Why Your Advisor won t mention ETFs

Post on: 16 Март, 2015 No Comment

- How do investment advisors make money?

Aside from the fees that advisors charge, the single best way to keep a client is to keep the costs of their client’s portfolios low. They basically earn their keep in either of two ways: fee based charges, a method of giving advice and charging the client by the hour with the client executing the advice on their own or by charging the client a percentage of the portfolio under management. One thing is consistent with both types of client/advisor relationships: the client usually has ideas and if the advisor can say no, that won’t work, or that will cost too much, they will be considered the advisor most likely kept.

Many of the richest individuals are wealthy for one simple reason: they focus on costs.

What sorts of investments do advisors generally recommend?

One of the most profitable forms of investments in the eyes and wallets of the advisor is the mutual fund. Mutual funds come in two basic varieties: those that charge loads (a sort of entrance or exit fee based on the invested assets) or no-load (no fee for investing). The reason advisors suggest load mutual funds is the fee structure they receive as a commission. Fund companies are well-aware of this relationship and even if they have better suited mutual funds, the advisor will take the fee offered on the funds the company promotes. Clients should be also cautioned when using advisors who recommend in-house mutual funds.

These advisors also tend to direct clients towards annuities, which generally charge much higher fees than individual mutual funds. Clients may find their advisor suggesting frequent trades, another method to generate additional fees in a commission based arrangement.

Why don’t advisors recommend low cost investments?

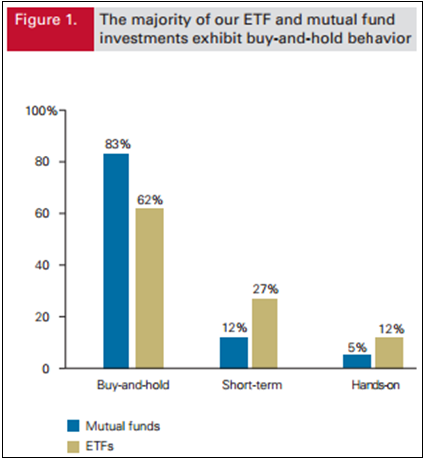

Low-costs investments tend to be passively managed, such as index mutual funds or exchange traded funds (ETFs), which in more instances than not, are also index funds traded on a stock exchange through a broker. Neither of these investments tend to be pushed by the fund families and because of that, are not usually part of the conversation. These two investments are easy for the individual investor to use, with index mutual funds being the easiest.

Why don’t advisors recommend ETFs?

Even as simple as ETFs tend to sound, they are somewhat complicated and involve some legwork by the investor. ETFs are baskets of securities that are sold as such through a broker on the stock exchange. Many mimic the same indexes used by the largest mutual funds. If the investor already uses mutual funds to create an indexed portfolio, diversified across a variety of disciplines (large-cap, mid-cap, small-cap, international, and fixed income), there is little incentive to change course. Investors interested in ETFs may approach this tool as they look to add risk where they may not have much. ETFs can, in most instances be a low-cost alternative to mutual funds.

But advisors often give different excuses as to why they don’t recommend these investments to their clients. The vast majority simply don’t understand them. Others still believe that mutual funds are better suited for their clients or that they didn’t feel ETFs were good for their clients.

Should clients insist on having the discussion?

Clients could push the issue. But advisors also face other issues with ETFs they may not mention: short-term selling penalties if the investor wants out. Some fund families are now adding on a small fee on ETFs sold within sixty days of purchase.