What Is a Balanced Mutual Fund

Post on: 25 Апрель, 2015 No Comment

Splitting Your Money Between Stocks and Bonds with a Single Mutual Fund

You can opt-out at any time.

Please refer to our privacy policy for contact information.

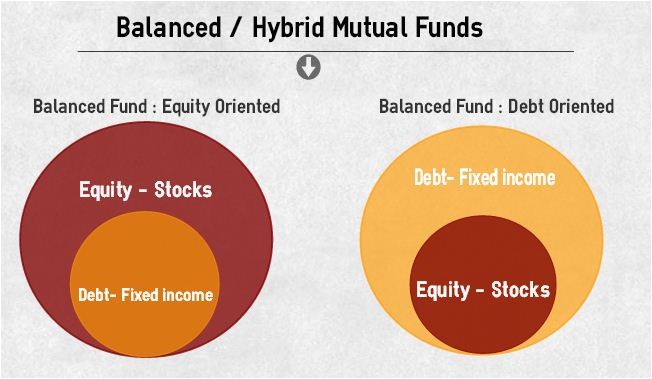

Mutual funds are classified by the type of investments they own. Some mutual funds only own stocks. These are called equity fund s. Some mutual funds only own bonds. These are called bond funds or fixed income funds. But some mutual funds own both, and these are called balanced funds or blended funds.

Why would a mutual fund want to own both stocks and bonds? Simple. Some investors don’t want to deal with choosing from a wide variety of mutual funds. They want a single, all encompassing choice that they can buy regularly, offers a decent chance at a good return on their money, and that is more likely to avoid major volatility when the world falls apart, even though this means less upside when we are in a bull market. A well-managed balanced fund has the best chance at achieving that because when the stock market falls, the bonds tend to hold their value better, and when the stock market rises, bonds yields are typically lower.

The biggest danger of a balanced fund in my opinion is the possibility that the expense ratio, which is the costs paid by the mutual fund on behalf of the mutual fund shareholders, might be higher than if you were to buy two separate funds, one an equity (stock) fund and one a bond fund. There are alternatives, though, thanks to low-cost companies like Vanguard. In fact, Vanguard developed the Vanguard Balanced Index Fund Investor Shares (ticker symbol VBINX), which keeps 60% of the money in U.S. stocks and 40% in U.S. bonds. With an expense ratio of only 0.25% annually, it is simply not possible to achieve any meaningful savings over such efficiency. Such a fund has been a good choice over the past decade because it has outperformed the Dow Jones Industrial Average as bond values acted as a safety cushion went the stock market crashed.

The entire idea of a balanced portfolio goes far beyond just balanced mutual funds. I was writing about a sample balanced asset allocation model portfolio on my personal blog almost a year ago, detailing how a certain type of investor might structure his or her holdings to protect against major fluctuations in any specific market. The biggest advantage of the entire balanced approach is psychological. Put in its most basic terms, investors are less likely to panic and do something dumb if their portfolio tends to hold its value. As irrational as it is, most investors would prefer slightly lower returns that came in smoother intervals than a higher return that came with massive drops and increases in value.