William C Dudley Risks of wholesale funding

Post on: 19 Июль, 2015 No Comment

Welcoming remarks by Mr William C Dudley. President and Chief Executive Officer of the Federal Reserve Bank of New York, at the workshop on the Risks of Wholesale Funding, New York City, 13 August 2014.

18 Aug 2014

Michael Fleming, Jamie McAndrews, Susan McLaughlin and Joseph Tracy contributed to preparing these remarks.

It is a pleasure to welcome you to the New York Fed today to discuss the important issue of wholesale funding.

As you all know, the financial system plays an essential role in modern economies, and liquidity is in turn critical to the functioning of the financial system. Because financial intermediation is critical to economic activity and intermediation is dependent on funding and liquidity, disruption to funding and liquidity can cause severe damage to the economy. The experience of recent years revealed serious flaws in the system. Risk was mispriced and there was a build-up of excesses before the crisis. Structural weaknesses in the financial system then amplified the effect of the sharp decline in U.S. house prices, and the result was a widespread financial crisis and a deep recession both here and abroad.

The extensive use by financial firms of short-term wholesale funding was one critical factor in the crisis. Not only did this reliance on short-term funding create the potential for a firm to fail in an extraordinarily rapid manner when faced with a loss of market confidence, but it also served as a channel through which the effects of those failures were widely propagated throughout the broader financial system.

I will focus my brief remarks on describing the structural vulnerabilities associated with short-term wholesale funding, laying the groundwork for our discussions at today’s workshop.

As always, my remarks reflect my own views and not necessarily those of the Federal Reserve System.

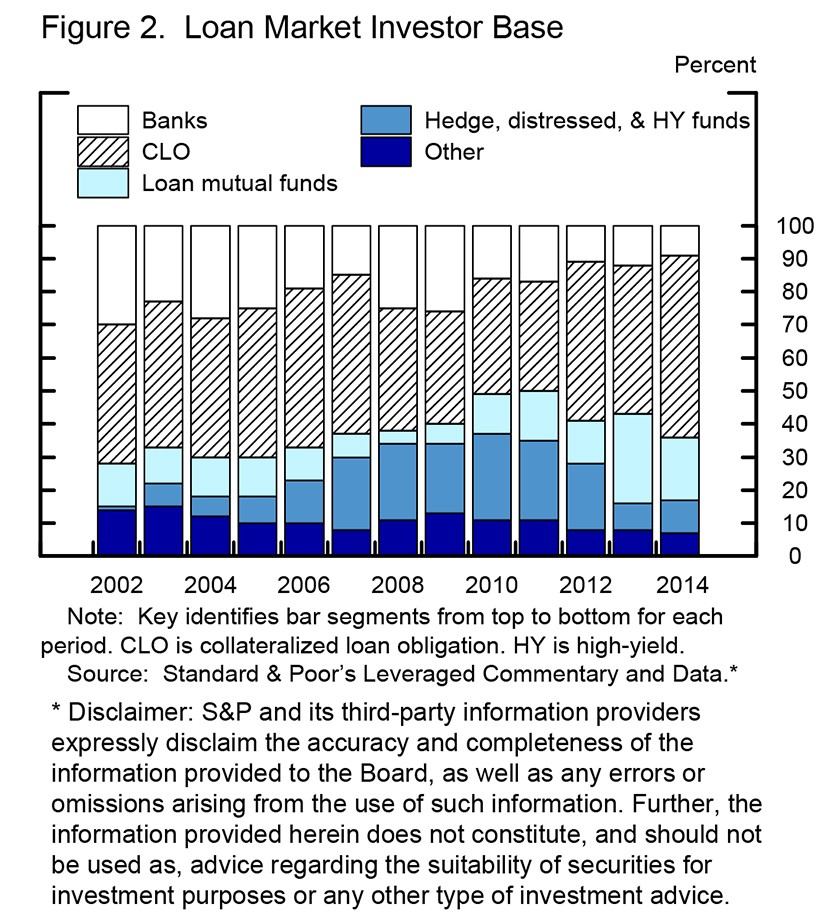

As this audience knows, in the two decades leading up to the financial crisis, the global financial system underwent a rapid transformation. During this period, there was a shift from bank-based financial intermediation to capital markets-based financial intermediation, and an increase in the scale and complexity of securitization activities.

