Why PG&E Corp Can Power Your Portfolio Ahead of FourthQuarter Earnings

Post on: 16 Март, 2015 No Comment

NEW YORK (TheStreet ) — Pacific Gas and Electric Company, otherwise known as PG&E Corp (PCG — Get Report ). announced last Tuesday it delivered record electric reliability to its customers for the sixth straight year — a good thing for its customers.

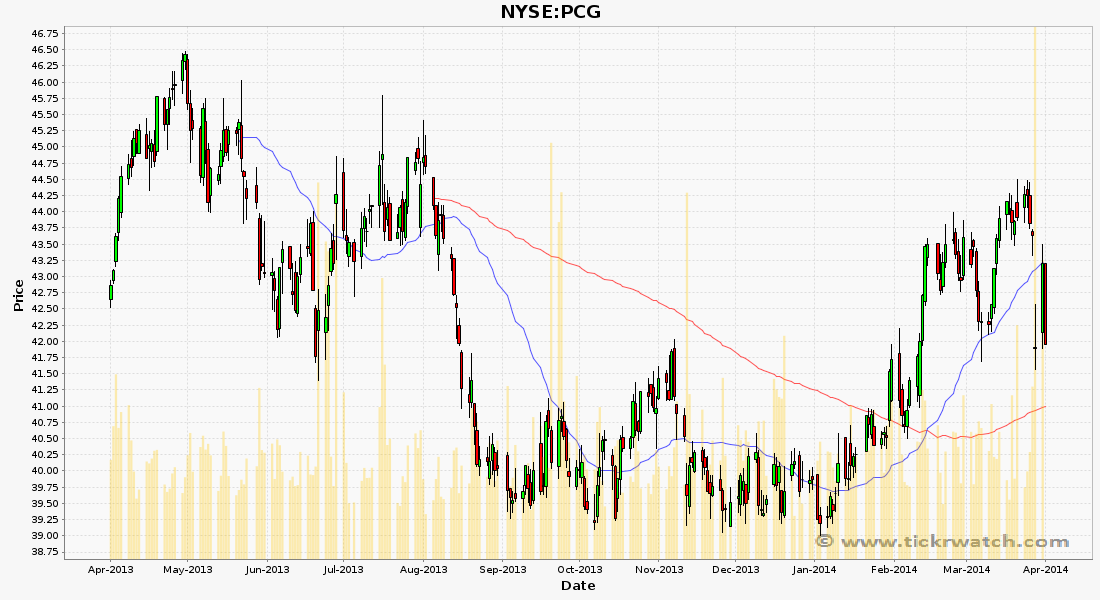

For investors, however, they care more that PG&E has powered their portfolio with 35% stock returns over the past 12 months, beating the Utilities Select Sector SPDR Fund (XLU ). which is up just 20% during that span. And there’s more to come. Take a look at the chart.

PG&E, headquartered in San Francisco, is one of the largest combined natural gas and electric utilities in the U.S. And aside from paying a solid dividend yield of 3.25%. PG&E has also become a growth stock with revenue jumping 18.2% year over year in the most recent quarter — beating estimates by $260 million. And the shares have just gotten cheaper.

The stock closed Friday at $56.06. down 3.44%. Prior to Friday’s decline, PG&E stock was up almost 9% in 2015, demolishing both the Dow Jones Industrial Average (DJI ) and S&P 500 (SPX ). which have traded flat. So this pullback Friday is a rare buying opportunity.

With shares trading at around $56, PG&E trading at a trailing price-to-earnings ratio of 18, almost two points lower than the average P/E of companies in the S&P 500. And on a forward-looking basis, with 2015 earnings estimates of $3.46, the P/E drops two points lower, and still below the average P/E of S&P 500 companies.

What’s more, that PG&E is growing revenue and profits at around 20%, analysts will be forced to increase their estimates. Part of the reason, while analysts have given PG&E a consensus buy rating, they’re only projecting the company to grow at a five-year annual rate of 8%.

The thing is, PG&E has exceeded that level in each of the past several quarters. And not only is it projected to grow earnings in this just-completed quarter by 26% year over year (from 42 cents to 53 cents), its full-year projected earnings of $3.46 per share, is expected to climb 27% from $2.72 per share earned last year.

In other words, PG&E is not being assessed based on its actual performance, meaning the company will continue to beat estimates and issue better-than-expected guidance, which will continue to power the stock upward. In that regard, it means the stock should not be measured on its average analyst target of $56.50, but rather on its high target of $64.50, implying 15% gains from current levels.