What Does Mutual Fund Full Closure Mean Financial Web

Post on: 13 Июнь, 2015 No Comment

Full closure of a mutual fund means liquidation of the fund. This is similar to a bankruptcy liquidation for an individual or liquidation of a bank that is insolvent. The fund simply does not have the money to continue operating, so it must cease operation and sell off assets. Since the owners of a mutual fund are its investors, the investors are the ones forced to sell. If your fund experiences full closure, you will likely lose a large portion of your investment and may even owe taxes on capital gains.

Reasons for Mutual Fund Liquidation

The main reason a fund liquidates is it can no longer validate the expense of operations through investor fees. A fund incurs expenses to exist and trade on the market. The additional expense for each new investor is minimal, so large mutual funds are comparatively cheaper to operate than small mutual funds. This phenomenon is similar to diminishing returns, leading to success in large factories over small factories. When a fund starts to lose money, it will lose investors, and the cost of operating per investor will go up. Eventually, the fund may have to close if it cannot recover.

Losses Due to Liquidation

As an investor, you lose money when you are forced to liquidate your investments in a mutual fund. It is possible you realize selling at this exact moment is a bad option, but you will be forced to exercise the option nonetheless. The result is a loss in potential earnings, and you may even lose money all together. In this case, you would be selling for a net loss instead of a net profit. This is more of a likelihood with a new mutual fund that failed to pick up investors than with an established fund that simply cannot sustain growth.

Losses Due to Capital Gains Tax

You may have to sell for a net profit, despite losing quite a bit of potential profit due to selling at an inopportune time. Any time you net a profit on the sale of an investment, you are subject to capital gains tax. Most investors are careful with selling investments as part of an overall strategy to minimize capital gains. Unfortunately, if you are forced to sell immediately, your strategy can go out the window. You do not receive a tax break just because you were forced to liquidate. You owe taxes as if the decision was solely yours.

Moving Forward from Liquidation

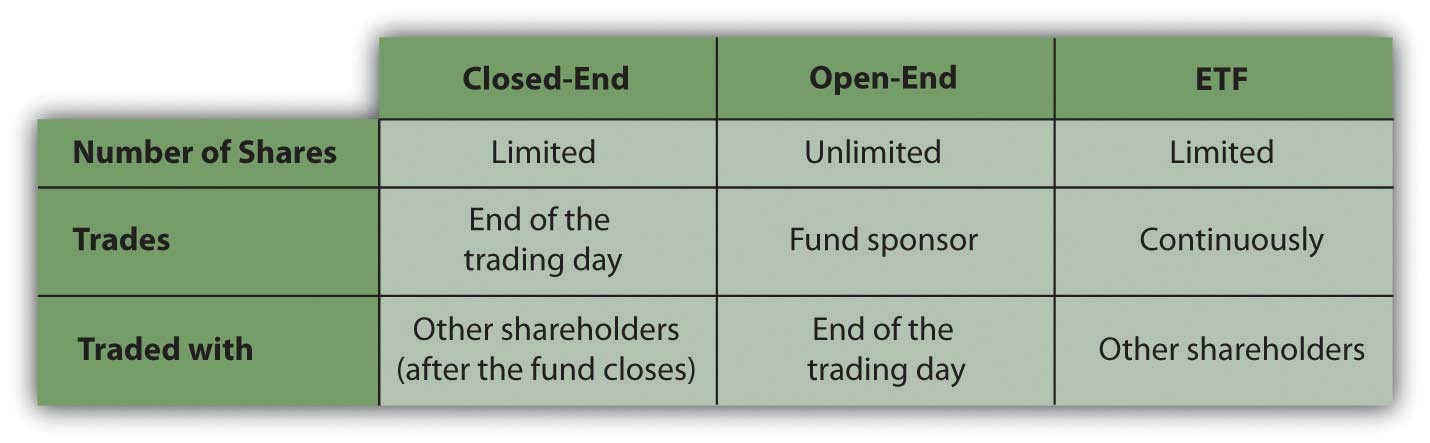

If you have to liquidate your fund, there is nothing you can do to prevent selling your assets. You will have to accept the loss and move on with your investment strategies. However, in the time leading up to a potential closure, you should exercise good judgment. If you are in an open-end mutual fund, you can exit at any point. Do so if you believe the fund is heading for liquidation. In a closed-end fund, consider whether the assets are currently selling at a premium or a discount. If they are selling at a premium, cash out now. If they are selling at a discount, ride out the losses.

$7 Online Trading. Fast executions. Only at Scottrade