What Is A Mutual Fund Redemption Fee

Post on: 20 Июль, 2015 No Comment

FAQ: What are mutual fund redemption fees and when are – What are mutual fund redemption fees and when are they charged? a. What is a mutual fund redemption fee? A mutual fund redemption fee, also referred to as a

Redemption Fee Definition | Investopedia – in-and-out trading of mutual fund shares. Generally, the fee is in effect for a holding period from 30 days to one year, but it can be in place for longer periods If incurred, redemption fees do not go to the investment company, but are credited to the funds assets. Filed Under

Which Class of mutual fund is best: Class A, Class B or – Mutual fund alphabet soup? Thats a load. Dear Dollar Diva, Mutual funds offer various classes of shares, such as Class A shares, Class B

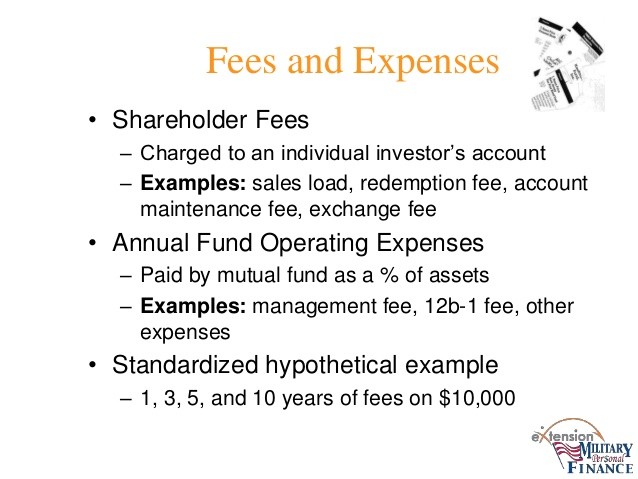

SEC.gov | Mutual Fund Fees and Expenses U.S. Securities and – Mutual Fund Fees and The short answer is the SEC generally does not, although the SEC limits redemption fees to 2% in most situations. The It takes only minutes to use a mutual fund cost calculator to compute how the costs of different mutual funds add up over time and eat into your

A mutual fund is a type of professionally managed collective investment scheme that pools money from many investors to purchase securities. While there is no legal

4 I. BACKGROUND Investors in mutual funds can redeem their shares on each business day and, by law, must receive their pro rata share of the fund’s net …

If you invest in mutual funds and especially if you use a broker or investment adviser to do so it is important to fully understand the fees related to your

Mutual Fund Fees and Expenses. As with any business, running a mutual fund involves costs. For example, there are costs incurred in connection with particular

What is Redemption Fee? The commission or charge paid when an investor exits from a mutual fund. They are basically imposed

One of the questions investors frequently send me is, What Is a Mutual Fund Share Class?

Mutual fund redemption fees vary from company to company, according to the Alerus website. The first in, first out (FIFO) method of determining shares subject to

External links Mutual Fund Fees and Expenses article by U.S. Securities and Exchange Commission; A concise but complete tutorial about mutual fund fees and expenses

What are mutual fund redemption fees and when are they charged? a. What is a mutual fund redemption fee? A mutual fund redemption fee, also referred to as a redemption fee, market timing fee, or short-term trading fee, is a charge by a mutual fund company to discourage

What Is the Mutual Fund Expense Ratio? A Definition and Explanation of Mutual Fund Expense Ratios

A mutual fund is a firm that basically gets the assets of all its investors and pools them together for per share. If an investor redeems his share, he will pay redemption fees in addition to the funds NAV. Mutual funds can be categorized in four types: 1) Money market funds, 2

The following is an excerpt from “The Complete Money and Investing Guidebook” by Dave Kansas. A mutual fund pools the assets of its investors and invests the

More Investments Articles.

- Mutual Funds Performance Comparison Charts. Comparison of Mutual Fund Performance | eHow – Comparison of Mutual Fund Performance. Mutual funds have grown so numerous that there are now more mutual funds than individual stocks available for purchase. …. Compare Mutual Funds Online | Invest in.

- No Load Mutual Funds Minimum Investment $100. Investment Selections & Timing, Inc. – No-Load Mutual Fund Selections & Timing —monthly newsletter (online and mailed). ETF Selections & Timing —weekly eletter. Consistency, can it get any better than that? Want the top funds? Try the t.

- Mutual Fund Tickers Stock Tickers. Mutual Funds India: Mutual Funds Investment, Best Funds to. – Mutual Fund: The Complete Guide to Mutual Funds, Best Funds to Buy, Mutual Fund Calculator, Latest NAVs, information, and news on the net asset value (NAV. MarketWatch Mutual Fund.

- Best Vanguard Mutual Funds 2007. Best Vanguard Mutual Funds | Top Growth Stocks For 2014 – Best Vanguard Mutual Funds. Vanguard is best-known for its index funds. But 69% of its mutual funds—80 out of 116—are actively managed. Vanguard’s Best Funds | Vanguard Index Funds | Van.

- Large Cap Mutual Funds Meaning. Large Cap (Big Cap) Definition | Investopedia – A term used by the investment community to refer to companies with a market capitalization value of more than $10 billion. Large cap is an abbreviation of the term. Definition of a Large Cap Mutua.