What Is a Mutual Fund Sales Load

Post on: 30 Апрель, 2015 No Comment

How Do Sales Loads Work and Should I Pay Them?

Recently, a friend of mine sent me some questions about working with a new stock broker. He and his girlfriend had moved across the country and gone to the branch office of one of the biggest investment firms in the United States. He was presented with a suggested portfolio but the new broker mentioned that all of his mutual fund purchases would have a five percent sales load on them. My friend contacted me and wanted to know what a mutual fund sales load was and whether or not he should be concerned. In fact, just like most

new investors. he wasn’t even sure if a 5% sales load was good or bad.

To help you better understand mutual fund sales loads. I am going to provide a brief overview of what they are, why they exist, and how you should handle them if you are confronted with the possibility of having to pay one to your stock broker.

A Mutual Fund Sales Load Is a Type of Commission

Money management companies, including mutual fund companies. make money by piling up assets and charging a fee each year. To get stock brokers to sell their fund instead of the thousands of funds offered by competitors, some mutual funds try to sweeten the broker’s compensation deal by offering to pay the broker a percentage of everything they get their clients to invest in their fund. This is called a load or sales load. A successful broker could make hundreds of thousands of dollars just from selling you investment products and not from his or her performance. It is a skewed incentive system that doesn’t favor you, the investor.

Even worse, the sales load doesn’t come out of the mutual fund company’s pocket. It comes directly out of your investment!

The Two Types of Mutual Fund Sales Loads

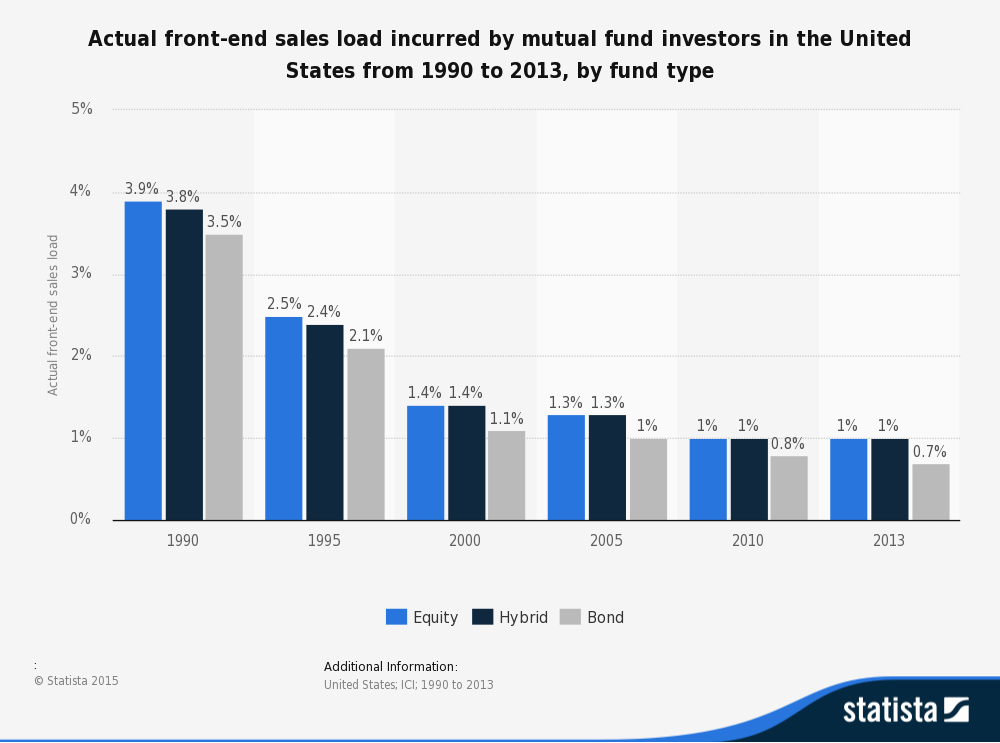

There are two types of mutual fund sales loads — front end sales loads and back end sales loads (also called deferred sales loads).

- Front End Sales Loads. These are marketing fees paid up front at the time of the investment. If you invest $100,000 into a mutual fund with a 5% sales load, when you make the investment, $5,000 will be taken out of your account and used to pay the broker and other distributors that helped get you to choose that investment. That means you will begin with only $95,000 in money working for you. Over time, that can make a big difference. If your mutual fund grew by 8% compounded for 50 years, that $5,000 sales load charge would result in you having $234,508 in less wealth.

Some mutual fund back end sales loads have a declining feature. This means that with each passing year, you would be forgiven from paying a portion of the sales load if you were to sell your investment. In most cases, a declining back end sales load would result in you owning no sales load at all if you held the investment for seven years or longer, which can encourage long-term thinking. You need to read the mutual fund prospectus, though, to find out the details of your specific holdings.

What should be clear to you, though, is that a mutual fund sales load results in less money in your pocket in most cases. That leads us to one of the most important rules of mutual fund investing: You should probably never buy a mutual fund that has a sales load .

You Should Probably Never Buy a Mutual Fund with a Sales Load

As a general rule, you should avoid mutual funds with sales loads attached to them. That is purely a marketing expense. You are literally taking out your checkbook and writing it to pay a commission that the mutual fund company doesn’t want to pay itself! That means you lose all of the dividends, interest and capital gains you might have otherwise made on that money.

Companies such as Vanguard and Fidelity have made no-load funds the virtual norm for do-it-yourself investors. You can visit their site, open an account directly or even purchase shares through most stock brokers (for more information, read How Do I Buy Shares of a Mutual Fund? The Three Ways New Investors Can Buy Shares of a Mutual Fund. You may also want to read The Beginner’s Guide to Investing in Mutual Funds