What Is a Unit Investment Trust

Post on: 4 Июнь, 2015 No Comment

Unit investment trusts are type of investment company, similar to mutual funds, closed-funds and exchange-traded funds. Unit trusts have some of the features of the other fund types plus a few unique ones. Unit investment trusts are sold almost exclusively through investment advisors and brokers.

Other People Are Reading

Unit Trust Characteristics

A unit investment trust starts with a fixed portfolio of securities, such as stocks and bonds, selected by the trust sponsor to meet the trust’s investment objectives. Once the securities are selected, the portfolio remains static and no securities are bought or sold. Investors buy shares or units of the trust. Every unit investment trust has a termination date on which all of the securities in the trust are sold and the proceeds paid out to unit owners.

Cost to Invest in UITs

The units of a UIT are purchased through an investment advisor at what is called the public offer price. The offer price is the current net asset value of the units plus a sales charge. The sales charge is used to pay the broker or investment advisor a commission. Once purchased, the units of an UIT will be valued at the net asset value. Reinvested dividends purchase additional units at the net asset value.

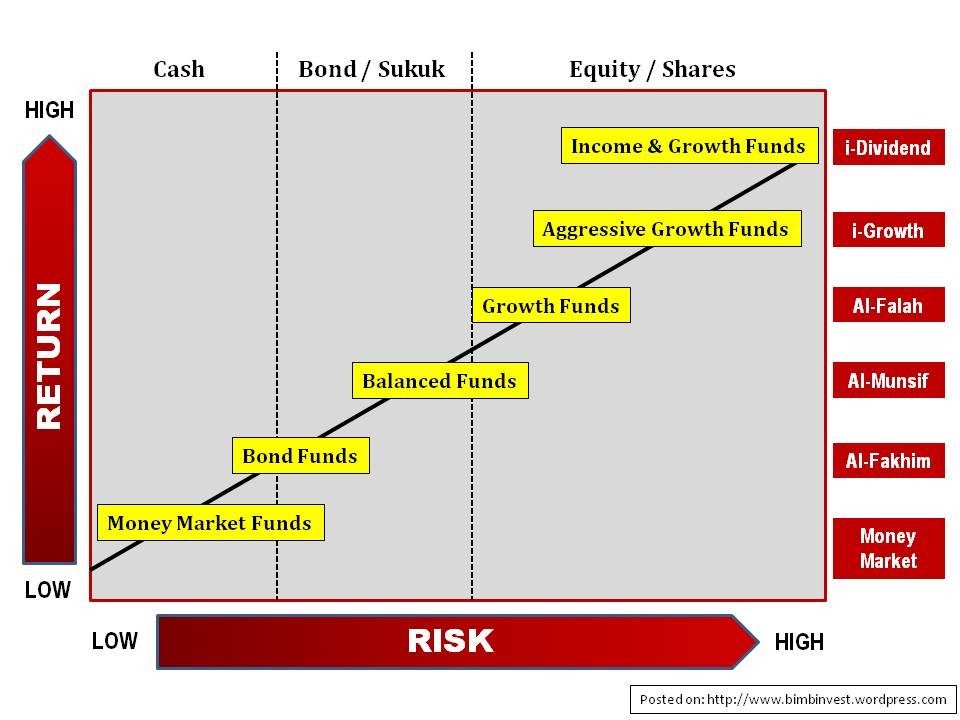

Types of Unit Trusts

References

More Like This

What Are the Benefits of Unit Trusts?

The Disadvantages of Unit Trust

Investment Objectives & Risks of a Unit Trust

You May Also Like

Unit Investment Trusts are financial instruments that are very similar to mutual funds, yet they do have some key differences. The Exchange.

While most investors are familiar with mutual funds and hedge funds, a similar type of fund known as a unit investment trust.

Unit investment trusts represent an interesting opportunity for investors to grow their money. A unit investment trust typically purchases a mixture of.

A bond unit investment trust is a type of investment company that issues a set number of stocks or bonds that have.

Mutual funds and unit investment trusts are types of investment companies that pool investor money and the investor's own shares in the.

Investors have a plethora of investment opportunities to choose from. The number and the variety of investment vehicles continues to grow and.

Unit investment trusts are investment products organized under the same laws as mutual funds and closed-end funds. Unit trusts are sold exclusively.

Unit investment trusts, or UITs, are packaged investment products formed under the same rules as mutual funds and exchange-traded funds (ETFs). Unit.

Investments made through various investing vehicles have different tax implications, such as fixed-income investment versus equity investment, or investment through a.

Effective working relationships are built on mutual trust. Whether it's among employees or between managers and their subordinates, trust is necessary for.

Unit investment trust funds, or UITs, are one of the four types of investment companies along with mutual funds, closed-end funds and.

A unit trust is a lot like a closed-end mutual fund. It is an investment company organized as a trust, the trustee.

A unit investment trust or a UIT is a trust that incorporates the savings of a large number of investors. The fund.