Why you should consider investing in taxefficient funds

Post on: 16 Март, 2015 No Comment

With mutual funds, it’s not what you earn but what you keep that makes the difference

Because taxes can take a big bite out of your returns, you should ask yourself, How tax-efficient are my investments?

What makes a mutual fund tax efficient?

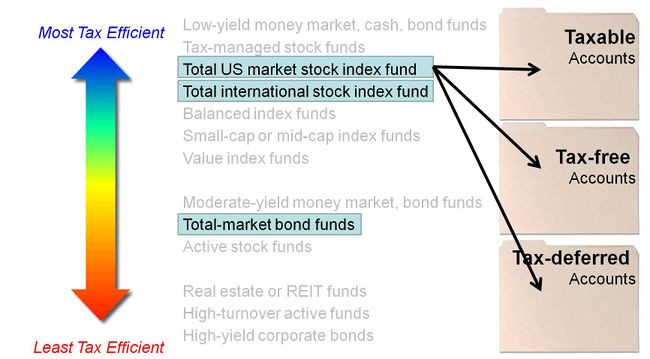

Factors such as investment approach (active, broad index, narrow index) or methodology can weigh heavily on a fund’s tax efficiency. However, certain types of investments are, by their nature, more tax-efficient than others.

With stock funds, for example, the amount a fund distributes affects its tax efficiency, of course, but the type of distribution also plays a big role.

Because of tax law changes over the years, the difference between the rates levied on long- and short-term capital gains has widened. (Capital gains are the gains mutual funds distribute to investors resulting from profits from the sale of a security within the fund or the gains investors realize when they sell a stock or a bond for more than they paid for it.)

Most investors pay the maximum 15% on qualified dividend income and long-term capital gains. However, the tax rate can be as much as 35% on short-term capital gains. This huge difference means that if you’re concerned about taxes, don’t buy funds in taxable accounts that distribute high levels of short-term capital gains and avoid selling your investment before a one-year period.

What types of funds are tax-efficient?

Although any given fund has tax-saving potential, these three types are the most tax-efficient.

Tax-exempt funds: A smart choice for income-oriented investors to consider

If you’re in one of the higher federal tax brackets and seek current income, you may benefit from a municipal bond fund. These funds generate monthly dividend income that is exempt from federal income taxes.* (Vanguard also offers some state-specific tax-exempt funds that are exempt from state and local income taxes.)

To determine if a tax-exempt bond fund might be more advantageous than a comparable taxable bond fund, calculate its taxable-equivalent yield .

Index funds: Buy-and-hold strategy reduces taxable gains

Index funds are probably the most common tax-efficient option. These low-cost funds, which seek to track the performance of specific benchmarks, typically hold all or a representative sampling of the securities that make up the index. Their buy-and-hold strategy makes them less likely to distribute taxable capital gains to you, although this is not guaranteed.

Tax-managed funds: Sophisticated techniques minimize taxable distributions

Tax-managed funds also seek to track a particular index through a buy-and-hold strategy. They go a step further, though, by following specialized investment plans designed to minimize buying and selling of shares that could generate taxable gains. They also impose policies designed to discourage investors from frequently moving into and out of the funds.

Armed with some basic information about tax-efficient funds, you can improve the chances that you’ll keep more of your investment returns. Because taxes are such an integral consideration in mutual fund investing, you should review your specific situation with a tax advisor.

* Although the income from a municipal bond fund is exempt from federal tax, you may owe taxes on any capital gains realized through the fund’s trading or through your own redemption of shares. For some investors, a portion of the fund’s income may be subject to state and local taxes as well as to the federal alternative minimum tax.

NOTES:

- All investments are subject to risk.

- Tax-managed funds may not meet their objective of being tax-efficient.

- The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

- Investments in bond funds are subject to interest rate, credit, and inflation risk.