Why did the stock market crash

Post on: 16 Март, 2015 No Comment

Why did the stock market crash?

January 21, 2008

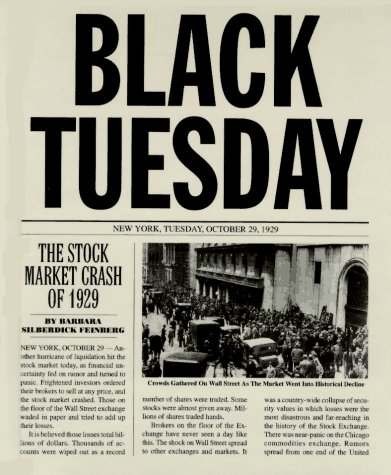

B lack Monday saw bloodbath on Dalal Street as the Indian stock markets crashed by over 1430 points in afternoon trade (the market has since then recovered somewhat), reminding investors that there is no one-way bet on the stock market.

Why did this huge fall happen?

Many factors. One, there is a change in the global investment climate. One of the primary triggers is the huge fear of the United States’ economy going into a recession with foreign institutional investors trying to reallocate their funds from risky emerging markets to stable developed markets. Analysts are now expecting a cut in US interest rates.

Hedge funds and FIIs could have been the biggest sellers in the Indian markets, booking profits and making the most of the unprecedented bull run that has dominated the Indian stock market for a long time now.

The current volatility is also linked to global bourses. There is a big correlation among global markets. The presence of hedge funds across asset classes, along with increased global movement of capital, has increased event-related volatility.

Volatility in commodities markets has also significantly affected equity markets.

A combination of global and local factors is affecting this market, said Mihir Vora of HSBC Mutual Fund, on NDTV Profit. On the global front, other emerging markets were down nearly 20% so India is playing catch-up, he said.

On the local front there has been a huge build-up in derivatives positions and volatility led to margin calls. Also many IPOs have sucked out liquidity from the primary market into the secondary market, said Vora. At current levels it would be a buy call and we would not advise investors to wait to catch the bottom, he added.

How long will the markets keep falling?

Analysts expect the markets to continue to be choppy for a while till global liquidity and commodity prices settle in. With the markets falling, a technical correction in the derivatives segment has perpetrated a larger fall.

The Sensex can fall another 10-15%, said Adrian Mowat of JP Morgan, on NDTV Profit.

India is trading at 65% premium to emerging markets and India is playing catchup with other declining global markets, he added. There is no need to get very pessimistic that this is the end of equity investing in India, he said. This could be seen as a buying opportunity and we will re-visit market valuations after the correction, he added.

India cannot escape a global meltdown. With fears of an impending US recession high, no country is likely to be spared.

Traders look stunned as the Indian stock markets plummted on Monday.

Text: rediff Business Desk & Business Standard .

Photograph: Indranil Mukherjee/AFP/Getty Images