3 Covered Call Writing Tips for Passive Income

Post on: 16 Март, 2015 No Comment

For those unfamiliar with covered call writing, the strategy is fairly simple and straightforward.

In a nutshell, covered call writing is simply selling the right for someone else to purchase stock that you currently own (100 shares per contract) at a certain price (called the strike price). If the stock closes above that strike price, the call will be exercised and youll be required to sell at the specified price. If not, following the expiration of the option, youll retain ownership of the stock and youre free to write another covered call for additional premium (the cash you receive for selling, or writing, the call).

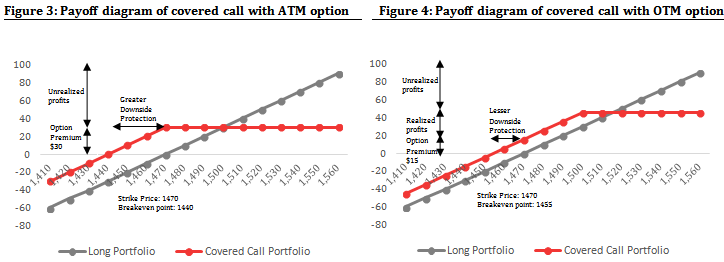

The covered call writer can increase his or her potential returns by choosing stocks with higher implied volatility (which equates to higher corresponding premiums on its options) and by writing the calls out of the money (i.e. choosing a strike price thats higher than the stocks current price). Writing an out of the money call allows the call writer not only to collect the premium from the call, but also to participate in any capital gains up to the difference between the purchase price and the strike price (should the stock trade through that strike price).

For many covered call writers, however, the more important question isnt, How do I maximize my potential covered call returns? but rather, How can I generate income more consistently from my covered call trades?

Here then are 3 tips:

Tip #1 Choose a High Quality Company. Theres always a temptation to employ covered call strategies on stocks where the options have a very high premium. But in many instances, there is good reason for the high premiumthe stock is highly volatile and the market has priced in the likelihood of a large move one way or the other (think of a biotech company with an important Phase III drug awaiting an imminent approval decision from the FDA).

Its important to stick with high quality companies. Unless you truly believe a stock is a legitimately strong business to invest in for the buy and hold investor, you should not write covered calls on the stock yourself. A high quality company (one thats consistently profitable, not overburdened with debt, and isnt overpriced from a valuation perspective) will protect you in important ways: it will drop in price less steeply (and hopefully less often) and it will most likely rebound more quickly from declines in share price than will a mediocre company that struggles to be profitable.

Tip #2 Write In the Money Calls. Writing in the money calls, as opposed to writing out of the money calls, will drastically improve the consistency of your covered call returns. True, you may give up some potential gains, but youll gain much more downside protection.

Say you own 100 shares of stock trading at $32.50/share. You look at the option chains and perhaps you see see the following: you could write a $35 call for $1 in premium, a $32.50 call for $2 in premium, or a $30 call for $3.50 in premium.

Your maximum possible gains on the $35 call is $350 ($250 capital gains + $100 premium). On the $32.50 call its $200 (all premium). And on the $30 call its $100 ($250 capital loss as you sell the $32.50 stock for $30/share + $350 premium = $100 net returns).

But look at how much downside protection each option gives you. With the $35 call, you lose money if the stock closes below $31.50/share. With the $32.50 call, you lose money if the stock closes below $30.50/share. But with the $30 call, you dont actually lose any money until the stock trades below $29.00/share.

Tip #3 Use Basic Technical Analysis. Covered call writing is an extremely effective strategy for stocks that are either flat or trending slightly higher. By utilizing basic technical analysis, you can greatly improve your selection process of identifying stocks that meet your criteria.

You dont need to spend thousands of dollars on software and seminars becoming an expert on technical analysis, but the ability to draw trend lines, identify important support and resistance levels, and develop an awareness of where the stock is in relation to its 50 and 200 day moving averages will go a long way to improving your selection process.