What Is a Flat Income Tax Details on the Flat Tax

Post on: 16 Март, 2015 No Comment

Siri Stafford/ Photodisc/ Getty Images

The flat tax is an income tax system in which everyone pays the same tax rate regardless of their income. Flat tax systems are in place in several states in the U.S.

Fairness and Simplicity by Eliminating Deductions

Advocates of flat tax systems argue that a flat tax is fair because everyone pays the same tax rate. In addition, flat tax systems eliminate deductions, tax credits, and most exemptions, thereby eliminating biases towards certain behaviors and activities.

Eliminating deductions, tax credits, and complex tax brackets also simplifies the tax code, making compliance easier. Some proponents of the flat tax would like to see the Federal Form 1040 replaced by a simple post card on which you write your wages and multiply it by one tax rate.

Tax Only Earned Income

Another part of the flat tax philosophy is to remove double taxation, by only taxing earned income. Things like dividends, interest on savings, or capital gains that result from investment or increases in asset value would not be taxed under a pure flat tax system. This is seen as increasing the fairness and simplicity of the system, as well as encouraging investment.

Economic Growth and The Flat Tax

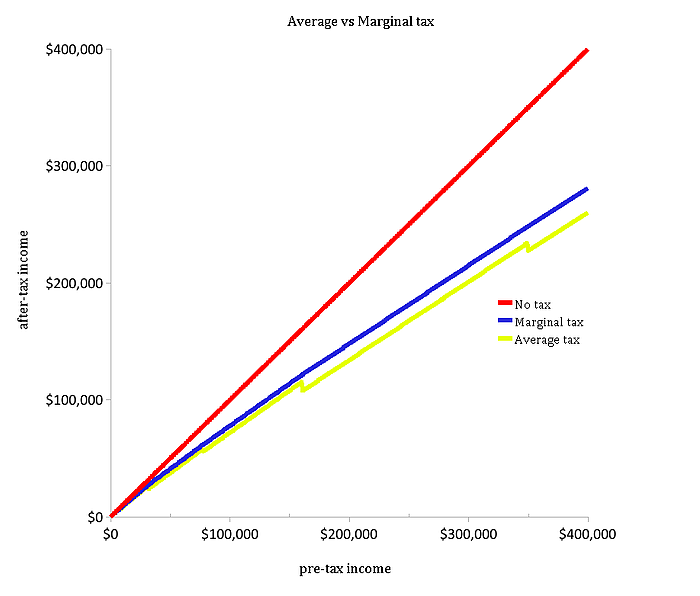

Supporters of flat tax systems claim that a flat tax encourages economic growth by avoiding a system in which you are penalized in higher taxes for being productive and earning more money. They argue that progressive tax systems create a penalty against things like hard work, risk taking, and entrepreneurship. The flat tax is supposed to avoid this by taxing every dollar at the same rate.

At the state level, reducing the top income tax rate by moving to a lower flat tax rate is thought to attract and encourage business investment and bring in high income individuals. This is thought to increase overall tax revenue and economic stability.

Arguments Against a Flat Tax

Opponents argue that flat tax systems place an undue burden on the lower and middle class by removing deductions and expanding the tax base to include every level of income. They claim that moving to a flat tax system shifts the tax burden from the rich to the poor, those who are most effected by taxes and least able to pay. By exempting unearned income like interest or dividends, opponents argue, that the working class is supporting the idle rich. Some flat tax systems in the U.S. get around this by exempting from tax those who fall below certain income limits or by offering special exemption or tax credits for lower income individuals.

Opponents of the flat tax argue that progressive tax systems are fair because they tax disposable income (income minus expenses). This viewpoint says that its only fair that the rich pay more because they have more disposable income and therefore a greater ability to pay. They argue that the economy would be better stimulated by decreasing the taxes of the middle class, who make up the largest part of the general public, which would give more people more disposable income to spend on products.

Sources: Heritage Foundation (a conservative research and education foundation); Tax Policy Center (a nonpartisan research institute)