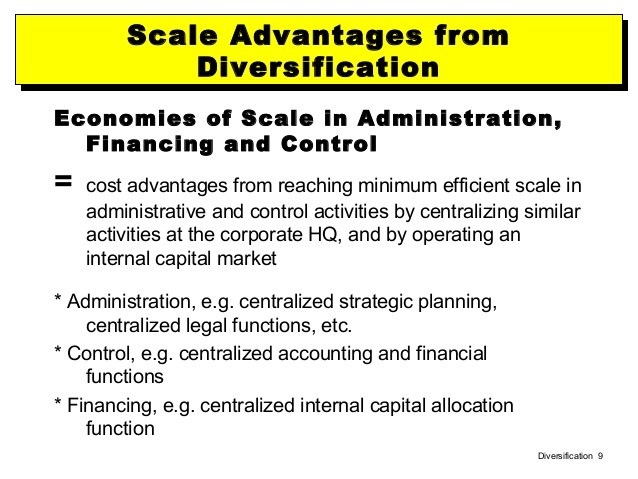

What Are the Advantages of Diversification

Post on: 15 Август, 2015 No Comment

These 10 animal facts will amaze you.

Adorable animal families that will make you aww.

These 10 facts about space will blow your mind.

There are several advantages of diversification in a portfolio. The primary advantage is that it reduces the risk, the second primary advantage is it allows the portfolio investor to maximize the return on their investments. Another advantage of diversification is that it allows investors to reallocate or re-diversify their portfolio investments as their financial goals change over time.

One of the most important advantages of diversification is that it reduces the overall risk of the portfolio. Diversification requires the investor to invest their money in different types of investments. Some of the most popular investment options include stocks, bonds, mutual funds and certificates of deposit. While these are some of the most popular investment options, this is certainly not a comprehensive list of options.

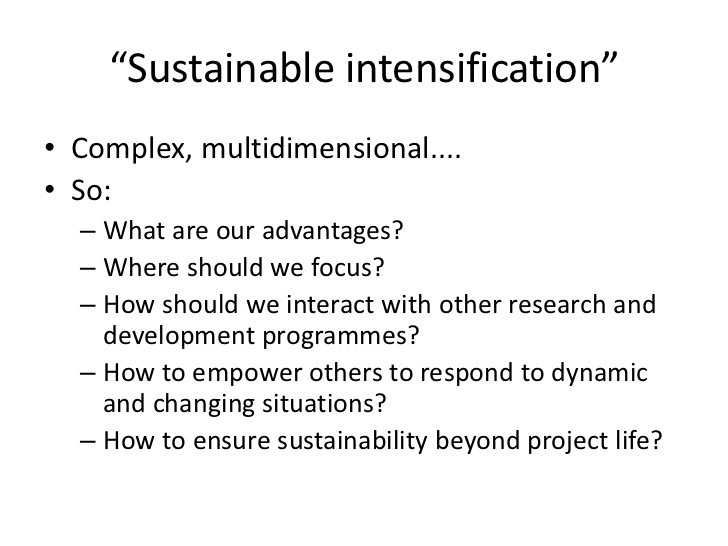

Depending on the goals of the investor, a diversification plan can be put in place to help the investor reach their goals in the time frame that the investor has set. Diversification is not a set mold, where a certain percentage should be invested in stocks, a certain percentage in bonds, a certain amount mutual funds and a certain amount in certificates of deposit. The percentage varies according to the goal that each individual investor has.

In the end, the advantages of diversification include balance. Diversification balances the investment account to reduce risk. This means that if the stock portion of the portfolio is performing poorly, the rest of the portfolio is keeping the portfolio at the same value or compensating for the loss in stock value with one or more of the other types of investments doing well.

The second of the advantages of diversification is that it permits the investor to maximize the return on their investment portfolio. Since the portfolio is balanced and the money is spread out in different types of investments, when a particular investment is doing well, the investor benefits.

The third of the advantages of diversification is that nothing is set in stone. Investors should assess the portfolio diversification on a quarterly, semi-annually or annual basis. During this evaluation, the investor can decide if their investment goal has changed. If so, then they may reallocate or re-balance the diversification of the investments in the portfolio to meet the new goal.

It may also be that a specific sector of the portfolio has been performing poorly. The evaluation process allows the investor to re-balance the portfolio to get out of poorly performing investments and move the money into investment options that have the potential to perform better.