What Did 2013 Mean for Fixed Income Markets

Post on: 9 Июнь, 2015 No Comment

As we approach the end of the year, it’s scorecard time once again time to see how our predictions and projections for 2013 worked out. In my first blog post of the year. I explained what I thought the macro environment would look like and identified 3 strategies that I thought investors should consider as a result.

So how did I do? Interestingly, the year shaped up very much like I had expected, but the markets moved in an unexpected way. Economic growth was modest, so that turned out to be the right call. And the Fed did maintain their quantitative easing program. continuing to purchase both US Treasuries and mortgage-backed securities each month.

I had expected that the Fed’s decisions would keep interest rates relatively low. However, the tone and guidance provided by the Fed changed, and that resulted in an increase in interest rates. After trading below 2% for most of the year, Bernanke’s comments on tapering in May caused the 10 year Treasury to shoot up to 2.7% by early July, a rise of 100 basis points in just 2 months. That sudden increase in rates has led to negative returns for many fixed income portfolios, especially those with more interest rate risk.

Given that backdrop, let’s look back at the three strategies I outlined for investors at the beginning of the year and see how I fared:

- Focus on municipals and credit. Of the two, credit performed better, and actually outperformed US Treasuries during the year. But both asset classes were hit hard by the increase in interest rates and subsequent investor withdrawals. This was especially true in municipal bonds, where we saw outflows in both mutual funds and ETFs over the year (driven not only by the rise in interest rates but also by heightened credit concerns on the back of the City of Detroit filing for bankruptcy and fiscal concerns in Puerto Rico ). Investors in less interest rate sensitive funds did better, with funds like the iShares Short-Term National AMT-Free Muni Bond ETF (SUB ) and the iShares Floating Rate Bond ETF (FLOT ) experiencing positive returns. Lower credit quality also fared well, like the iShares iBoxx $ High Yield Corporate Bond ETF (HYG ). Because high yield has exhibited some equity-like properties. this served it well in 2013 as it was pulled up by the strong equity market and outperformed all other fixed income sectors.

- Look outside the US. This ended up being a mixed call as developed markets performed better than most U.S. markets, with funds like the iShares International Treasury Bond ETF (IGOV ) down slightly. But emerging markets fell sharply, as evidenced by the negative returns of the iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB ). A combination of rising interest rates and a shift in EM sentiment hit the market hard in May and June and it never recovered.

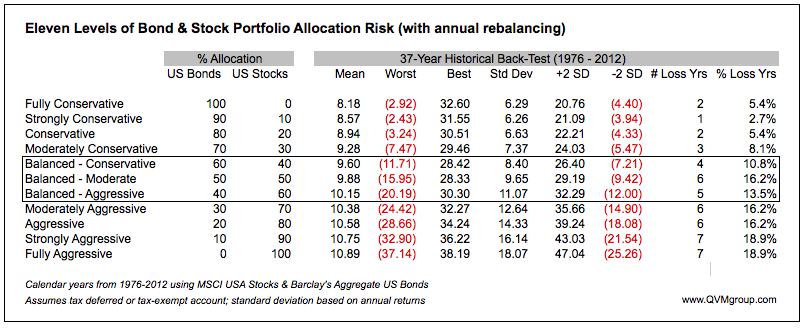

- Rethink the role of Treasuries . Here I stressed the importance of diversification and the value that Treasuries can play in balancing portfolio risk and potentially evening out returns. This turned out to be true, but not necessarily in the way you might have imagined. The S+P 500 is up an amazing 29.11% for the year (as of 12/11/13). The Treasury market has done its job as a diversifier, returning -1.97% during that same timeframe. It’s a hard pill to swallow in such a strong equity year, but remember that diversification is a long term value proposition . If the equity markets were down and Treasuries up, investors would feel very differently.

So what can we take away from the year? Three important lessons for investors really stand out:

- The most important decision for any fixed income investor is how much interest rate risk they take on. You can make a lot of smart decisions, but if you get the rate call wrong it can undo everything else. If you are uncomfortable with that risk then don’t make any extreme interest rate bets with your portfolio.

- Forecasting the market environment is not just about market levels; sentiment also plays a huge role . With the Fed still very active with QE, what they say is in many ways just as important as what they do. Pay close attention to Fed messaging and how it evolves in 2014, because that could drive investor behavior and interest rate movements.

- Diversification is a two-way street. Yes, a diversifying asset can help moderate portfolio returns through time. However, by definition the diversifying asset should perform differently than other assets in your portfolio meaning sometimes it will provide relatively positive returns, and sometimes it can drag portfolio performance. The latter was certainly the case for Treasuries in 2013. But over long periods, diversification can help produce higher risk-adjusted returns than a less diversified approach.

So what’s on tap for fixed income in 2014 and, perhaps more importantly, can I do a better job of predicting investment opportunities next year? I will cover this in my next post.

Matt Tucker, CFA, is the iShares Head of Fixed Income Strategy and a regular contributor to The Blog . You can find more of his posts here .

Past performance does not guarantee future results. For standardized performance for HYG, click on the ticker above. Index returns are for illustrative purposes only. Indexes are unmanaged and one cannot invest in an index. Diversification may not protect against market risk or loss of principal.