What Is a Bond (Investing for Beginners)

Post on: 21 Апрель, 2015 No Comment

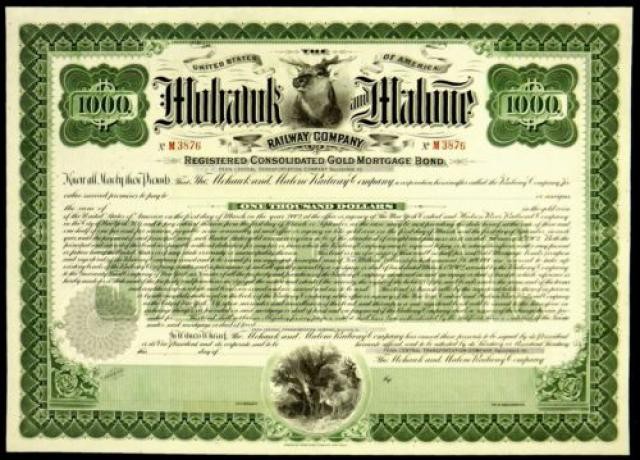

A bond is created when investors loan money to a government or corporation in exchange for a promise of repayment plus interest.

Question: What is a Bond?

Answer: A Bond is simply an ‘IOU’ in which an investor agrees to loan money to a company or government in exchange for a predetermined interest rate for a pre-determined length of time.

If a business wants to expand, one of its options is to borrow money from individual investors. pension funds. or mutual funds. The company issues bonds at various interest rates and sells them to the public. Investors purchase them with the understanding that the company will pay back their original principal (the amount the investor loaned to the company) by a specific date (this is called the maturity date). Meanwhile, they get to enjoy the interest income .

A bondholder is mailed a check or, these days, receives a direct deposit from the company at set intervals. In the United States, it is common for bonds to pay interest twice a year. In some other countries, bonds pay interest once a year. Still other bonds can pay monthly interest. It is entirely up to the contract that governs the bond offering. Unfortunately, these documents can be very difficult to come by, unlike the 10K or annual report of a share of stock. Your broker should be able to help you track down the necessary filings for any specific bond that catches your attention.

The rate of interest a bondholder earns depends on the strength of the corporation that issued the bond. For example, a blue chip is more stable and has a lower risk of defaulting on its debt. When companies such as Exxon Mobile, General Electric, et cetera, issue bonds, they may only pay 7% interest, while a much less stable start-up pays 10%. A general rule of thumb when investing in bonds is the higher the interest rate, the riskier the bond.

Who can issue bonds? Governments, municipalities, a variety of institutions, and corporations.

There are many types of bonds, each having different features and characteristics. A few of the most notable are zero coupon and convertible.

For new investors, one of the biggest risks of investing in bonds is something known as bond spreads. This huge hidden cost can result in thousands of dollars in losses if you trade your bonds frequently. Bond duration is also another risk.

You can find more bond information in the following articles and tutorials: