Why you should be investing in short term debt funds

Post on: 13 Июнь, 2015 No Comment

Impact

Unlikely the Indian equity markets, it’s been rather a quiet journey for Indian debt markets. With inflation on Reserve Bank of India’s (RBI’s) vigil amongst host of other macroeconomic factors, interest rates in the country have remained rather elevated. So those who believed earlier in the thesis that interest rates may move down, have been disappointed. With yields of 10-Yr Government security also having moved up during such times, those who invested in long-term debt funds were also disappointed. But on the other hand, those who invested in short term debt funds witnessed better returns or outperformance rather comfortably. You see, short term debt funds have outperformed across time frames (see chart below).

Short Term income Funds vs. Long Term Income Funds

Data as on April 28, 2014

Note 1: Returns upto one year are expressed in absolute terms, while for those over a year are compounded annualised Note 2: Category average of short term income funds and long term income funds is considered to measure performance

(Source: ACE MF, PersonalFN Research)

Why short term debt funds have outperformed?

To arrest the downside of the Indian rupee against the U.S. dollar. RBI restricted borrowing of banks under Liquidity Adjustment Facility (LAF) in 2013. Marginal standing Facility (MSF) rates were also hiked. Banks used aforesaid windows for meeting short term demand-supply mismatches. When they can’t borrow adequately through LAF, issuances of Certificate of Deposits (CDs) go up as banks try to borrow from other sources. In such a scenario MSF rates come into picture as they would often be taken to benchmark yields. In such a condition if overall financial system is somewhat facing liquidity crunch, banks have to offer higher yields and that makes investing in CDs attractive. So when short term debt mutual funds have exposure to CDs in such a scenario, naturally they gain. Likewise having held Commercial Papers (CPs) and yields having moved up thereto, they gained here as well.

And what were the hitches for long-term debt funds?

There has been a supply pressure on long end of the yield curve. Huge borrowing calendar of the central Government not only sucked liquidity but made issuance unattractive. Moreover, rising yields on Government treasury bonds in the United States made Indian debt market seem unattractive to foreign investors, as higher rates induced them to invest there.

The other prominent macroeconomic factors that made long term debt funds unattractive were:

- High fiscal deficit of the central Government;

- Sustained inflation; and

- Anti-inflation monetary policy stance of RBI

Going what you can expect:

RBI has kept the target of 8% inflation as measured by the movement of Consumer Price Index (CPI). Although inflation came down for a few months, it has now started rising again. Furthermore, retail inflation is more affected by the food price inflation. In India, food prices are sensitive to monsoon. Indian Meteorological Department has predicted a weak monsoon this year. In such a scenario, RBI may overlook weaker industrial performance and concentrate on inflation. Interest rate sensitivity of debt securities having longer maturities is higher than that of securities with shorter maturities. Investors would take cues from the political landscape panning out and which Government comes to power at the centre. Thereafter the Indian debt market would observe the policies which would be framed and how the fiscal situation would be managed. If Government draws out a plan to contain fiscal deficit and achieves any early success, markets might be slightly relieved.

Securities with shorter maturities may stay attractive as there is no clarity on liquidity. Although spread between MSF rates and the repo rate is 100bps or 1%, which appears normal; there has been no clarity on direction of the liquidity in the system. On one hand, RBI introduced term repos and conducted Open Market Operations (OMOs) to shore up liquidity, but on the other, it has brought down permissible limit for LAF borrowing by banks. Unless this changes, short term papers would remain attractive. Movement of rupee against U.S. dollar would be crucial. RBI may lift restrictions on borrowing only if it is bullish on the outlook for rupee.

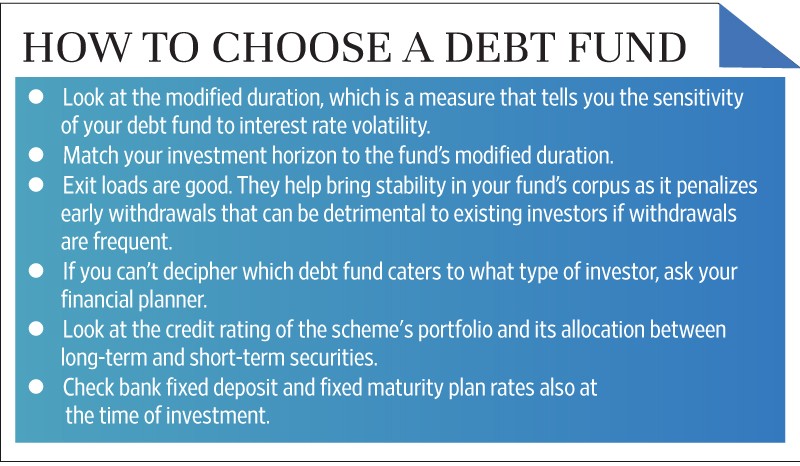

PersonalFN is of the view that, investors should consider their time horizon first before investing in any debt fund. Although short term debt funds appear more attractive for now, it would be imprudent to invest in them if your time horizon is just a month. In such a case you should only consider investing only in liquid funds. PersonalFN is also of the view that, you shouldn’t have more than 20% of your debt portfolio in long term debt funds.