Why Invest Internationally

Post on: 16 Март, 2015 No Comment

Key Points

- Some investors shy away from international investing believing it’s too risky or complicated. We’ll show you how it can lower your overall risk while potentially boosting your returns. ETFs and mutual funds can make international investing convenient.

A young, educated workforce in Singapore. Rising household income in Brazil. Export growth in China. Natural resources in Canada, Australia, Brazil and Norway.

These are some of the factors driving global growth. And if you’re only investing in US companies, they represent opportunities you may be missing. In fact, investing solely in the United States amounts to excluding three-fourths of the global economy 1 and over half of the world’s stock market value. 2

We believe that allocating between 5% (conservative) to 25% (aggressive) of your total portfolio to international stocks can be a smart move for a number of reasons:

- Potential for higher rates of growth abroad.

- International stocks are becoming a larger share of the investment universe.

- Potential to lower overall risk in your portfolio.

- Multiple currencies can provide an added layer of diversification.

Let’s look closer at each of these.

How do I get started?

We believe even the most conservative investors can benefit from an allocation to international stocks. In the stock portion of your portfolio, we suggest up to 25% in international, depending on your risk tolerance. Schwab’s model portfolios incorporate risk tolerance, resulting in an allocation to international stocks of 5% for a conservative investor’s total portfolio and 25% for an aggressive investor’s total portfolio. For more details, clients can use the Schwab Portfolio Checkup tool to see how their current allocation stacks up against their target allocation.

We recommend allocations to international stocks include a small exposure to emerging markets —developing countries experiencing rapid growth and industrialization. Despite the higher risks of investing in emerging markets, growth is generally expected to be stronger than in other markets. More importantly, emerging markets may perform differently than developed markets, helping diversify your international holdings. As a guideline, Schwab’s maximum recommendation—for the most aggressive investor—is 5% of your equity portfolio in emerging markets.

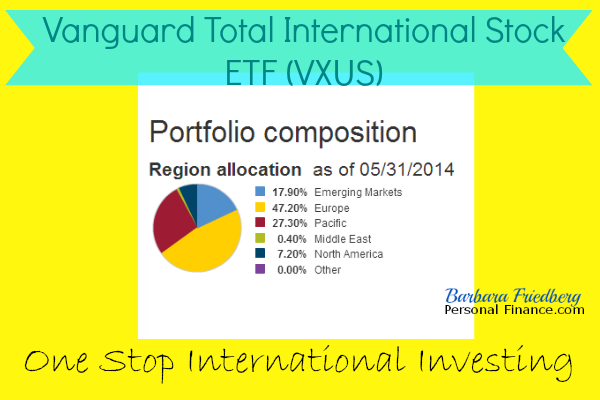

For most investors, the most convenient and cost-efficient way to invest internationally is via exchange-traded funds (ETFs) and mutual funds. Read the prospectus to confirm the fund holds a diversified group of companies, sectors, countries and regions.

From a bond perspective, we suggest allocating no more than 15% of an investor’s bond portfolio to international, with risk tolerance determining the actual percentage allocation as outlined by Schwab’s model portfolios. Emerging market bonds are a component of the aggressive fixed income allocation that also includes high yield bonds, preferreds and convertibles, where we suggest investors limit their exposure to no more than 20% of their bond portfolio. For more on bond investing, see www.schwab.com/onbonds .

Schwab international resources

Schwab provides a number of different ways for clients to invest in equities internationally: exchange-traded funds (ETFs), mutual funds and individual stocks.

Clients can find out more about specific countries on the international research pages. Go to Regions & Countries. and select a country. Here, you’ll find economic data, research, news, allocation guidelines and investment options, including the ETFs and mutual funds with the largest exposure to each country.

You can invest in individual international stocks, but you’ll need a high risk tolerance and time to devote to in-depth research. Read Managing an International Equity Portfolio Using Schwab Equity Ratings to learn about our recommended research process for creating and managing an international stock portfolio.

Schwab clients can get the Schwab Equity Rating International Report on a particular stock. You can find it in the Ratings Summary box on a stock’s summary page under the Research tab. The report can help you evaluate the investment potential of a particular stock. It includes insights into a stock’s rating along with valuation, earnings and fundamental metrics.

Investors trading foreign ordinary shares in the US OTC market using our online and automated trading platforms can contact Schwab’s Global Investing Services team at 800-992-4685 for more information.

High rates of growth abroad

International markets can offer growth opportunities that may not be available in the United States due to differences in household income, younger populations, availability of natural resources, export strength, and movement toward free-market economic policies. Many Asian countries, for example, benefit from exports to the Chinese economy.

Exposure to these unique growth areas, as well as emerging markets, can boost return potential. Emerging market countries typically have lower household incomes and lower debt levels relative to developed markets, giving them the ability to grow faster.

Economic growth in the United States is expected to be subdued in the near term. The International Monetary Fund (IMF) is forecasting growth in the United States to be below world growth over the next several years. 3

Emerging-market economies in particular are expected to have high growth rates which the IMF estimates are two to three times faster than developed-market economies. 4 Corporate revenues have the potential to grow faster when economic growth is higher. However, bottom-line profits depend on how expenses grow. For example, wages in China have continued to rise this year, despite the slowdown in revenue growth.

United States becoming a smaller share of the pie

In addition, while the United States boasts the world’s largest economy and stock market, the country’s importance and share of the world economy has been declining, particularly as emerging markets have grown in size. Remember, investing solely in US stocks means excluding nearly three-fourths of the global economy and over half of the world’s stock market value.

While it’s true that US companies can have international operations, investing in companies located overseas provides the potential to benefit from currency diversification (more below).

Potential to lower overall risk in your portfolio

Investors can potentially reduce portfolio risk by diversifying their investments across various asset classes—categories of investments—each tending to respond differently to various market cycles and events. International stocks are one of the five main asset classes, along with large-cap stocks, small-cap stocks, bonds and cash investments. While international investing has higher stand-alone risk, the power of diversification across asset classes can potentially lower your overall portfolio risk.

Put simply, by investing abroad you gain exposure to companies operating in other countries—with potentially unique products and customer sets—that may weather market downturns and upturns differently.

See the table below, which shows how performance in the United States has stacked up versus other developed markets in recent years.

The Best and Worst Performing Markets