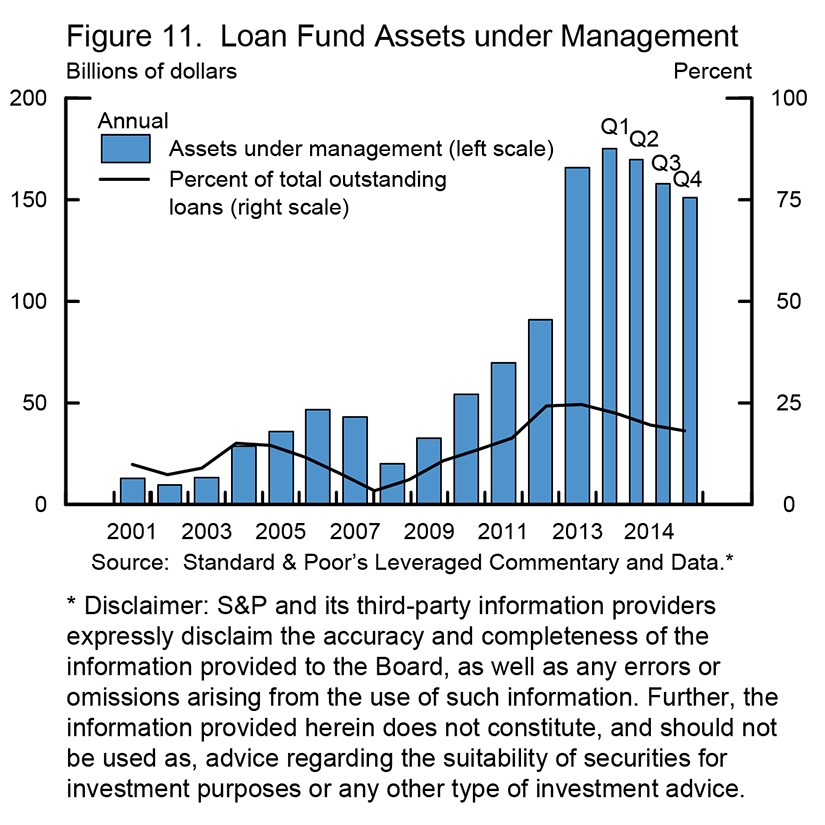

In the pre-crisis period, the growth of securitization was accompanied by an increasing reliance on short-term funds raised in wholesale markets to finance securities and activities essential to securitization. This ranged from the use of repo funding to finance inventories of securities held for market-making purposes to the issuance of asset-backed commercial paper by conduits created to acquire and hold securities.

Both demand and supply factors drove the increased use of short-term wholesale finance. On the supply side, the growth of savings from corporations and institutional investors in need of deposit-like products in which to place their cash balances created a plentiful source of funds. These products were viewed as safe since, after all, the funds were only exposed for a short period of time, and in the case of repo, they were secured by collateral. On the demand side, setting aside any possible instabilities in this funding source, it was more profitable to use shorter-term funds to finance longer-term assets.

In fact, the growing reliance on short-term wholesale funding to finance longer-term assets increased liquidity and maturity mismatch risk in the financial system. This was particularly dangerous because many of the assets being financed were structured-credit products, some of which were opaque, difficult to value and illiquid. In periods of market stress, these features increase the run risk by funding providers.

Short-term funding of longer-term assets is inherently unstable, especially in the presence of information and coordination problems. It can be rational for a funding provider to supply funds on a short-term basis, reasoning that it can exit if there is any uncertainty over the firm’s continued ability to roll over its funding from other sources. But, if the use of short-term funding becomes sufficiently widespread, the firm’s roll-over risk increases. In this situation, there is a strong incentive for each lender to run early if there is any uncertainty that could undermine the borrower’s ability to continue to roll over its funding from other sources. This is the case even if the provider of funds believes that the borrower would remain solvent as long as it retained access to funding on normal terms. The cost of running when it turns out to be unnecessary is small relative to the cost of not running when it turns out to be prudent.

Of course, this insight is not a new one. Prior to the establishment of a lender of last resort and retail deposit insurance for banks — which came with the quid pro quo of prudential regulation — bank runs were a regular and disruptive feature of our financial system. These innovations solved the coordination problem and stabilized this source of funding.

What was new prior to the crisis was the extent to which maturity transformation and financial intermediation had migrated outside of commercial banks. The growth of what we call the shadow banking system occurred largely without the types of safeguards — robust prudential regulation, deposit insurance, lender of last resort — that have safeguarded the commercial banking system from the types of widespread panics and runs that are capable of destabilizing the financial system. The systemic risk created by this gap in coverage was not well recognized by regulators or the private sector prior to the global financial crisis. Market participants had little incentive to internalize the negative externality of the run-risk created by their collective choice of finance, and they made erroneous assumptions about the liquidity of asset markets and the capacity and willingness of banks to distribute central bank liquidity to the wider financial system during periods of stress.

Because the boom years resulted in strong earnings, low price volatility and few credit losses, firms were able to operate at extreme levels of leverage. When housing prices started to decline, the vulnerabilities of this type of business model soon became apparent.

Heavy reliance on short-term wholesale funding exposed the system to a series of intertwined downward spirals in asset and funding markets. This spread in waves. It began in the market for asset-backed commercial paper (ABCP) issued by off-balance-sheet conduits, and spread via auction-rate securities to the repo, money market and financial commercial paper markets that formed the core financing for market-based financial intermediation.

