Why 2014 Could Be Good for Commodities

Post on: 4 Июнь, 2015 No Comment

You can opt-out at any time.

If you are looking for a way to diversify your portfolio in 2014, commodities can be a good idea. But before you invest in this asset class, be sure to do a little homework first. Here are a few things to know about investing in commodities.

What Are Commodities?

A commodity is a good or service without qualitative differentiation that supplies a basic consumer market demand. In different words, commodities can come in various forms or types but each commodity within a certain class or group is not fundamentally different than other commodities in that particular class or group. For example, think of a common commodity like sugar. When a consumer goes to the grocery store, they will typically buy a bag of sugar with the lowest price. This is because sugar is, well, sugar! There is nothing special or unique about any other bag of sugar, with exception of the packaging. Other commodity goods include crude oil, coal, corn, tea, rice, gold, silver, and platinum.

Why and How to Invest In Commodities

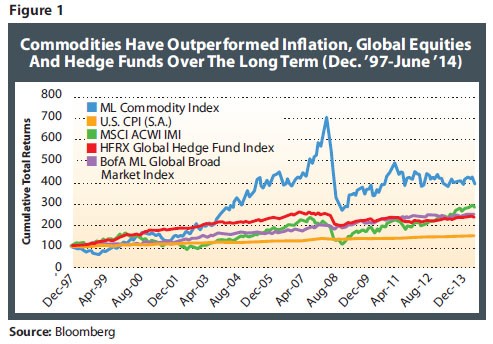

Investing in commodities can be complex and most investors should avoid buying them, especially in the futures market. But a small portion, such as 5%, can help add diversity to a portfolio of mutual funds. This is because commodities price have a low correlation to stock prices. Although not always the case, commodities prices can rise when stock prices fall and the opposite can be true.

The best way for most investors to buy commodities is with a broad basket Exchange Traded Fund (ETF), such as the Powershares Commodity Index Tracking Fund (DBC ), which offers exposure to a wide variety of commodities, not just one concentrated area.

Commodities in 2014?

There is never really any signal that says buy this investment or asset class now but commodities as a whole have had three consecutive years of falling prices, while stocks have climbed to record highs. This under-performance is partially due to the fact that Gold prices had one of the worst years in history in 2013. Therefore, from a contrarian investing perspective, commodities may be due for comeback in 2014.

2014 could also be a year where a healthier economy can translate into higher relative inflation. When the price of goods rise commodities prices are rising. Therefore commodities can be hedge against inflation.

Should You Invest in Commodities?

As always, this post is for informational purposes and does not represent a recommendation to buy securities. With that said, investors with smaller portfolios, such as $20,000 or less may not benefit much from the diversification aspects of commodities. However, larger portfolios, such as $200,000 or more, may benefit by adding a small portion, such as 5%, to their portfolio.