Why ETFs are heating up the market what they mean to your portfolio Yahoo Finance Canada

Post on: 29 Май, 2015 No Comment

You may have heard the term ‘ETF’ being bandied about the financial papers and investment news lately. From in-flight Air Canada commercials to big acquisitions, ETF firms are making waves in the investment community as a complement to traditional mutual funds. Recognized for their lower-cost structures, trading ease and reasonable taxation, here’s why diversifying your portfolio with a little ETF-edge may just be worth considering.

What is an ETF?

Exchange-traded funds are commonly referred to as the middle child of stock trading. Comfortably seated between indexes and equities, ETFs are an index-based investment (or occasionally, correlated to another underlying asset) representing a grouping or basket of stocks; their performance is based on their correlating index. In other words, they’re kind of like a mutual fund, except for the fact that they trade like a stock — on a stock exchange.

ETFs and mutual funds compared

There are 4 major differences between mutual funds and ETFs.

- ETFs are bought and sold through a brokerage house. Unlike mutual funds, whose prices are calculated at the end of day, ETF prices can change at any second. And while you can purchase mutual funds during the day, the actual trade doesn’t occur until the end of the day, after the market has closed.

- ETFs are typically passively managed, due to the fact that they tend to represent indexes. Mutual funds, on the other hand, have an active management approach behind them.

- Even though there is a trading fee associated with ETFs, this type of investment product usually ends up costing less than a traditional mutual fund. This is because the ongoing management fee is normally lower. Furthermore, there’s never an entrance or exit fee (also referred to as a load), which are common with the sale of most mutual funds.

- ETFs can offer greater tax efficiency than mutual funds . This is typically due to their structure and low-portfolio turnover.

How ETFs can benefit your portfolio

- ETFs are a great way to hedge against risk while at the same time gaining exposure to a certain industry. Flexible and affordable, ETFs are meant to follow a particular index, not outperform it. While this normally leads to average market returns, it also means that you can avoid the due diligence required for individual stock selection, helps ensure diversification, and as an added bonus, the management fees are virtually non-existent.

- ETFs pay dividends or distributions. Depending on the ETF you choose, you may have the opportunity to earn income. This can be an essential part of any investment strategy. Dividends are a great way to increase the return during rising markets, help to manage downside risk during a falling market and/or pay an investor while she waits during a sideways market.

- Many ETFs list options and futures contracts . This can come in handy when assessing risk in your portfolio.

- ETFs are easy to transfer. Considered a portable investment, ETFs can easily be moved from one investment firm to another. Conversely, when a managed portfolio is switched between firms, complications sometimes ensue; this may result in increased commissions and fees and could potentially trigger the onset of early capital gains tax.

- Above all else, ETFs are extremely easy to understand. When you buy or sell an ETF, it’s done as one transaction; that’s it. As a comparison, with mutual funds, shares within the asset are continually being traded, which results in multiple trades, multiple prices and occasionally, multiple fees.

How to get started with ETFs

Whether you’re investing in mutual funds or ETFs, it’s important that you understand the product you’re about to purchase. As always, take the time to talk with your financial advisor or investment planner before taking the plunge.

It’s also important that you learn the risks associated with ETFs; for example.

- Some ETFs use leverage. That is, certain ETFs will use double or triple leverage which can result in losing more than double or triple the index along with your money. It’s critical to do your research and understand the ETF you are buying so you fully understand the risks.

- Some ETFs have a low-trading volume. This can often cause the bid-ask spread — the difference between the prices quoted for an immediate sale (ask) and an immediate purchase (bid) — to become too large, diminishing the product’s cost-effectiveness.

Once you’re aware of the risks, it’s time to decide on an investment strategy. An investor who is looking to gain exposure to a specific market sector may wish to proceed differently than someone who is using an ETF to hedge against risk. As such, before you start adding ETFs to your portfolio, make sure you understand why you’re making this investment decision and whether an ETF, mutual fund or other investment product makes the most sense.

Where to buy an ETF

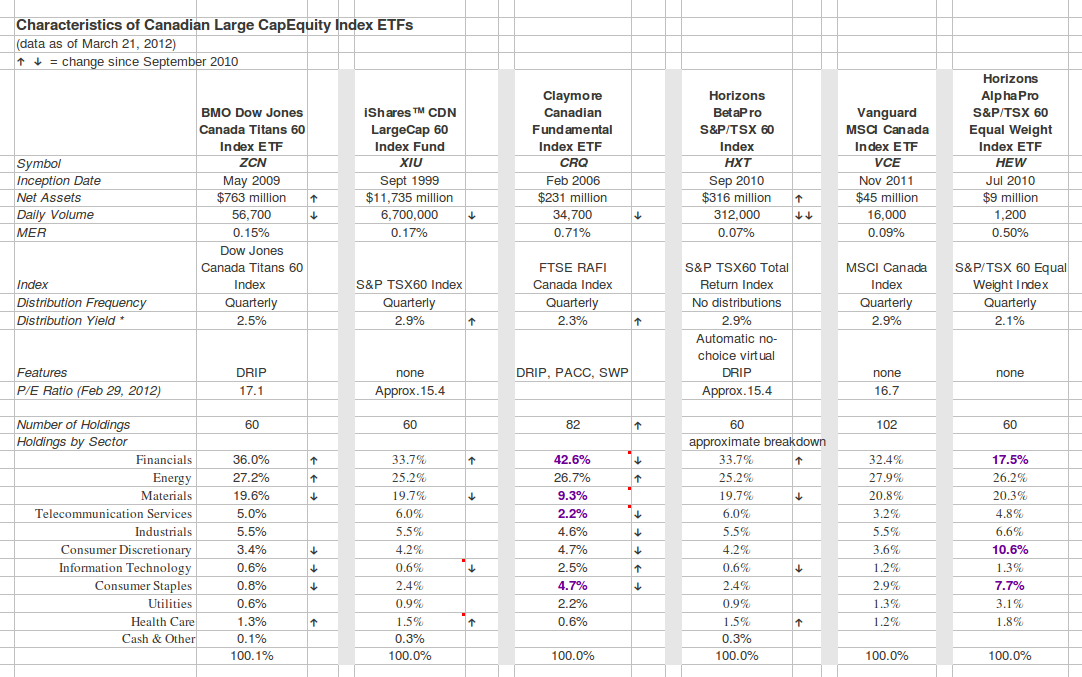

In Canada, there are currently more than 100 exchange-traded funds available. They cover all of the major asset classes, and then some. Canadian ETF suppliers are as follows:

- Barclays Capital

- iShares

- Vanguard

- Invesco PowerShares

- Claymore Investments

- Horizons ETFs

- Bank of Montreal

- RBC Global Asset Management

- XTF Capital

South of the border, investors will find more than 700 American ETFs. Unlike American mutual funds, which are off-limits to Canadians, U.S. ETFs can be purchased by Canadian investors.

If you find the task of analyzing, comparing and picking stocks daunting, you’re in the same boat as many of us. Luckily, you’ve got options to simplify the process. Like mutual funds, ETF products are making it easier for investors to understand and participate in low-risk investment opportunities. They’re worth getting curious about.

GoldenGirlFinance.ca is a free personal finance and education site for women.

Nothing contained herein is intended to provide personalized financial, legal or tax advice. Nothing should be construed as an offer to sell, or a solicitation of an offer to buy a security, a recommendation for any product or service by Golden Girl Finance or any associated third party, or a suggestion regarding the purchase, holding or sale of securities. Before implementing any financial strategy, you should obtain information and advice from your financial, legal and/or tax advisers who are fully aware of your individual circumstances.