Initial declines in asset prices especially for mortgage related assets forced leveraged holders with maturity mismatches to sell assets. This increased price volatility and further reduced the value of the assets that collateralized other firms’ borrowings. Higher volatility led banks and secured lenders to raise margins, while concern about counterparty risk and their own funding needs made banks reluctant to on-lend liquidity.

The resulting higher margins on repo and increased collateral calls due to credit ratings downgrades reduced the quantity of assets that could be financed in repo markets and elsewhere, prompting further asset sales. As wholesale investors started to exit, this set in motion a bad dynamic — a fire sale of assets that cut into earnings and capital. This increased the incentives of investors to run and for banks to hoard liquidity against the risk that they could themselves face a run. This downward spiral of fire sales and funding runs was a key feature of the financial crisis.

The inherent fragility of short-term wholesale funding was greatly aggravated by certain institutional shortcomings in these markets, particularly in the structure of the tri-party repo system and the U.S. money market mutual fund business.

Through the tri-party repo market, each day the two large clearing banks were providing a large amount of intraday credit to securities firms to facilitate the daily unwind of the prior day’s transactions. In the run-up to the crisis, the daily unwind helped make tri-party repo look like a very liquid investment while still being an apparently highly durable source of funding. This masked the underlying risks and contributed to weak risk management practices.

As the concerns about the U.S. housing market escalated in 2007, participants in the tri-party repo market became increasingly concerned about the liquidity and credit risks that they faced. The clearing banks became uncomfortable with their large intraday exposures to their clients — broker-dealers, thrifts and others. If the risk that a client might fail became too high, a clearing bank could decide not to unwind that client’s trades in the morning, leaving its investors with the collateral. Most of these investors lacked the operational or financial capacity to take possession of collateral and liquidate it in a gradual manner to recoup their investment; they had a strong incentive to run at the first sign of trouble to avoid getting stuck with the dealer’s collateral. Alternatively, if a client were to fail suddenly after the mornings unwind, then the clearing bank would be stuck with huge loans to these counterparties that could have put their own viability at risk, backed by securities that were not necessarily high quality and liquid.

The breaking the buck by the Reserve Fund following the Lehman bankruptcy also made it clear that the monies provided to the money market mutual funds by their own investors were also inherently unstable. This made such funds, in turn, an unreliable source of finance in repo, commercial paper and other markets. Investors in a fixed net asset value (NAV) money market fund could take their money out on a daily basis at par value, with no redemption penalty. This could occur even if the money market fund did not have sufficient cash or liquid assets that it could easily sell to meet all potential redemptions. As with bank deposits prior to deposit insurance, this created an incentive for investors to be the first to get out whenever there was any uncertainty over the underlying value of the assets in the fund. By being first in line, they could exit while the fund could still repay at par, leaving others to bear any losses. The longer the investor waited, the greater the risk that the fund would be forced into the fire sale of assets to meet redemptions and end up breaking the buck.

As the crisis unfolded, the Federal Reserve, the U.S. Treasury and others took a series of actions to contain the spiral of funding runs and asset fire sales. First, the traditional lender of last resort function was strengthened through the introduction of the Term Auction Facility (TAF) and foreign exchange swaps with foreign central banks.

Then, as the crisis intensified, the lender of last resort liquidity provision was extended to directly backstop key wholesale funding markets and made available to certain nonbank firms. The Federal Reserve created a direct backstop to the tri-party repo system through the Primary Dealer Credit Facility (PDCF). When the Reserve Fund broke the buck after the failure of Lehman Brothers, precipitating a run on money market mutual funds, the Treasury guaranteed money market fund assets and the Fed introduced the Asset-Backed Commercial Paper Money Market Fund Liquidation Facility (AMLF). The Fed also backstopped the commercial paper market (formerly funded in large part by money market mutual funds) by introducing the Commercial Paper Funding Facility (CPFF). When wholesale funding for non-residential mortgage securitizations evaporated, the Fed rolled out the Term Asset-Backed Lending Facility (TALF).

These actions ultimately stabilized funding markets and crowded back in private funds. But, they were an emergency response, not a sustainable long-term solution. After all, because most of the special Fed liquidity facilities were authorized under Section 13.3 of the Federal Reserve Act, they were required to be temporary in nature and to end when times were no longer unusual and exigent.

Much has been done over the past few years to mitigate the structural flaws that make wholesale funding a point of weakness in the global financial system. The New York Fed, for example, has led a Federal Reserve effort to make the tri-party repo system more resilient to stress, while the SEC has taken steps to address risks associated with money market mutual funds. Nonetheless, some important issues and vulnerabilities remain. Moreover, because the Dodd-Frank Act raised the hurdle for the Federal Reserve to exercise its Section 13.3 emergency lending authority, extraordinary interventions will be more difficult to undertake, perhaps causing investors to be even more skittish in the future. This is why it is essential to make the system more stable. To that end, I look forward to hearing the insights and suggestions that come out of today’s workshop.

Thank you for your attention.