What Financial Advisors Do And How They Can Help You

Post on: 16 Март, 2015 No Comment

January 26, 2012 by Long Pham

A financial advisor is someone who analyzes a clients current situation, learns what their goals are, and develops a plan in order for them to reach that goal. Most often, financial advisors or financial planners focus on retirement, estate planning, debt reduction, and education savings. They help clients meet their goals by getting them on a budget, properly allocating investment portfolios, and calculating insurance needs.

What are the advantages and disadvantages to paying for the services of a Financial Advisor? Is it worth the money?

There are several things you have to know about financial advisors before I can answer this question.

- Qualifications Financial advisors come from all walks of life. Although firms are getting tougher with initial hiring requirements, almost anyone can call themselves a financial advisor. Look for someone who has an advanced degree or qualification, like a CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst). These organizations put candidates through a rigorous education and testing process, to include a minimum amount of work experience, before granting them the title. If a financial advisor is boasting one of these credentials, make sure to verify with the Certified Financial Planner Board of Standards or the CFA Institute.

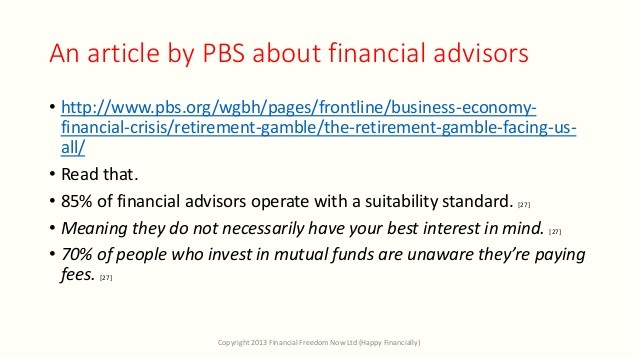

- Licensing Most financial advisors work for Registered Investment Advisors (think large brokerage firms or trading houses). As an agent, or representative, they must obtain a Series 66 and Series 7 registration by completing an exam. Basically, this grants them a license that tells you they have at least a minimum amount of knowledge in providing investment advice and holds them to a fiduciary standard. Fiduciary standard means that the advisor must act and serve in the clients best interest.

- Compensation — As much as financial advisors like to help people, they cant do it for free. A lot of people think that financial advisors are very wealthy, but very few are. The median wage, as reported by the BLS (Bureau of Labor Statistics) as of 2010 for a personal financial advisor is $64,750. That said, there are three primary ways a financial advisor gets paid.

- Commission Based These types of financial advisors earn their compensation when they conduct a transaction for clients. Sometimes, with very high net worth individuals, they earn a percentage of the assets they manage every year.

- Fee Based This is a hybrid of Fee Only and Commission Based compensation. The way this plan usually works is the client pays an agreed upon amount for the financial advisor to develop a plan for them. After the financial planner has explained the plan to the client, they are free to do with it as they please or they can continue working with the advisor to implement the plan. When clients choose to continue working with the advisor, they will end up paying commissions on the products they purchase through the advisor. Reputable advisors will give this information upfront to clients and will continue to work in the clients best interest.

- Fee Only This type of compensation is the most appropriate for the majority of people seeking the services of an advisor. Financial advisors using the fee-only method of payment work on a set hourly rate, or an agreed upon fee with a certain amount of hours available to the client per year. These types of advisors never receive any commissions or incentives from third-party groups.

The Advantages of Hiring a Financial Advisor

- Financial advisors can help you learn more about yourself and where you want to go in life by helping you define the risks you are willing to take and holding you accountable to your goals.

- They can help you balance your investments. This is huge for most people because people tend to have investments spread across several different 401(k)s and IRAs when switching jobs frequently.

- They can help you plan for the worst case scenario. Many people, especially those with families, are not very well prepared with life insurance, income-loss insurance, wills, etc. if the worst were to happen. Financial planners can help ease this burden off your shoulders and walk you through the difficult conversations youre not likely to have.

- They will get you on an appropriate budget in order to reduce your debt, save for retirement, or get you financially ready to get a new job or start a business.

- Financial planners can help you with tax planning. They will identify potential tax deductions that you may have missed, can set your payroll withholding appropriately (so you dont withhold too much and get a refund, or have to pay by not withholding enough), time investment purchases and sales to avoid or defer taxes.

- They can strategize Social Security retirement (if you qualify) in order to maximize your income. They can also help you plan your retirement account withdrawals so your savings will last your entire lifetime.

The Disadvantages of Hiring a Financial Advisor

I suggest reading Kiplingers Personal Finance magazine, my favorite personal finance magazine. It will give you a great introduction into the various ways you can plan for your goals and retirement. Every year they sponsor free financial advice from fee-only financial planning professionals throughout the country. You can call a toll-free number and speak to an advisor or visit the bus that tours the country. Details and dates can be found in the magazine.