10 Golden rules of investing How to secure your financial future Economic Times

Post on: 31 Март, 2015 No Comment

For an intangible entity, time is starkly palpable. It seems to strum with glee when you make swift gains in the market; it’s a sentient savant when you suffer losses; it can be an irksome sprinter for the ageing saver; a sluggish bore for a young trader. But mostly, time is a capricious companion, loyal to none, yet equanimous to all.

We, at ET Wealth, have not been immune to its caprices, swept as the rest into its contrarian fold. So, during the economic slowdown, into which we stepped with our launch on 13 December 2010, we felt laden with our readers’ expectations. However, two years later, having navigated you through financial undulations, we feel leavened by your response. Through it all, we have tried to maintain our own equanimity, which stems from our acute perception of your needs and the deep insight into personal finance. Between fielding time’s whimsies and setting you on the right course, we have reached another milestone — we have turned two. It’s a special occasion because in this short span we have learnt to tweak time’s truancy to our advantage. In its contortions, we have found a constant.

We call it the Golden Rules of Investing. A synthesis of the past learnings, these principles are our way of celebrating the present by securing your future. The mark of any rule is its universality and ability to transcend time. What we have framed for you are 10 canons that are based on these benchmarks, a compilation of our previous stories. They will act as a bulwark for your finances against the attenuating swipes of time. They will hone you into an aware investor in sync with your needs.

Most importantly, they will help you grow your wealth, so that we can keep the promise we made at the time of our launch — that we would lead you to riches in this golden decade of investing. In the following pages, we will tell you how to build a safe portfolio; how to work towards a fret-free retirement; ways to defend against the crushing impact of the unforeseen; how to juggle your portfolio and when to cut your losses; how to deal with the trap of taxation; how to make the distinction between insurance and investment; the much-brandished benefits of diversification, and why you need to factor in the eroding effect of inflation.

In essence, we offer a seminal guide that spans the gamut of personal finance. Still, our work remains unfinished. For, even though the country’s fiscal fate appears to be altering, thanks to the proposed reforms, the world has not quite remedied its economic ills. And while regulatory activism spells hope for the small investor, the responsibility to secure your finances ultimately rests with you. So time shall continue to remain a pulsating presentiment and will not stop throwing challenges at you. But you shall not be alone; we at ET Wealth will guide you through all your financial travails. And together we shall learn to tame time, perhaps even befriend it.

Rule 1: Know your worth before you begin

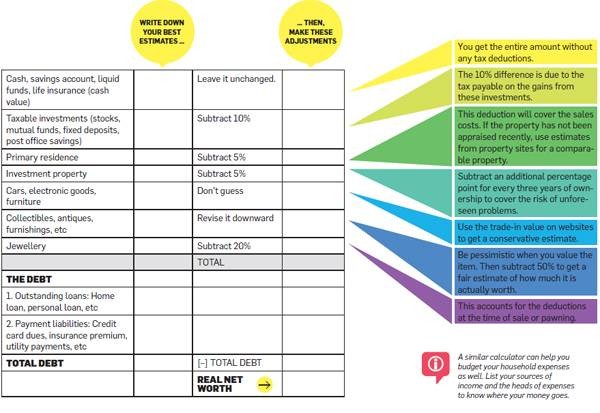

To reach the finishing line, you must first know where the race begins. As any financial planner will tell you, figuring out your net worth is the first step towards formulating a successful financial plan. The best way to do this is by drawing up a list of your assets and liabilities. Use the table on the right to calculate your net worth.

It will also give you a broad idea of your current asset allocation. Taking stock of your current status is necessary to help you make informed financial decisions. The slowdown may have affected your annual increment. Volatility in the stock market may have prompted you to stay out. Before you plan to invest, sit down and take a fresh look at your financial situation. Once you have figured out where you stand, find out your attitude towards investing. Your ability to take risks determines the investments you should opt for. If your stomach churns whenever the Sensex goes into a freefall, equity is not for you.

Stick to the safety of debt options or take exposure to stocks through mutual funds. On the other hand, if a 20-25% fall in value doesn’t upset you, equity can be a great way to build wealth. Another important trait is the keenness to conduct research before investing. Some people love nothing more than digging into financial statements and crunching numbers, while others might not have the time or inclination to plough through prospectuses and product brochures.