4 Tips to Finding the Perfect Retirement Formula

Post on: 7 Май, 2015 No Comment

How much money is needed for a comfortable retirement? It’s a question only you can answer.

The amount depends on factors such as your retirement goals, living situation, general health and expected lifespan. None of these are sure things, so it’s essential to store away a substantial nest egg — and be financially prepared for almost anything.

But, how can you plan for a multitude of diverse financial scenarios?

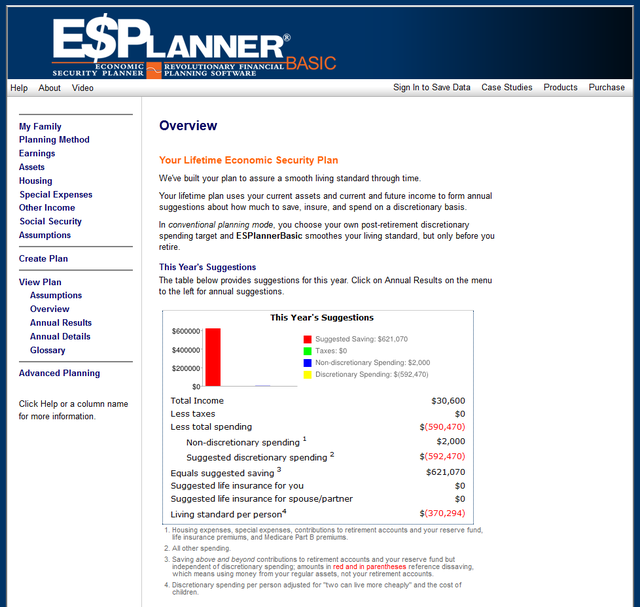

An online retirement calculator can help. This web-based tool enables you to put concrete figures around your retirement expectations.

Simply plug numbers into specific variables — such as your current age, annual income and retirement savings — and you can determine if you’re financially on target to meet your retirement goals. If you’re off course, you can use the calculator to obtain a better sense of how to fine-tune your future investment strategy.

The options can be overwhelming. A Google search for retirement calculator yields over 650,000 results. Many online calculators are free, and some are more complex than others. But they all operate with the same general purpose: to help you financially plan for a secure future.

Here are some things to keep in mind to find the best retirement calculator for your financial situation:

The more time it takes to fill out the question fields on the retirement calculator, the more thorough, and therefore, more accurate the calculation is likely to be. It can take you anywhere from about 3 to 30 minutes to fill one out online. If you want just a quick gauge of where you think you’re headed, a simple retirement calculator should be just fine. However, if you want a more complete analysis, it’s worth dedicating the time to filling out a longer, more intensive retirement calculator questionnaire from CNN Money.

2. Do Your Homework

To get the most out of your retirement calculation session, you should be prepared with all of your financial documents in front of you. You’ll likely need to fill in information about your pension contributions, your registered savings plans and any insurance or annuity plans you currently pay into.

3. Comparison Shop

Not all calculators are created equal. A good online retirement calculator is built to factor in changing hypothetical variables, such as inflation and tax rates. Look for calculators that take into account inflation, inflation adjustment, tax rates and savings plan rates. Without calculating these elements, your long-term picture isn’t going to be accurate.

Still, it’s important to realize the numbers you plug in are estimates and could substantially increase or decrease by the time you actually retire. Therefore, don’t put all your faith into a retirement calculator and don’t base your entire retirement plan on just one calculation. Try several calculators to see if the figures you get are close.

4. Be Realistic

Some calculators may ask you to plug in numbers such as your expected life-span or the projected rate of return on your investments. These numbers are nearly impossible to determine. But, you can use your own personal history, combined with nationwide trends, to help you better predict the future.

As we explained in our article, Longevity Insurance: A Solution to Your Worst Retirement Nightmare, the U.S. Census Bureau estimates that by 2020, the average U.S. citizen will live to be nearly 80 years old. If you’re currently healthy, there’s a solid reason to believe you too could hit this age.

However, to ensure you have enough money past 80, it’s suggested you play it safe and put age 90 as your default lifespan setting. Similarly, a projected rate of return higher than about 8% could drastically throw off your investment projections; the average return rate in North America is currently hovering around 1.5%. It’s, therefore, suggested you input a return rate of about 3%.

You should also take into account where you plan on living, especially if you ever plan to retire abroad. Where you live in the world will have a substantial impact on your taxes and the government-based pension programs you may pay into. Both will affect your retirement outcome. Find a calculator that’s right for you, based on the country in which you live.

Calculators We Like

Based on the factors above, we’ve scoured the Internet to find what we believe are the best free retirement calculators out there. Because our InvestingAnswers audience is largely North American, we’ve focused on retirement calculators geared to Americans and Canadians. Here are two good calculators:

U.S. Retirement Calculator: The Ballpark E$timate® is a free, simple-but-effective retirement calculator. It’s sponsored by the Employee Benefit Research Institute and the American Savings Education Council It consists of only 16 questions, but it takes into account projections such as expected lifespan and inflation. The results summarize how much you’ll need to save annually in order to meet your retirement goals.

Canadian Retirement Calculator: A federal government agency, Service Canada. offers a simple-but-very-thorough free tool to help you calculate your financial needs as you enter retirement. You’re able to input your company pension and registered retirement savings plans (RRSPs), plus expected rates of return. The results summarize your expected before-tax annual income.

Finally, InvestingAnswers offers some excellent, free calculators that are easy for anyone to use.

If your goal is to retire a millionaire, try these two financial calculators:

If you have a different goal in mind, try our Compound Savings Calculator to see how much you need to set aside to reach a specific goal. And, if you simply want to figure out how much you could save over time by investing or saving a portion of your income, try our Simple Savings Calculator .

The Investing Answer: Keep in mind, online retirement calculators are simply one tool to help in the retirement planning process. No matter how good the calculator — free or not — each will have its own strengths and limitations.

Try number crunching with more than one calculator before committing to specific retirement savings plan. And, always realize that your plans may change; these changes could impact your life savings. While a retirement calculator can’t do the planning for you, it can help you more accurately assess your finances so you can see gold in your golden years. We invite you to try all of the InvestingAnswers financial calculators here .