Which ETFs You Should Avoid (BOND SPY IWB BND)

Post on: 16 Март, 2015 No Comment

At their best, exchange-traded funds (ETFs) that track mainstream indexes and some sectors of the financial markets provide a transparent, low-cost, style-specific way to invest. They are a great portfolio building block for both long-term investors and traders.

In the wake of the financial crisis and the stock market debacle of 2007-08, the popularity of ETFs has grown exponentially. ETF providers are falling all over themselves to bring new products to the market in an effort to gather assets. While some of these ETFs are worth considering, others should probably be avoided. (For more, see: Avoid ETFs with These Traits ).

ETF Deathwatch

The web site Invest With An Edge updates its ETF Deathwatch list each month. The list included 226 ETFs and 110 exchange-traded notes (ETNs) as of December 2014. One mainstay on this list registered two years without a single trade.

Products are added to the ETF list if average daily dollar volume for a given month is less than $100,000 for three consecutive months or if assets under management are below $5 million for three consecutive months. These are abysmally low numbers for any financial product and the number of exchange-traded products on the list is telling.

Was the Index Created in a Lab?

Some 60% of ETFs launched since 2000 used benchmark indexes that were less than one year old at the time of launch, according to a report by The Vanguard Group.

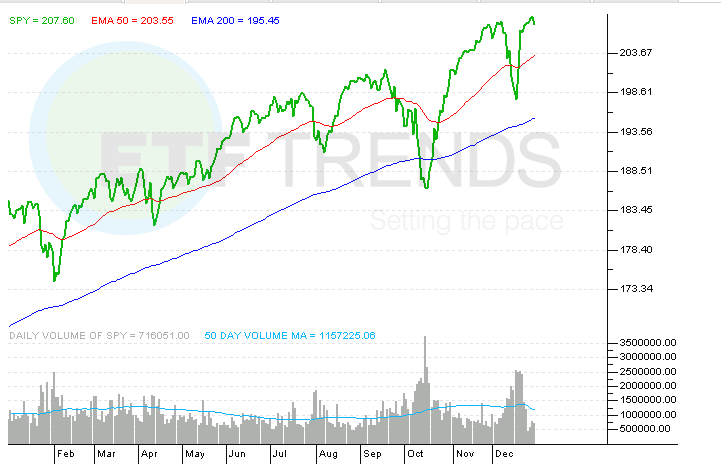

There’s nothing wrong with back-tested data per se, but ETFs that track mainstream benchmarks with real market data are probably a better bet. The SPDR S&P 500 ETF (SPY ), iShares Russell 1000 ETF (IWB ) and the Vanguard Total Bond Market ETF (BND ) are a few examples. (For more, see: 5 Things You Need to Know About Index Funds ).

Loading the player.

Are Smart Beta ETFs a Smart Buy?

An article in Forbes counts 59 ETFs marketed as some sort of smart beta fund. Of these, 29 were launched after January 2011 and only 27 had five full years of performance data. Said another way, we have no idea how smart these ETFs will look during the next market downturn. (For more, see: Building a Better Mousetrap with Smart Beta ETFs ).

This is not atypical of a number of newer concept ETFs that have been developed over the past several years, some in response to the financial crisis. Many are designed to mitigate risk and market volatility. But again, in many cases, we have nothing but back-tested results to guide us as to how these products will perform during the next major market correction.

What About Free Trades?

Several major custodians. including Fidelity Investments and Charles Schwab & Co. (SCHW ), have established platforms where investors can trade certain ETFs with no transaction costs. This can be a good thing, especially for investors who might be buying and selling ETFs in smaller lots. (For more, see: Charles Schwab Announces Commission-Free ETF Trading ).

Schwab’s One Source platform offers 175 ETFs with no transaction costs from a number of fund families including Schwab’s own ETFs. There is nothing wrong with this platform but investors should note that a number of core, mainstream ETFs are absent.

Fidelity’s ETF platform offers 70 commission-free ETFs from iShares, plus its own recently launched sector ETFs. Fidelity’s platform has some short-term trading restrictions on commission-free trades.

If the ETFs offered fit your investing strategy then this is a good way to go. It doesn’t make sense to choose an ETF just to save a few dollars in transaction fees.

Actively Managed ETFs

Actively managed ETFs have not taken off to a great extent as of yet. One that has been quite successful, though, is the PIMCO Total Return Active ETF (BOND ), which is the ETF version of PIMCO’s flagship Total Return (PTTRX ) bond mutual fund. (For more, see: Time to Look at PIMCO’s Total Return Fund Again? ).

One of the issues is that many active managers want to keep their holdings and transactions under wraps with limited disclosure compared to what is required of mutual funds. This has caused some friction with regulators. Whether or not these are a good idea only time will tell. (For more, see: Actively-Managed ETFs: Risks and Benefits for Investors ).

The Bottom Line

At their best, ETFs offer investors a low cost method to buy and own index funds that track mainstream benchmarks. Fund families such as Vanguard, iShares and SPDRs offer low cost core index products. These ETFs serve the needs of individuals and professionals who want to buy and hold or who want to trade more frequently. With their popularity, ETF providers have fallen all over themselves to bring new products to market. Some newer ETFs are great additions, while others are questionable at best. Far too many are based primarily on back-tested data from benchmarks that have little or no actual market data. (For more, see: 5 ETF Classes to Avoid ).