What is the difference between mutual funds and ETF s

Post on: 7 Август, 2015 No Comment

Good question! Since this website is all about investing in mutual funds, and ETFs have become so popular in recent years just what exactly is the different between mutual funds and ETFs?

First off, ETF is an acronym for exchange traded fund. Its an investment vehicle which packages securities together for a specific financial goal. An ETF may own 50, 100, 1,000 or more securities just like a mutual fund.

There are a few major things that separate the two investment securities. Remember though, they both are pooled investment vehicles designed to accomplish specific investment objectives. In fact you can have ETFs that mirror mutual funds by holding identical (or nearly identical) investments.

- How They Trade. Mutual funds generally trade with a ticker symbol consisting of five letters ETFs trade with tickers typically 3 letters, but sometimes two and sometimes up to four letters.

- How They Price. Mutual funds post their prices once per day. On the west coast they generally price at 3pm. ETFs price throughout the trading day just like stocks.

- What They Invest In. Most ETFs are geared towards mimicking a specific index, for example the S&P 500. Mutual funds do this as well, but also vary greatly in trading strategies and the securities owned. There is a lot more diversity in the types of mutual funds you can invest in vs. the types of ETFs you can invest in.

- Mutual Fund and ETF Expenses. Most mutual funds dont have a trade cost, meaning you can invest in them for no commission or fee. They do this because they have internal costs which are buried in the prospectus. Some funds however do have trading costs, for example no-load mutual funds purchased at a discount or online custodian such as TD Ameritrade. Some mutual funds have outrageously high internal expenses and some tack on heavy commissions as well. Others have ultra low cost internal expenses and no commissions it varies greatly. ETFs generally have a trade cost or commission such as $9.99, and internal fees. Since most ETFs attempt to track specific indexes, their internal expenses are generally lower than mutual funds on average.

- Liquidation. Mutual funds must be liquidated through the custodian or mutual fund management company directly, whereas ETFs can simply be sold throughout the trading day on the exchange.

- How Much You Can Invest. Mutual funds have minimum investment amounts, some as low as $1,000 some substantially higher. ETFs have no investment minimums, you can buy one share if youd like.

- Commissions. Mutual funds have varying commission structures, from a commission up front, to a deferred commission if you redeem prior to when the fund manager wants you to redeem, so an ongoing internal commission. ETFs have one commission which is really just a trade cost and generally thats very low.

- Taxes. Mutual funds can be tax efficient, but some are incredibly tax Inefficient. ETFs are generally more efficient from a tax standpoint.

- Premiums and Discounts. ETFs trade intraday, so they may (and do) trade at premiums and discounts to what is actually owned in the portfolio. For example, if an ETF has a lot of buying activity you may actually pay more for the shares than the underlying securities are actually worth. If there is a lot of selling activity an ETF may actually trade cheaper than the underlying value of the securities. Mutual funds only price once per day, so you always pay the exactly amount of the underlying securities.

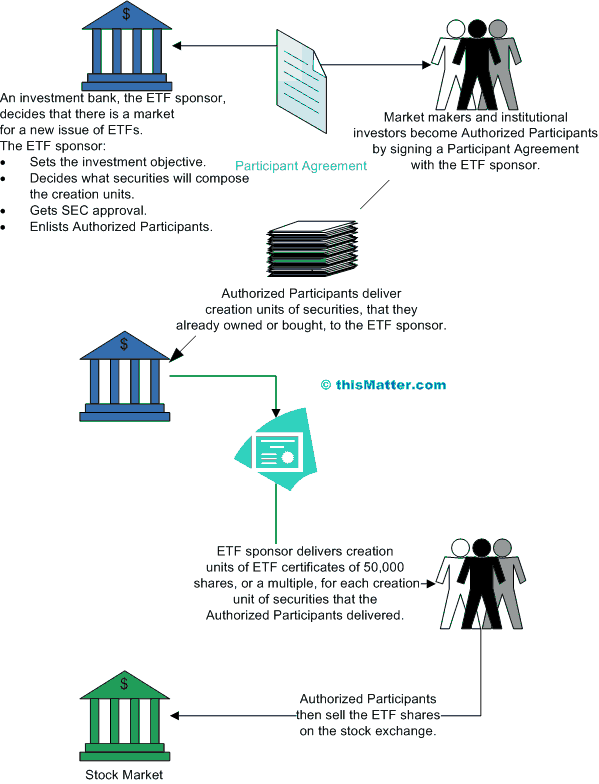

- Issuance. Mutual funds can issue more shares when you invest in them, whereas ETFs issue a set number of shares and stick with it unless the ETF management company decides to issue more shares.

There are quite a few differences between ETFs and mutual funds as you can see. There are costs and benefits to both. Which is right for you? If youre buying the right mutual funds, the best mutual funds then both may be right for you or even a mix of both. However high cost horribly inefficient mutual funds always lose out to their lower cost and more efficient ETF counterparts.

In our private practice, we use a mix of both ETFs and mutual funds. Neither mutual funds NOR ETFs specifically perform better than the other, and neither have the BEST of the BEST of every asset class on every occasion. Pick and choose the best of the best from the universe of ALL mutual funds and ETFs!