Will money market funds break the buck

Post on: 16 Март, 2015 No Comment

Posts Tagged will money market funds break the buck

SECs New Money Market Fund Rules

Posted by Larry Doyle on January 29th, 2010 10:44 AM |

Sense on Cents once again thanks our friends at 12th Street Capital for providing tremendously useful information and analysis. What do we learn today? The new rules adopted by the SEC for money market funds.

The overview of these rules is provided by Orrick, Herrington and Sutcliffe LLP. The driving force behind the new SEC rules is an effort to promote greater disclosure and liquidity within money market portfolios. After the crisis of 2008-whenever (its not over yet), money market funds were and are much riskier than previously perceived. The risks lay in the fact that these funds invested in a fair amount of risky assets. Now that the government backstop of this industry has ceased, the new rules are needed for the industry to move forward.

Investors need to know that when these rules are effective (sometime in 2010), funds can break the buck ($1.00 NAV, net asset value) and suspend redemptions.

Navigate accordingly knowing that the money market industry is not what it used to be.

Thanks again to 12th Street and to Orrick for this 2-page overview. Click on image to open pdf document:

No Time for Complacency on Insurance and Money Fund Exposures

Posted by Larry Doyle on July 29th, 2009 1:02 PM |

Despite the rise in the equity markets and supposed hints of stability in the economy, this is no time to get complacent about your investments. The transition we are experiencing in the economy and the markets will present real opportunities, but also real risks.

On the topic of risks, it is of paramount importance that all investors get full information from your brokers and financial planners across all your exposures. Do not allow those managing your money to indicate the market feels OK here and leave it at that. Why? Significant underlying fundamental risks remain in the market. I am reminded of two of them this morning as I read the following about insurance companies and money market funds:

1. Experts Call for Fed Involvement in Insurance Industry but to Different Degrees; InvestmentNews. July 29, 2009

Members of Congress are being urged to create — at a minimum — a new regulatory body within the federal government to focus on the insurance industry. “There is some systemic risk in insurance requiring a regulator,” said Travis Plunkett, legislative director of the Washington-based Consumer Federation of America, who was part of a panel of experts testifying today at a Senate Banking Committee hearing on modernizing insurance regulation.

“In order to fully understand and control systemic risk in this very complex industry, the federal government should take over solvency and prudential regulation of insurance as well.

This shift in regulatory oversight of the insurance industry would be a massive undertaking. Recall that all insurance companies are currently regulated at the state level; however, state insurance reserves to protect policyholders against defaults are woefully deficient.

The Wall Street Journal touches upon this as well, in writing Syntax Error? Life Insurers and Earnings :

Some life insurers used the recent market upturn to raise more than $10 billion in combined capital. Hartford Financial Services Group and Lincoln National, which report after the market closes Wednesday, accepted Treasury Department money. The injections have scaled back doomsday scenarios, as well as liquidity concerns that made a few insurers short-selling favorites.

At Hartford and Lincoln, analysts are watching closely to see if the government bailouts may be tainting the insurers in consumers eyes.

While certain banks were forced to take TARP money, for Hartford and Lincoln taking TARP became a necessity. If I had exposure to these institutions, Id be monitoring them very closely. Id do the same with all my insurance exposures.

I’m among the last people standing who think that Paul Volcker is right about money-market mutual funds. They pose a systemic risk to the financial system and need a radical fix.

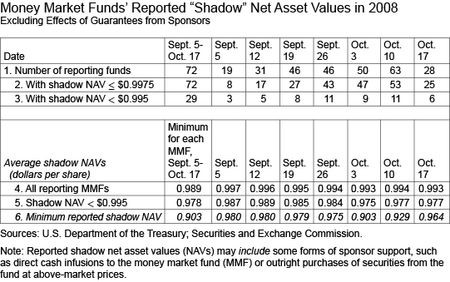

When a central banker of Volckers magnitude raises a concern of systemic risk, I am all ears. Virtually the entire money market industry is currently backstopped by Uncle Sam. How many of these money funds may break the buck without some form of assistance? Bryant asserts:

In most cases, money-fund sponsors have come to the rescue of their funds if any question arose about the $1 value of their shares. Peter Crane, president and founder of Crane Data LLC in Westboro, Massachusetts, says as many as one-third of the funds will have needed support by the time this global financial squeeze abates.

But you can’t be sure that sponsors will always be willing or able to bail out their shareholders, says Jack Winters of Hingham, Massachusetts, an expert who worked in the industry from 1976 to 2008 and commented on the SEC proposals.

“Dealers supported auction-rate securities for 25 years until their financial situation precluded it,” Winters says.

We know all too well how the ARS debacle unfolded.

No time for complacency!!

Related Commentary