Why Hyperactively Managed Funds Outperform

Post on: 16 Март, 2015 No Comment

Many mutual fund managers don’t do much, but those that do generate high alpha net of fees

Illustration by Thomas Reis.

To say that active management has fallen out of favor in academic finance is like saying that leeches have fallen out of favor in medicine. An author who dares to suggest that active mutual fund managers provide value generally causes journal reviewers to reach for their pitchforks.

Two recent articles by Antti Petajisto, former NYU assistant professor and now vice president for BlackRocks multi-asset strategies group, buck this trend. Petajisto finds that a lot of active managers dont do much. Since they charge higher fees than passive funds, its natural that they will underperform. Other active managers try to do something. And thats where things get interesting.

Petajistos 2009 article, co-authored with Yale Professor Martijn Cremers and published in the Review of Financial Studies. found that the percentage of mutual fund assets that were managed passively increased steadily through the 1990s and 2000s. The problem is that not all of these passively managed funds were index funds. Some called themselves actively managed funds, charging management fees that suggested they did something other than play golf and enjoy three-martini lunches. These are the so-called closet indexers. They dont do well.

The percentage of passively managed fund assets has risen from about 10% in the mid 1990s to about 50% now. But only about 20% of these fund assets are held in pure index fundsthe other 30% are held in actively managed funds that essentially hug the benchmark. The other half of mutual fund assets are invested in funds whose asset holdings deviate substantively from their benchmark. These are, presumably, the ones who identify stocks or sectors they believe are undervalued. In other words, they try to do something.

As it turns out, the ones who did something were able to achieve a positive risk-adjusted return net of management fees (see nearby table).

In their research, Cremers and Petajisto introduce a new measure called active share, which describes the extent to which managers deviate from the allocation to stocks within their benchmark. So if a mid-cap growth manager decides that Tesla has become overvalued and underweights the stock and decides to overweight Yahoo. this will create a deviation from the benchmark. More deviation means more active share. Active share seems much more closely related to the ability to generate alpha than tracking error.

Cremers and Petajisto show that the more the fund deviates from the benchmark, the better it performs. And the relationship appears surprisingly linear and consistent. The more work they do, the higher the alpha net of fees. The gold standard of fund performance is persistence. Are yesterdays high active-share funds going to outperform tomorrow? Funds with high active share today are significantly more likely to have high active share in five years and to outperform other active funds.

Money for Nothing

The flip side of the exciting research in active share is that it identifies a large segment of the mutual fund universe that appears to be inactive. In a paper titled Money for Nothing, American College assistant professor David Nanigian and I investigated whether managers who did more work charged higher fees. It turns out that they do. Closet indexers charge less, but they still charge a lot more than the expense ratio on pure index funds. This leads to two questions. Why would anyone invest in an active fund that does nothing? And why arent more fund managers trying to do something?

Closet indexing may be related to fund marketing. Studies have found that excess performance attracts a lot of new investor cash. But once in the fund, investors tend to be less sensitive to returns unless a fund crashes. So the optimal strategy is to work to attract new investor funds, and then sit back and track the index to avoid the possibility that youll do significantly worse than the benchmark. If existing investors are happy with average returns, then theres no reason to rock the boat.

Nanigian thinks that the risk of deviating from an index can help explain why so many actively managed funds have a low active share. When a fund manager chooses to deviate from her benchmark she is taking a risk that she will underperform the benchmark.

Indeed, a 2012 report on active share by Vanguard finds that excess performance, positive or negative, rises with active share. Since a managers compensation and continued employment may be threatened by underperforming the benchmark, Nanigian believes that hewing close to the benchmark is a safer bet. Acting in self-interest, it makes sense for them to engage in closet indexing.

In Petajistos newest paper to be published in the Financial Analysts Journal this year, he identifies 180 closet indexing funds. The 180 most active funds (he calls them the stock pickers) hold $480 million in assets while the 180 closet indexers hold over $2 trillion. The expense ratio of the stock pickers is 1.41% on average while the closet indexers charge 1.05%. The net alpha of the stock pickers, however, is 1.89% annually versus -1.07% for the closet indexers between 1990 and 2009.

Unfortunately, those closet indexing active fund owners hold what is essentially a really expensive index fund. Although expense ratios are lower for the closet indexers, their expenses will always equal their underperformance.

Is Active Share Valuable?

A recent research report by Vanguard questions whether the hype over active share might be overblown. Using a more recent time period, 2001-2011, there is little evidence that funds with greater active share performed better. And there appeared to be little persistence in 2006-2011 performance among more active fund managers who performed well between 2001 and 2005. Petajistos most recent study, however, shows that stock pickers (measured through active share) outperformed during the full 1990 through 2009 time period, and that they also outperformed during the financial crisis of 2008 and 2009.

John Ameriks, the new head of active equity at Vanguard, explains that the report should be taken as a criticism not so much of active share but maybe a criticism of the idea of a magic metric that you can use to beat the market. Any single metric really isnt going to give you all the information you need to make a good choice about an active manager, so be careful.

