What are the best mutual funds in the Philippines

Post on: 16 Март, 2015 No Comment

There are different types of investment funds currently in the Philippines. We need to know the characteristics of each type to see that our needs and personality. There are four basic types of investment funds, namely, the activities of la, la, la capital and money market. We are the first three types and a list of the best in Argentina.

Another term for equity funds equity funds. As an end in itself, consisting ofInvestments in shares of pure client. And 'how to invest in the stock market indirectly. Rather than support the monitoring of the stock market on a daily basis, a management company or fund. Investing in mutual fund shares is very risky, since the results on the stock market is very volatile. However, it is true the saying The bigger the risk, the higher the return. In most cases, those that invest in long-term actionsIf investors have extensive experience in creating long-term investment. In the Philippines, the investment funds in the ranking of the best equity Phil, Phil PSE Equity Index, the first Metro Save and Learn Equity Securities Index, Poland, Phil strategic growth Amir, Germany, Sun Life Prosperity Phil equity, equal opportunities and ATR KimEng Philippines DWS German l '.

Mutual

Pension fund is a different way if the Fund for a financial vehicle very Bond Fund is the opposite of riskthis decision. Instead, the funds invested in equities, clients of investment funds in fixed income securities such as bonds, treasury bills, treasury bills, notes and bonds invested Agency Revenue Bonds. If pension funds were introduced in the Philippines, many conservative investors, such as practical as it was in a vehicle of interest. However, changes in the decisions of the Securities and Exchange Commission has amended the financing of these vehiclesBe the interest of a mark. In simple words, pension funds varies, but is minimal and nothing compared to the volatility of equity funds experienced. In the Philippines, is a popular means a pension fund, because the more that most Filipinos are very cautious investors. The best funds in the ranking is Prudentialife fixed-income securities, fixed income Cocolife, Sun Life Prosperity GS, SunLife Prosperity Bond, James Bond Phil Amir, Weight Clip-Bono, the first Metro store in fixed income and equity obligations Phil weight, Philippines DWS German pension and mutual Ekklesia.

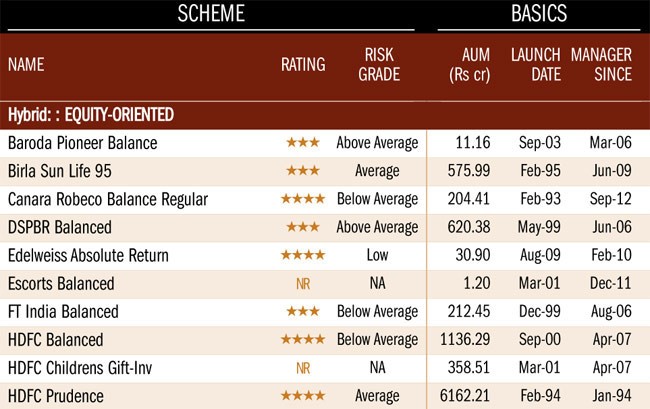

An investor who is conservative, but I would try to fund an aggressive form of balanced mutual funds that want to try. For balanced funds, the investor may have the best of both worlds. Fifty per cent of the balance of the fund invested in the stock market, and invests the other halfStocks. In other words, when should the stock market, and then the balance is too high for investors. At the same time, as bond yields positive results for investors should be too high. In short, the result of the balance of funds to a large extent on the actions of the shares and bonds. The best mutual funds in the category of balanced funds include an increase in the first record and learn Clip-MetroSustainable, Inc. Phil Amir, Inc. GSIS Mutual Inc. Kabuhayan MFCP, sustainable Optima, Sun Life Prosperity Balanced Galleon and First Family.

It 's true that the type of fund to invest should also depend on the nature of your personality. If you are aggressive, then the ideal place to invest in equity funds. If there are conservative bond funds are best for us. If we are the best of both worlds, and then the agent is very closerecommended.

What are the best mutual funds in the Philippines?