What Is the Relationship Between Financial Risk Financial Return

Post on: 16 Март, 2015 No Comment

Risk-Free Investment

A risk-free investment is an investment that has a guaranteed rate of return, with no fluctuations and no chance of default. In reality, there is no such thing as a completely risk-free investment, but it is a useful tool to understand the relationship between financial risk and financial return. According to basic concepts of market economics, there would be such a high demand for a risk-free investment that the institution owning the assets underlying the investment would set the rate of return to something essentially equal to the time value of that investment. In other words, if you invested in a risk-free investment, your return would essentially be based entirely on the value of having money now as opposed to some point in the future. That is why interest rates on savings accounts are so low. These are virtually risk-free investments.

Risk Premium

Volatility

In the debt market context, investors are primarily faced with two scenarios: they will be compensated at the promised rate of return, no more and no less; or they will lose all of their investment. With stock investments, the possibilities of returns are virtually infinite. A stock could become completely worthless or worth an unimaginable amount of money. This is because the value of a stock is determined by market forces that cause the stock to increase or decrease in value over time. This is known as volatility. A stock with higher highs and lower lows is more volatile, and therefore riskier. However, because this stock has higher highs, it has a higher potential rate of return.

Portfolios and Managing Risk

References

More Like This

Financial Decision Making: Risk & Return

Risk & Return in Financial Management

The Best Way to Establish Credit

You May Also Like

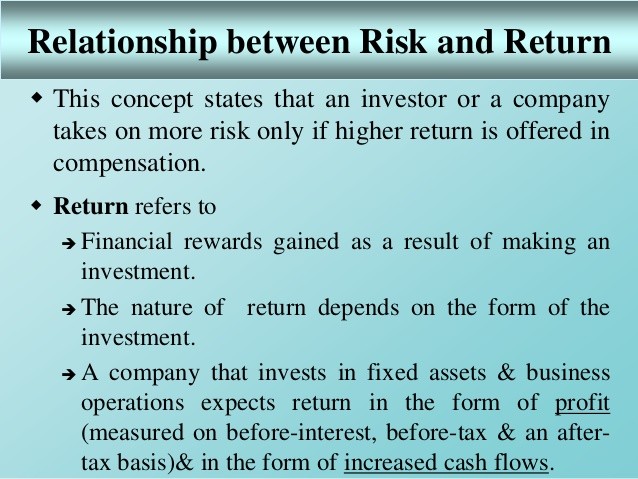

A basic investment philosophy is that you generally must take more risk to achieve higher returns. However, that doesn't guarantee that your.

Savers balance potential risks against rewards when making investment decisions. Investors diversify to manage risks. Efficient diversification targets assets that.

Forward rate is a term used in finance. It relates to interest rate because these two rates are needed to calculate the.

The concept of financial risk and return is an important aspect of a financial manager's core responsibilities within a business. Generally, the.