Zero Coupon Bonds_1

Post on: 11 Апрель, 2015 No Comment

Zero Coupon Bonds

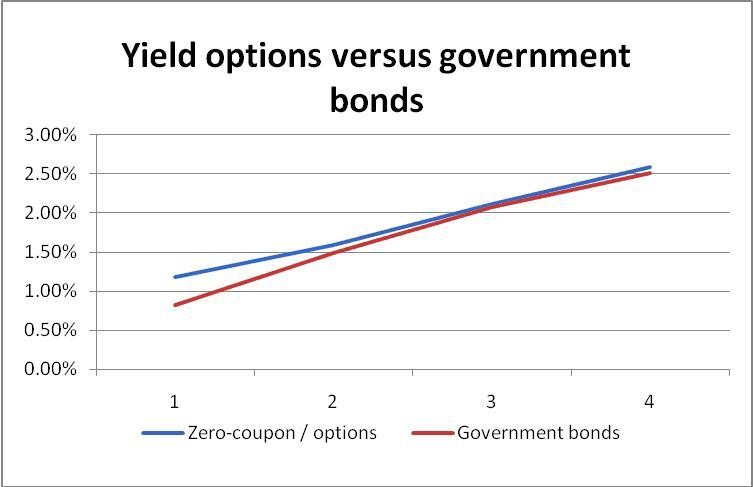

Finding the right investment mix could make a difference in staying ahead of the vast fluctuations in todays financial market. Zero coupon bonds (also referred to as discount bonds or deep discount bonds) are one option that allows investors an opportunity to allocate funds that will pay a fixed return at a later date. These bonds differ from other types because they do not pay dividends or periodic interest payments to the investor who receives the full accumulated interest and the face value of the bond at maturity. Sold as both short and long term bonds, some may reach maturity in as little as one to fifteen years or longer. Common zero coupon bond types include U.S. Treasury bonds, municipal bonds and Savings bonds.

Advantages of Purchasing Zero Coupon Bonds

U.S. Treasury bonds offer a stable and secure investment because they are federally insured and pay a fixed rate over time. They are sold at a lower price than the face value which is paid to the holder at maturity. Another safe investment option includes U.S. Savings bonds which are backed by the government and can be purchased in small increments, as low as $25 (USD). These bonds contain deferred interest requirements, exemptions from state and local taxes and are easily redeemed at a bank or credit union. Municipal bonds are used for funding city and regional projects and are sometimes exempt from federal income taxes. Purchasing a long term discount bond provides a savings plan method that may be used for education, retirement or future needs.

Disadvantages of Purchasing Zero Coupon Bonds

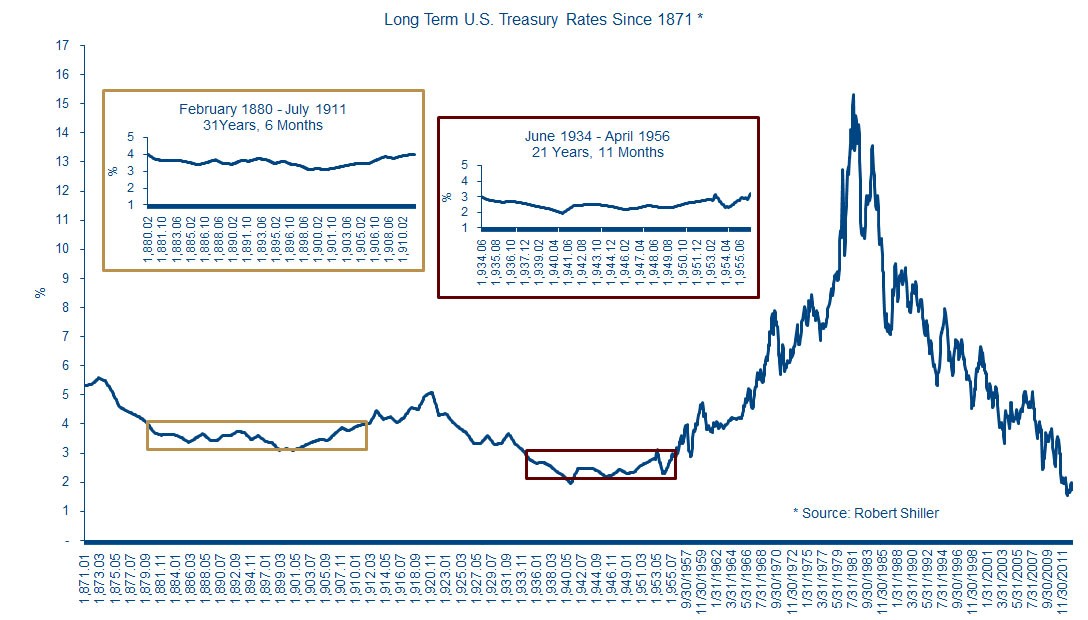

U.S. Treasury bonds provide a safe investment but not necessarily a high yield. Annual taxes must be paid on U.S. Treasury bonds even though actual interest is not received. Fluctuating market conditions may cause the bond to be a lower value than originally anticipated if they need to be sold. Most zero coupon bonds carry a face value that is paid to the holder of the bond at a fixed maturity date but interest rates may vary and actual bond returns become unpredictable. If the market conditions increase and interest rates rise, choosing a bond investment rather than other options may bring a lower return.

Risks and Rewards

Any bond investment includes the risk that they may not be worth the full value at the expected maturity date. A discount bond purchased today could drop in value tomorrow and then rise again in a week. But buying a discount bond could result in a high yield situation although no money is collected until the end of the term. Investors who are interested in receiving a lump sum at the end of a set period will be more inclined to consider these bonds than anyone looking for a quick return.

As with all investments, being diversified is a wise standard to follow. Purchasing zero coupon bonds within a well designed portfolio that includes regular bonds, stocks, mutual funds and other types of investments provides both stability and growth.