Would You Take Financial Advice From an Algorithm

Post on: 6 Май, 2015 No Comment

Dave and Les Jacobs | Blend Images | Getty Images

One industry newsletter has called them the most underappreciated threat to the advisory business. Another website intones, Advisor beware.

The menace in question is a rash of Web-based investment management tools that aim to replace traditional practices with algorithms. If that weren’t threatening enough, the online services often replace advisors’ fee structure—typically 1.5 to 2 percent of client assets—with a flat fee.

Asset management fees are the greatest invention for financial advisers, but there is a big conflict, said Chris Cook, president of Beacon Capital Management, an institutional investment firm that recently launched the flat-fee ZeroCommissionPortfolios.com. You want the client to put in more money and you don’t want them to take distributions, because you are going to be paid less.

Advisors’ traditional business model has been under the gun since Vanguard founder John Bogle championed buy-and-hold investing in the 1970s, casting doubt on the effectiveness of paying advisors to beat the market. The years since have seen a growing faith not only in index funds and proper asset allocation, but in low-fee exchange-traded and target-date funds for retirement that automatically rebalance a portfolio as the investor ages.

Meanwhile, the Internet put research tools at private investors’ fingertips, robbing money managers of some of their mystique. A portfolio-punishing recession further fed disenchantment, and as fees drained already-depleted gains, investors began demanding more transparency.

The Web-based programs have moved into that breach.

The aim is to change the way the investment model works, Cook said. We suggest using an investor model, not the Wall Street model.

That model uses the Web’s scalability to reduce the time an analyst needs to spend with any one account and undercutting anyone charging traditional, client-by-client fees.

We’re not doing any more work for a million-dollar account than we are a smaller one, Cook said. The more professional approach is to take a flat fee.

What you get for your money varies. Jemstep. a site based in Palo Alto, Calif. that launched in March, analyzes a portfolio and makes detailed suggestions about which mutual funds to buy and sell in what quantities to reach an optimal tax-advantaged asset allocation.

You follow the program by trading on your usual account—Jemstep doesn’t buy or sell for you. The first $25,000 is managed gratis; you pay for anything above that on a sliding scale, from $18 a month, to $79 a month for $600,000 or more.

Covestor has no algorithm and, like Jemstep, provides only explicit direction. It offers old-fashioned, active portfolio managers but also lets subscribers see what a selection of their most successful investors—from financial pros to the vice president of a construction company—are betting on.

Other services ask you to entrust them with actual funds. At Zero Commission, a back end that took coders years to compose plugs subscribers’ money into 11 TD Ameritrade ETFs, weighted equally across all sectors. The highest load a subscriber will pay is 14 basis pointsl, according to Cook.

The program has other bells and whistles, most significantly its stop loss feature. If the market dives, Zero Commission will pull you out automatically when your portfolio has lost 10 percent. The genie restores it according to a more complex calculation depending how quickly the market returns.

Cook has run simulations of his deviation from a straight buy-and-hold approach (which he calls buy and hope) back to July 1997, and that philosophy beat him only four times in eight market drops. The difference is when buy and hold is losing 30 or 40 percent, we really make money, he said.

Zero Commission’s full-service package is $149 a month. If you prefer to make transactions yourself, you can get just detailed instructions for $79 a month. Cook calculates that a full-service subscriber will start to beat the average advisor’s 1.5 percent commission when the investment level hits $120,000.

The sites also offer access to well-regarded voices in academia and business. Burton Malkiel, author of A Random Walk Down Wall Street, has recently joined Stanford economist Andy Rachleff at Wealthfront. Former PayPal and Intuit CEO Bill Harris is behind the site Personal Capital. and at Betterment. Columbia finance professor Geert Bekaert is teamed with industry professionals with distinguished track records.

For all the doomsday headlines, how much of a threat the sites pose to traditional advisors remains to be seen.

That’s great for the smaller account, said Gordon Peterson, an investment manager in Dallas. It’s taken off particularly with young people, who like the technology and the turnkey aspect. But younger investors’ attitude will change when they begin to accumulate or inherit wealth, he said. People with $5 million and up like a face-to-face approach. What they are paying for is the personal service. I don’t feel threatened at all.

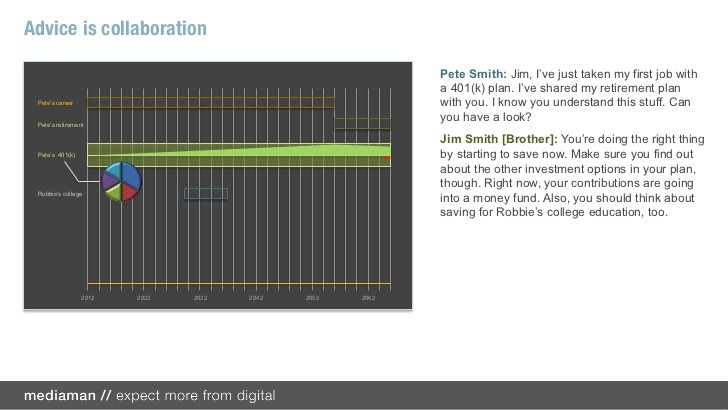

In an annual ranking of advisory firms by market researcher The Luxury Institute, responsiveness and trust are the virtues wealthy investors value most—not low fees, not even returns, according to CEO Milton Pedraza. Even young families want an advisor because there’s something an algorithm can’t give you—common sense, he said.

Jemstep President Simon Roy said that websites like his will appeal primarily to self-directed investors. And while Cook maintains that flat fees make more sense as assets rise, he admits that his first customers will come from the mass affluent category.

The early adopters will be those who have enough assets that they want professional help but don’t want to pay for services they can’t really take advantage of, like complicated estate planning, he said.

Monthly fees of $80 to $150 may seem high to this group, who are used to employing the online tools. And if they’re already paying a financial planner for guidance on college saving, retirement and their estate—advice everyone agrees they’ll still need—mass affluents may be reluctant to lay out more.

There’s no doubt that the algorithms have a lot going for them.

We offer the best practices of private wealth management combined with the best analytics and investing theory, Roy said.

The question is, is that enough?