What is Equity Mutual Fund Advantages and Disadvantages

Post on: 20 Май, 2015 No Comment

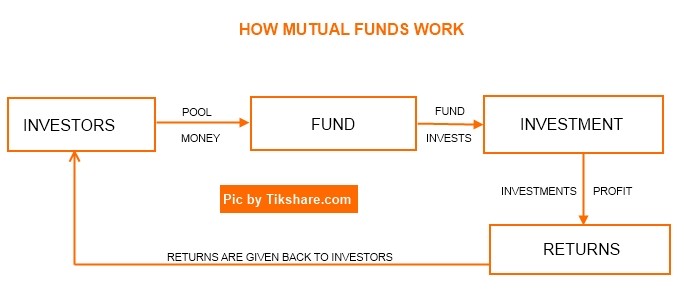

Investing in mutual funds is becoming popular lately probably because more and more people are looking for ways in which they can earn more money from the cash they have. As the name suggests, mutual fund is the pool of money from many people mutually agreed to make a larger fund to be invested in different types of investment.

In my previous post which I published many months ago, I discussed there the four types of mutual funds: equity, balanced, fixed-income and money market. So now, I would like to focus more on equity mutual fund.

What is Equity Mutual Fund?

An equity is the share of ownership of a certain company. Some people call it stocks. Therefore, an equity mutual fund is a fund invested primarily on equities or stocks of different companies based on the prospectus of the fund. Each company has its own goal and strategies in selecting which companies to invest in.

Most of the investment companies invest in several equities to diversify their investment. It poise a higher risk if they will invest in just one stock or equity. For example, FAMI and Philequity have equity mutual fund that invest in more than 5 equities of different Philippine companies.

Advantages of Equity Fund

Equity fund has several known advantages over other kinds of mutual funds. Here are some of the nice benefit that you get from equity fund.

1. Higher return

Based on the performance and history of different investment companies that offer equity fund, this kind of fund gives the highest return. For example,in 2009, two or three equity funds made more than 50% return on that year alone.

This means that if you invested P10,000 on the beginning of 2009, your total money plus the amount it gain in one year will be more than P15,000. However, please take note that the profit or return that you can get is not guaranteed, meaning, it may be lower or even higher than the past performance of the fund.

2. Indirectly invests in the stock market

Since equity fund primarily invests its assets in stocks of companies, you are somewaht investing indirectly in the stock market. However, you dont control and decide which stocks to buy, it is the job of the mutual fund manager who makes decision on which stocks to purchase based on his research and analysis.

If you dont have a background in investing in stocks or you are a total beginner in investing but you want to buy some stocks of good companies, an equity mutual fund will be the best way to go. Yet, stock investing is not really difficult to do since there are lots of information and tutorials that you can get around the web teaching how to wisely invest in stocks.

3. Low Initial Capital

For as low as P5,000, you can invest in equity mutual fund of the top investment companies in the Philippines. You dont need a big amount to start with.

When you directly invest in stock with a stockbroker. sometimes it requires you to invest an initial amount of P25,000. For most people, it is a big money that needs to be raised.

Disadvantages of Equity Fund

If there are advantages, there should be also disadvantages or down side of investing in equity mutual fund. Here are some on the list.

1. Profit is not guaranteed

Investing in mutual funds and stocks cannot give you a guarantee on the return because there are many factors involved on how you can make a profit. If you want a guarantee on return, you should put your money in savings account or time deposit that pays very little interest.

Actually, you pay the guarantee in time deposit or savings account because of very low interest. I think you dont need to worry about the return that you can get from mutual fund because Im sure you will get a positive return if you are willing to invest for couple of years.

If you want a high-profit investment, you should invest in no guarantee investment like mutual fund and stocks. However, if you want a guarantee and a very low profit from the money you have, invest it in time deposit or just put in savings account that pays only 0.25 to 0.50% interest per year. Do your math and you will be shocked how low you profit can be.

2. You cannot control which equity or stock to buy

Since you are just one individual in a pool of people investing in mutual fund, you cannot decide which one to buy. It is the responsibility and right of the fund manager to choose which stocks to purchase that will give a good profit.

He does not do it by trial and error or even guessing. The fund manager has tools, knowledge, connections and experience to properly select an equity that will give the best profit for the fund he manages.

3. Profit or return solely depends on the stock market

As I said earlier, equity fund primarily invests its money on stocks of different companies. I think more than 95% of the funds asset will be invested in stocks.

If the stock market is down, your equity fund will be also down. It is always directly proportional to the behavior of stock market. Thats why, the return is not guaranteed by the investment company.

Wrapping Up

An equity mutual fund is the best alternative if you dont want to invest directly in the stock market but you want to buy profitable companies. Your task should be choosing which investment company gives the best return on equity fund and how they manage the fund.