Why Country Funds Are So Risky

Post on: 16 Март, 2015 No Comment

Writing in the British Daily Telegraph Melanie Wright says, China has experienced meteoric economic growth recently…. But investment in this area is definitely not for the faint-hearted (February 2007). Such comments are familiar in the context of foreign country funds. which, for the U.S. theoretically means any non-domestic investments, but particularly those beyond the established western European markets.

China, other parts of Asia, Eastern Europe, South America and Africa are the classic areas to house international funds. And they really deserve the high-risk label. Philippa Gee, of the British firm Torquil Clark, says that a bumpy ride could occur with such countries’ funds, and that investors cannot expect continuous returns. In fact, extreme volatility is more realistic. In this article, we’ll explain exactly what can make country funds high-risk investments, and let you know whether the risk is worth it. (To find out where you sit on the risk/reward scale, see Determining Risk And The Risk Pyramid .)

Political and Economic Instability

For one thing, these countries pose political risk. Instead of the relatively gentle moves from one party to another that we get in the West, the turbulent political climate in developing countries can lead to massive flights of capital .

Such countries are often very dependent on a narrow range of products or services. Russia, Malaysia, Mexico and Brazil, for example, are so dominated by the very changeable demand for raw materials that their stock markets go up and down like a yo-yo. The Russian index, after all, is two thirds comprised of energy firms. This contrasts significantly with American indexes such as the Dow Jones Industrial Average (DJIA), which on the other hand, has the widest range of companies and products globally.

The narrow range of product situation is echoed in Poland, Hungary and the CzechRepublic. These types of countries can get even more risky and exotic. In really financially obscure places like Serbia, Vietnam, Peru, Nigeria and Morocco, the returns can be massive — but, so can the losses. If you invest in companies originating from Belgrade, Serbia, you could make 65% in three months, but you could also lose 65% just as fast.

Karl Pilny, a German expert on China and Japan, and author of The Asian Century (Campus Verlag, 2005), warns of the naivety with which Western firms pour billions (of dollars) into China. He is concerned that, over time, joint ventures there may not work out well, due to various clauses in contracts that enable the Chinese to get the best out of the deal — at the expense of foreign investors.

Although Pilny thoroughly recommends allocating the right amount of your portfolio into Chinese investments, he cautions that dreams of fast money can be deceptive. China’s growth, he claims, is heavily investment-driven (as opposed to demand-driven), which can lead to appalling and serious overcapacities. Pliny is also wary of the banking sector, the overall credit situation and potential for serious political errors intrinsic to the overall situation.

Mega-Corruption

There are a number of other factors to consider. Even though the West is not exactly free of corruption, in the developing countries, it often reaches another dimension altogether. There are many countries in Africa and South America, for example, where you simply cannot do business without bribing your way from start to finish. This does not make for stability or reliable returns from investment.

According to a paper entitled, Corruption, Public Investment and Growth from the International Monetary Fund (by Vito Tanzi and Hamid Davoodi, 1997), corruption distorts the entire decision-making process related to investment. Not only does this make for bad decisions, but it leads to general inefficiency, low productivity and a lack of transparency. Furthermore, the money being used to fund these illicit transactions is more often than not cutting into shareholder profit. Morally, this is not necessarily the kind of environment in which an investor wants his/her hard-earned savings to end up. (To read more about socially responsible investing. see Clean And Green: The Essence of Socially Responsible Investing . Socially Responsible Mutual Funds and Socially (Ir)responsible Mutual Funds .)

Problems on a Grand Scale

Domestic problems can also be truly alarming compared to those in the United States. In the States, people worry about unemployment rising from figures like 5%, and in countries like Germany, 10%. But in South Africa, despite the booming economy on one level, close to 25% of its population remains unemployed. If there is any real shock to the system, stock markets can go bearish fast.

Developing countries often run huge deficits on their balances of trade and are heavily indebted. They live beyond their means. This may sound somewhat reminiscent of America, but there is no comparison. The United States is fundamentally stable in a manner that emerging countries are not. (Keep reading about emerging countries in What Is An Emerging Market Economy? and The New World Of Emerging Market Currencies .)

Furthermore, smart investors know about all these problems, and are therefore very quick to sell their holdings in such countries as soon as things start to look even faintly dodgy. A manager with Julius Bar, a Swiss banking firm in New York, commented that in these situations people sell fast and ask questions afterwards. This can lead to rapid panic and markets that plunge as fast as they once rocketed.

Information Underload

One of the keys to successful investment is research and knowing the market. In our internet age, there is usually an information overload and one can easily get overwhelmed with facts, figures and opinions about American or European companies and economies. But try and find out about a company in Croatia or the Ukraine and you will see that the information situation is at the other extreme.

Culture Shock

Furthermore, the approaches to investment in funds in these emerging countries are extremely varied. It is not just the countries that differ from back home, but also the way the money is invested and managed. Investors need to look particularly carefully at the specific nature of the funds in question. Those with less experience and expertise may find themselves relying on and trusting brokers and banks more than usual.

The Positive Side

As traditionally known, these markets do not correlate highly with American and European investments. Therefore it is highly advisable and even necessary to have a sensible amount in your portfolio. Five to 10% is probably about right. This kind of proportion should in fact lower the overall volatility of a basically U.S./Western European portfolio. (To find out how to properly allocate your investments, see Achieving Optimal Asset Allocation . Choose Your Own Asset Allocation Adventure and The Importance Of Diversification .)

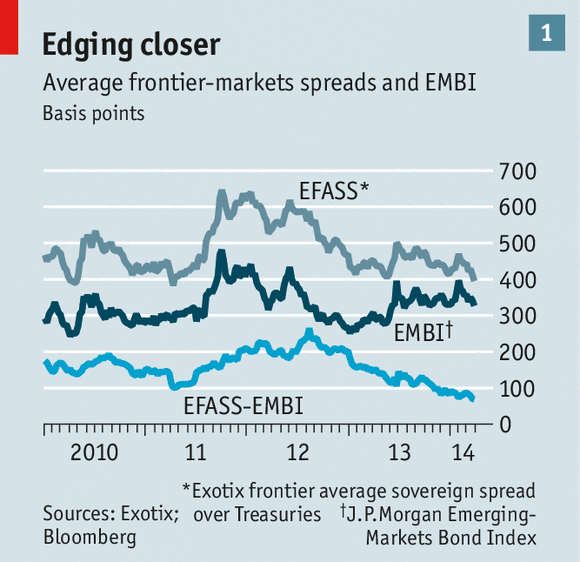

Risks are minimized by buying certificates and funds, rather than individual equities. If you do want the latter, it’s probably best to keep to blue chips. Furthermore, not just equities, but also bonds can be purchased. Emerging market bonds, in small doses, can also brighten up and diversify a portfolio.

Finally, these investments should be monitored particularly carefully and with limits set, in case things go wrong. By so doing, it is possible to constrain and control the risks. (Find out how to set your limits in The Basics Of Order Entry . Limiting Losses and The Stop-Loss Order — Make Sure You Use It .)

Conclusion: So is it Really Worth Investing in Country Funds?

Clearly, country funds offer both high risks and high returns. There is nothing necessarily wrong with that, but the balance between the two must be right. On the other hand, diversification is one of the most important safeguards in the investment process. While a sensible amount in any portfolio should be invested outside the United States, it needs to be managed with full knowledge and awareness of how different such assets are from those back home.