What is spread betting

Post on: 16 Март, 2015 No Comment

Spread betting is a tax-efficient* way of trading on the price movements of thousands of global financial products, including indices, shares, currency pairs, commodities and treasuries.

With spread betting, you don’t buy or sell the underlying asset (e.g. a physical share), you place a bet on whether the price of a product will go up or down in value.

When you spread bet, you buy or sell an amount per point movement, such as £5 per point, which is known as your ‘stake’. For every point the product’s price moves in your favour, you gain multiples of your stake. For every point the price moves against you, you lose multiples of your stake. Please note, losses can exceed deposits.

Watch our ‘What is spread betting?’ video

What is a spread?

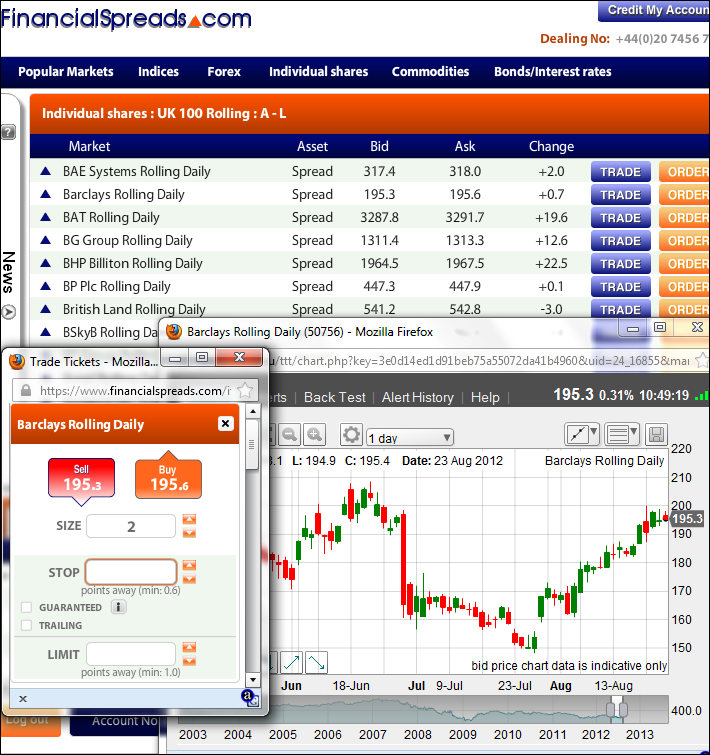

The difference between the buy price and sell price is referred to as the spread. Tight spreads mean prices don’t need to move as much before you start making a profit or loss. Spreads should always be competitive and consistent as spread size affects the costs of spread betting.

What is margin and leverage?

Spread betting is a leveraged product, which means that you only need to deposit a small percentage of the full value of the spread bet in order to open a position. This is called ‘trading on margin’. While trading on margin allows you to magnify your returns, losses will also be magnified as they are based on the full value of the position .

Learn more about margin

Example: Buying ABC Company

In this example, ABC Company is trading at 100 / 102 (where 100 is the sell price and 102 is the buy price). The spread is 2 .

Assume you want to buy at £2 per point because you think the price of ABC Company will go up.

ABC Company has a margin rate of 5%. which means that you only have to deposit 5% of the total position’s value as position margin. Therefore, in this example your position margin will be £10.20 (5% x (£2 x 102)) .

Remember that if the price moves against you, it is possible to lose more than your initial margin of £10.20, as losses will be based on the full value of the position.

Outcome A: winning bet

Your prediction was correct and the price rises over the next week to 152 / 154. You decide to close your buy bet by selling at 152 (the current sell price).

The price has moved 50 points (152 sell price – 102 initial buy price ) in your favour. Multiply this by your stake of £2 to calculate your profit, which is £100 .

Outcome B: losing bet

Unfortunately, your prediction was wrong and the price of ABC Company drops over the next week to 72 / 74. You feel the price is likely to continue dropping, so to limit your losses you decide to sell at 72 (the current sell price) to close the bet.

The price has moved 30 points (102 — 72 ) against you. Multiply this by your stake of £2 to calculate your loss, which is £60 .

What’s the difference between spread betting and buying shares?

Many investors choose to spread bet the financial markets as spread betting offers a number of benefits over buying physical shares.

- You can sell (go short) if you think the price of a product is going to fall

- Profits are tax-free*

- There is no stamp duty* to pay

- You can trade on margin, so you only need a small percentage of the overall value of the trade

- Access to trade on global share markets, as well as indices, currency pairs and commodities

- There is no separate commission charge to pay on spread bets

- Access to 24-hour markets

Understanding what can affect price movements

It’s a good idea to keep up to date with current affairs and news because real-world events often influence market prices. To take a historic example, let’s look at the Help to Buy housing scheme, announced by the UK government on 20 March 2013.

Many believed this scheme would boost UK home builders’ profitability. Say you agreed and decided to place a buy spread bet on Barratt Developments just before the close at £10 per point:

Please note: Losses can exceed deposits where the price moves in the opposite direction. Past performance is not indicative of future performance.

^Prices taken from the CMC Markets Platform. Our prices may not be identical to prices for similar financial instruments in the underlying market.

Want to learn more about spread betting?

CMC Markets offers a range of educational webinars and seminars catering for new traders.

Introduction to trading Seminar

Master the basics of spread betting in this seminar. Even if you’re new to the financial markets and have never placed a trade before, our introduction to trading seminar will help you get started on the Next Generation platform.