it stands right now, all you really see along the lines of fees are the expenses each fund charges. Trust me, there are 401k hidden fees that the plan gets charged and the plan passes these fees along to the plan participants (or investors, or basically, you). (Remember that the fees you pay on investments is an area that you control .) When people begin to see how much money they are being charged, they are going to revolt. This depends of course, on them first opening up their quarterly statement and reading it.

It shouldnt surprise you if at sometime in the near future you receive notification that your company is changing 401k plans because of the high fees that the plan charges.

I urge you to open up your quarterly statements for your 401k plan and review it for the actual fees you are getting charged. If they seem outrageous (and I think they will be based on what I see), then speak to your benefits administrator at your company and tell them that they need to change plans to find a lower cost plan.

Action Item

Since many people wont take the time to review their quarterly report, I recommend you sign up for Personal Capital. Its 100% free and will pull in the data from your 401k and tell you just how much money you are paying in fees. It will also tell you how much you will pay in fees for the remainder of the time your money is invested. Even better, you can play with the numbers and see the effect lower cost investments have on your ending balance. I highly recommend it.