What Small Businesses Should Look for in a 401(k) Plan

Post on: 9 Май, 2015 No Comment

6 Questions to Ask a 401(k) Plan Administrator

You can opt-out at any time.

I get all worked up about 401k fees, says Greg Carpenter, founder and CEO of a company called Employee Fiduciary. The company administers 401(k) plans for small businesses. They can work with companies with five to 25,000 employees but, on average, their clients have about 20 to 25 employees. Carpenter says his company has a reputation for being and attracting white-collar cheapskates, which in this case means people who want 401(k) fees to be as low as possible and completely transparent. (Transparency is clarity; meaning you don’t need to be a financial whiz to know exactly what you are paying for.) He says employers should demand nothing less from their own 401(k) administrators.

Understanding 401(k) Fee Disclosures

As of July 2012, a new Fee Disclosure Rule was put in place by the Department of Labor. Known as Rule 408(b)(2), it requires 401(k) plan administrators to fully disclose their fees in a way that makes it easier for the plan sponsors, or employers offering 401(k)s, to understand what they are paying for. It’s a step in the right direction, says Carpenter, but not necessarily enough. Business owners, and especially small business owners who don’t have the same leverage that larger companies have when dealing with 401(k) plan administrators, still need to ask more questions about exactly where each dollar goes.

That means digging into expense ratios. the fees that you pay for mutual funds. Who gets each dollar your employees pay? And what about the share class. Even if the mutual fund being offered is a good one, there might be a cheaper version of it in a different share class.

Fees matter, Carpenter says. Over a long period of time even a quarter of a percent or less makes a huge difference in the value of the investment at retirement. The plan sponsor who has his or her eye of the ball needs to know this so they can make the best decisions about the employee’s money.

Six Other Questions to Ask a 401(k) Administrator

What else should small businesses look for? Carpenter offers the six questions you should ask when considering a 401(k) plan:

How does the payroll work? Your business will have to share its payroll information every pay period. How does the plan administrator do that? While some businesses may have excellent controllers or payroll administrators who can handle anything that comes at them, others may have a simplified system. For those companies, it may be worth it to pay more for extra help with payroll.

How are you going to test it? The IRS has compliance tests to ensure that a 401(k) plan does not favor certain employees over others. How does that work? What needs to be done on the part of the employer?

Who takes care of the paperwork? As a 401(k) plan sponsor, you’ll be faced with some pretty hefty paperwork. Does the administrator file government forms on your behalf?.

How do I communicate how the plan works? Most people don’t know how to talk about money. Will you be responsible for explaining the plan to your employees, or does the administrator do that? Some plan administrators excel at employee communications.

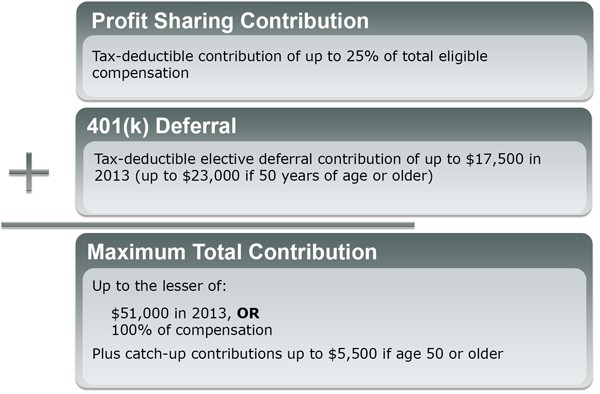

How are you going to help me design this plan? Should you offer an incentive match? Allow 401(k) loans? Accept catch-up contributions? What is profit sharing? There are a lot of elements to a 401(k) plan. Find out whether the administrator will help you design your own plan. Some providers will say here are three choices, choose one. Others will say you can have whatever you want, says Carpenter. Decide which option works best for your company.

How do I get your money out? What happens when an employee retires is one question. But what about before then? Will there be loans, hardship withdrawals? How do you do a rollover if an employee leaves or retires? What if someone leaves with $500 in the plan? These details will come up, so find out how to deal with them at the outset.

Small business owners who approach a vendor with these six questions will have a good start on getting a handle on their plan. If the vendor can’t provide answers, it probably isn’t the best choice. Carpenter has a stake in the game, but he recommends that employers shop around. Get a variety of recommendations. Start with small local companies. Ask around. Does your payroll provider have a recommendation? Maybe Vanguard knows of a good firm. Interview a large plan provider like Fidelity. Interview a variety of different sources and you will have a better chance finding the right administrator for your plan, and the right plan for your employees.