With Mutual Funds It s All About the Costs

Post on: 30 Июль, 2015 No Comment

One would think that finding a fund with a great mutual fund manager would be very important. After all, this is the individual who leads the team that picks the stocks in the mutual fund. There are also advertisements for fund companies that show the managers having private meeting with the owners of companies to find the best picks. Who wouldnt want to invest with people who are meeting directly with the management and getting so much information about the companies they are buying? You would think that managers who are out on the streets, ferreting out the details would be better than one who sits in the office and watches CNBC. Ironically, even the best managers can do no better than the worst managers over a long period of time due to the constraints they are under.

If given a couple of million dollars to manage, there are certainly some managers who would outperform the others. Some of these would be the ones who could find companies that will outperform the others over long periods of time and buy and hold these. These are the firm foundation managers. Others would be good at spotting trends that are emerging and buying the companies that will benefit early in the cycle. These are the castle in the clouds managers.

The trouble is that if they do well, they end up with billions of dollars to manage. This is kind of like giving a skilled artist a 6 paintbrush. Even if he is great at what he does, the tools he is given prevent him from doing his best work. A manager may think that Coke is a great buy and will do better than Pepsi, but if he were to invest only in Coke he would buy up all available shares and push the price up so far there is no way he could make a profit. He therefore needs to buy Pepsi as well and a dozen other companies he really doesnt want to own.

He needs to buy not only his first choice in a sector, but his second, third, and forth choice as well. Pretty soon, if his fund invests in large caps, his portfolio ends up looking a lot like the S&P500. A small caps manager ends up with a portfolio that looks a lot like the Russell 2000. He is also not very nimble when getting into and out of positions because his trades, due to the size of the positions, actually move the price of the stock.

For this reason, when buying mutual funds, it is all about the costs. This includes the costs for buying and selling the fund, called the load; the fees charged each year by the fund company and given to the management; and the cost of trading and administration of the fund. If you have two funds that each get about the return of the S&P500 say 15% per year and one charges 1% fees and the other charges 3%, you will get about 14% per year from the first fund, on average, and 12% from the second. Over a period of many years this can mean balances of 20-50% less.

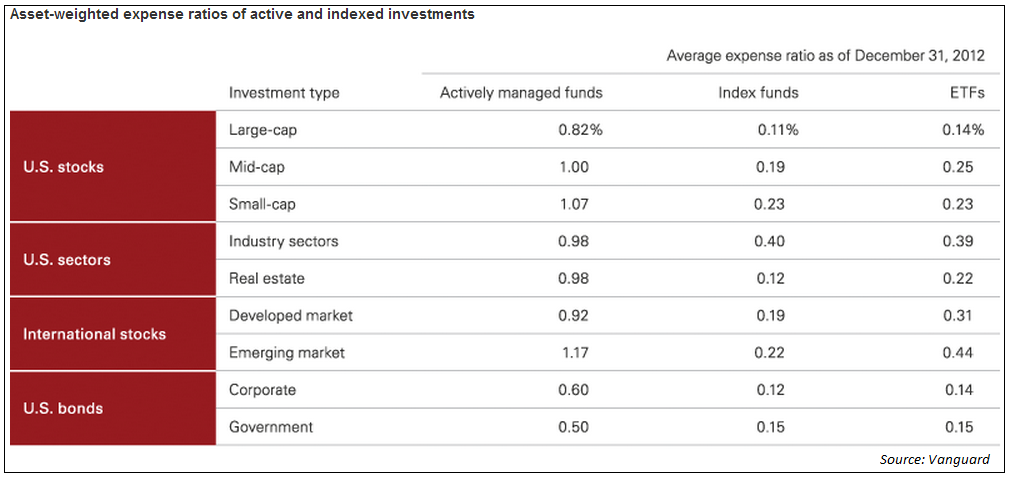

The best place to get low-costs is with index funds. Because there is no active management the fund simply buys the stocks needed to mimic the behavior of an index the management fees are a lot lower. In addition, the amount of trading is less since indexes dont typically change their make-up too often, which keeps trading costs down. Index funds typically have no load as well. With an index fund you can often get fees down below 1/2 of 1 percent, versus an average of about 1.5% for low cost managed funds.

You can do even better with fees if you go with Exchange Traded Funds (ETFs). These are like mutual funds that trade like shares of stock through a broker. You will need to pay a brokerage commission when you buy and sell these, which is like paying a load to a mutual fund, but once you purchase them the fees can be 1/4 of 1 % or less. To minimize the effect of the commissions, buy these in large quantities, meaning at least $3000 worth at a time, and plan on holding them for several years. If you wish to invest small amounts regularly, a standard index fund would be a better choice. Many companies even offer payroll deductions or regular deductions from your bank account to make investing easier.

So remember, when looking for funds, forget the hype. Its all about the fees. Go with low-cost index funds and ETFs and your portfolio balance can be hundreds of thousands of dollars more in 30 years.

Please contact me via vtsioriginal@yahoo.com or leave a comment.

Follow me on Twitter to get news about new articles and find out what I’m investing in. @SmallIvy_SI

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.