Morningstar head of retirement research David Blanchett agrees that the value of active share is primarily to identify who is not providing value rather than identifying managers with exceptional skill. I think it does a better job focusing investors on getting what they are paying for. If you buy an actively managed mutual fund with an expense ratio of 1.20% that has a 50% overlap with its benchmark index, which could be purchased for say 20 basis points, in reality youre paying about 2.4% for the actively managed portion. This makes it very difficult for the active fund to outperform, given the high fee for the active portion.

Petajisto provides an example using the Fidelity Magellan fund between 1980 and 2009. In 1980, manager Peter Lynch had an active share in the fund of over 95%. Each year after 1980, the active share declined until Lynch left the fund. Jeffrey Vinik later increased active share back up to 75%. After the departure of Vinik, manager Robert Stansky reduced active share to just over 30% by the early 2000s. In essence, Fidelity Magellan turned from an active fund to a closet indexing fund over the course of 20 years.

The Magellan fund eventually increased its active share in the mid-2000s under new manager Harry Lange. So big mutual funds dont have to slide toward closet indexing. During Langes tenure, active share rose to 80% in 2008. In contrast, the American Funds Growth Fund of America reduced active share from over 95% in 1981 to about 40% in 2009 as its asset base expanded.

What active share perhaps does best is help an advisor evaluate an active fund that is doing little to provide the alpha needed to justify a higher expense ratio. Theres simply no way that a closet indexing manager is ever going to beat an index fund.

Selecting the Right Fund

One explanation for the value of more active management is that it allows informed stock pickers to exploit inefficiencies in markets where investors may not spot a bargain. Active share is highest in fund categories where these inefficiencies are most likely to exist. Small cap styles average about 90% active share while large cap styles average closer to 70%.

Ameriks notes that there continues to be a conviction that active management somehow is a more attractive proposition within less efficient parts of the market, and I think its absolutely true that you need to have some market inefficiency in order to create an environment for an active manager to provide value.

But markets are a zero-sum game. Simple mathematics implies that some managers will outperform while others will underperform the market. Add on higher fees and the percentage of outperformers relative to index funds falls below 50% (and well below in categories with higher average expense ratios). The issue says Ameriks is on which side of that line youll be.

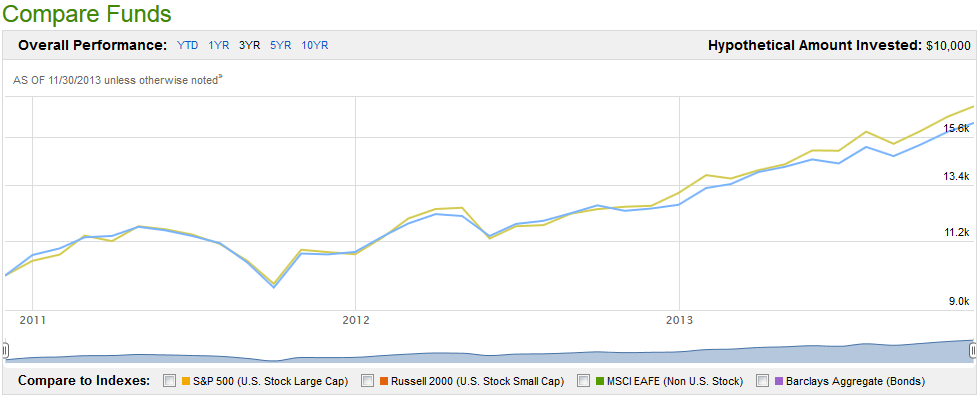

An increasing percentage of asset trades within a market are made without any thought given to fair valuation (see nearby table). The share of passively managed mutual fund and ETF assets rose from 2% in 1993 to 26% today. There is a danger that this relentless, blind flow of investment assets leads to overvaluation among equities in the most popular indexes. The price impact of being added to or deleted from the S&P 500 has jumped over the last 15 years. Does merely being added to the S&P 500 really mean that a companys intrinsic value is 10% higher?

The other danger is that the traditional governance role provided by institutional investors like pension funds and some active managers is abandoned by passive fund managers. This may be particularly true for companies in the S&P with the largest passive ownership. Who wouldnt want to be the CEO of a company where the majority of shareholders dont care about policing the board?

A paper by Professors Sanford Grossman and Joseph Stiglitz lays out a model where funds flow to passive as markets become more efficient through the efforts of active managers. But the lack of valuation-motivated trades creates inefficiencies, leading to flows of investor dollars back to active managers to take advantage of these opportunities. Nanigian notes that the proportion of fund assets that are passively managed is at an all-time high, which leads me to believe that the market is ripe with great opportunities for active managers.

The use of quantitative, data-driven methods to select securities can best be applied on a large scale through lower-cost fund investments. This may explain the increasing interest in active ETFs. Although Ameriks notes that ETFs and mutual funds are very similar (the F in ETFs stands for funds), the primary difference from the managers perspective is continuous disclosure of holdings.

This makes ETFs not so appealing to managers whose skill or semi-private information allows them to earn excess returns. That would allow anyone to replicate their trading at a much lower cost. Active ETFs may be most appropriate as a tool for executing more technical strategies at a cost that doesnt tempt copycat investors.

Actively managed mutual funds still dominate passively managed funds in terms of managed assets, and mutual funds continue to dominate ETFs despite their increasing popularity. This will mean that identifying opportunities to provide value among active managers will continue to be a challenge. For an advisor, it makes sense to identify which active managers have the best shot at earning their keep.