What is a mortgagebacked security Boston business development

Post on: 16 Март, 2015 No Comment

Federal Reserve logo

www.businessjad.com

Today, the US Federal Reserve announced that it will purchase, indefinitely, $40 billion/month of mortgage-backed securities until the labor market improves (economy gets better/unemployment rate goes down).

The Federal Reserve chairman Ben Bernanke believes this will help the economy, but will it? To answer this, let’s first answer the question, what is mortgage-backed security is?

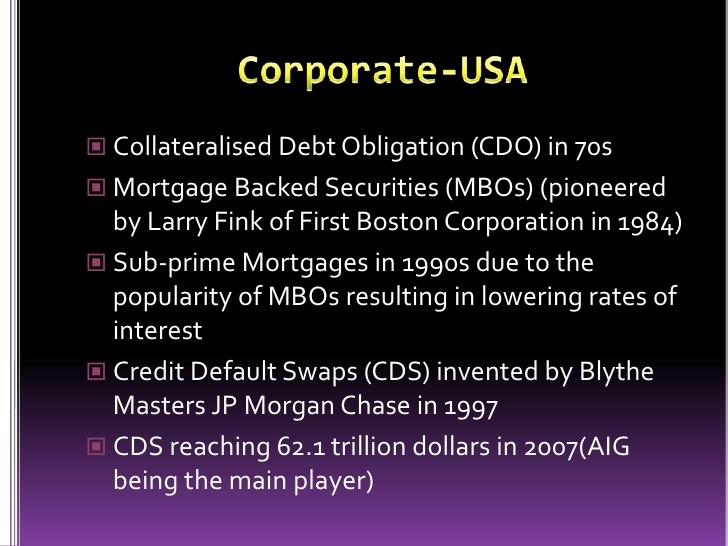

Let’s use you as the example. If you want to purchase a house for $1 million, you could go to the bank and get a loan of $1 million to buy your house. The bank makes money from charging you interest, let’s say, 10% per year for 30 years. But, the bank will have to wait 30 years to get back all of its money plus the interest that it loaned you. This ties up the bank, and reduces the amount of money it has to loan other people which is a problem for the banks. This is where mortgage-backed securities were born. The bank, wanting to have more money to loan to more people, will group their mortgages together and sell them as a bond, or mortgage-backed security to investment banks. The investment bank will buy the mortgages from the bank, as a result giving banks the money to give out more loans. That means you, the person who just bought the house, are actually paying the investment banks, not the bank you originally borrowed $1 million from.

For the sake of explaining if this will actually effect the economy, we do not need to dig deeper into mortgage-backed securities. If you are interested in learning more, click the link at the bottom of the article, after subscribing .

Now, will the Federal Reserve, in this case the investment banks, buying up mortgage-backed securities improve the economy? My guess is no, at least not long term. To make it clear, no one really knows — not even Mr. Bernanke. But what will happen for sure, is that banks will have more money to loan people to buy homes, even people that the bank SHOULDN’T be loaning money to because they are not qualified. Does that last sentence sound familiar? It should, because that’s the exact reason that caused the Great Recession in 2009. If banks promise to only give loans to qualified individuals, this may be good for the economy. But history repeats itself and it will do so again in this instance. The banks will loan to unqualified home owners, who have a much higher risk of defaulting and cause another major mortgage crisis. Yes, we may be good for now, but at a great expense of our future. Thank you Mr. Bernanke for restarting the countdown on the bubble that caused this whole mess to begin.

For more information on mortgage-backed securities, click the link below. Don’t forget to subscribe !