10 Ways to Save More for Retirement

Post on: 28 Март, 2015 No Comment

Key Points

- If your risk tolerance is conservative to moderate, consider aiming for a portfolio that’s approximately 25 times as large as your withdrawal during the first year of retirement. If you’re behind on your retirement savings, your options include saving more now, spending less in retirement, retiring later or working part-time after you retire. Avoid ramping up your portfolio risk or assuming your investments will produce an overly optimistic rate of return.

If you’re behind on your retirement savings, you aren’t alone. Whether it’s due to bear-market setbacks, getting off to a late start, or other reasons, a lot of people are trying to catch up on their retirement savings. Fortunately, there are plenty of actions you can take right now—and even after retirement—to help maintain a standard of living you’re comfortable with. And in an era when traditional workplace pensions are disappearing and Social Security benefits may be reduced, your personal commitment to retirement planning and investing may be what makes the difference for you.

How much do you need to save?

If you’re an investor with a conservative to moderate risk tolerance and you want to maintain your inflation-adjusted standard of living for 30 years, we suggest shooting for a portfolio approximately 25 times as large as your first-year withdrawal. This translates into roughly a 4% withdrawal rate in the first year of retirement, adjusted for inflation thereafter.

That may sound ambitious, depending on how far you are from retirement, what you hope to spend and how much you’ve already saved. But the target above assumes a portfolio big enough to let you adjust your first-year withdrawal each year for inflation with a high level of confidence that the money will last for 30 years. You may settle for a lower level of confidence, work longer or spend less. Or a combination of trade-offs could work as well. The main thing is to stay flexible, as no single rule of thumb fits all circumstances.

10 ways to catch up on retirement (or make the most of what you have)

1. Spend less and save more now. It’s as simple as it is unpopular. Create a budget and put your expenses under the microscope. Earmark a portion of your next raise or bonus for retirement savings. You also may be able to consolidate loan balances into lower-cost, and potentially tax-deductible, forms of debt.

2. Max out your 401(k) or other employer retirement plan. especially if you receive matching contributions. If you’re age 50 or older, make catch-up contributions (see table below).

3. Contribute to a deductible traditional IRA or a Roth IRA . if you’re eligible. People age 50 and older can also make IRA catch-up contributions.

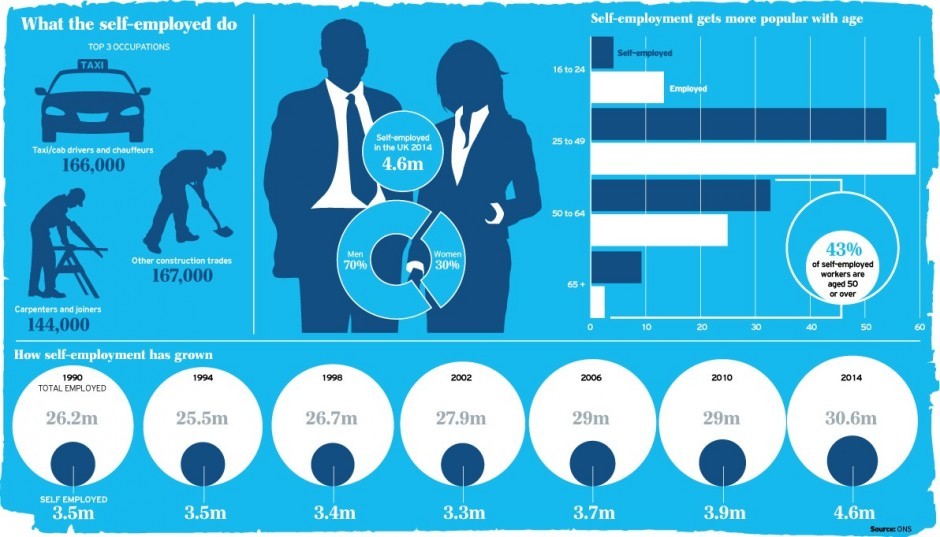

4. Talk to your CPA about small-business retirement account options such as an Individual 401(k), SEP-IRA, Qualified Retirement Plan (QRP)/Keogh or SIMPLE IRA, if you’re self-employed.

5. Save extra money in personal taxable accounts. if you’ve maxed out tax-advantaged accounts.

6. Spend less in retirement. We suggest you plan to need as much in retirement as when you were working, but you might be able to get by with less—especially if your mortgage is paid off, the kids don’t move back in and you don’t face dramatically increased medical costs.

7. Postpone retirement so you have more time to try to build a bigger retirement portfolio and shorten the time you’ll rely on savings. You can also increase your potential Social Security benefit by waiting to receive payments (up to age 70).

8. Work part-time. Many retirees find they enjoy the social interaction and sense of purpose as well as the income.

9. Consider tapping into your home equity as an additional source of retirement income. You may scale down to a smaller home in retirement and pocket the difference.

10. Settle for a lower level of confidence that your portfolio will last. While we recommend aiming for a 90% chance of making your savings last, there’s nothing magical about that number. Consider your health and life expectancy—among other factors—and decide if you can live with a slightly lower level of confidence.

Words of caution

Be careful about ramping up portfolio risk to try to meet your retirement goals. Unless you were irrationally conservative to begin with, you can’t suddenly make yourself more risk-tolerant. Also, shoot for a realistic rate of return—which may be lower than the returns that many of us have come to expect from our stock portfolios.

At Schwab, our long-term outlook on stock and bond market returns is significantly lower than the historical annual compound returns for the 1970-2013 time period, for two reasons. First, we expect lower-than-average inflation in the future. Second, we still expect real interest rates to remain low.

In order to cope with a low-rate environment, we recommend staying diversified and sticking with your long-term asset allocation plan to potentially maximize expected returns for your level of risk.

Over 50? Consider these catch-up options