What is Beta (Mutual Funds) Definition

Post on: 16 Март, 2015 No Comment

Definition, Example and Application of Beta for Mutual Fund Investors

Definition of Beta:

Beta, with regard to mutual fund investing, is a measure of a particular fund’s movement (ups and downs) compared to the overall market. For reference, the market is given a beta of 1.00.

Example of Beta:

If a fund’s beta, or what Morningstar calls best-fit beta, is 1.20, this tells an investor that they can expect the fund being measured to have returns 20% higher than the index in an up market and 20% lower in a down market. For example, if a fund’s best-fit index is the S&P 500 and the index has a return of 10% this year, the investor would expect the fund with a beta of 1.20 to have a return of 12%. Conversely, if the S&P 500 index fell 10% during the given year, the fund with a beta of 1.20 would be expected to fall 12% during that year.

Application of Beta:

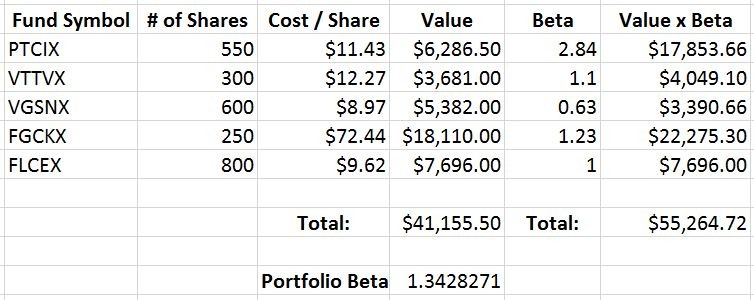

A mutual fund investor can use beta in planning their fund selection to determine volatility of the fund and to compare its sensitivity in movement to the overall market. Beta can be considered a measure of sensitivity or of volatility. Beta measures higher than 1.00 will indicate higher highs but lower lows (wider swings in price or NAV for mutual funds). A mutual fund investor looking for a fund with less volatility (less swings in price or NAV ) might look for funds with betas lower than 1.00. Beta is also used for planning for fund diversification and can be used as part of the process of building a portfolio of mutual funds .

Should You Use Beta?

Now that you know the basics, the question that remains is, should you use Beta for researching mutual funds? In summary, Beta is a statistical measure that can be quite useful for diversification and advanced risk/volatility measurement purposes but Beta is not necessary to build a great portfolio of mutual funds. The overall risk of a given portfolio is determined by its unique

The bottom line is to make sure your particular mutual funds do not have objectives that overlap (they are not too similar). To do this, simply select funds from different mutual fund categories. Taking a step further, you can also use index funds where possible. This insures that there will be no style drift. In other words, you know what you’re getting when you buy an index fund. However, an actively-managed fund can slowly but surely change its style or objective over time.

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.