What Are Mutual Funds in India

Post on: 26 Август, 2015 No Comment

Last Updated On: 21/01/ 2015

When ever I talk to a normal Indian who is not related to financial field, one of the common question they will ask is What are mutual funds and how mutual funds work in India. Honestly, its not a rocket science and anyone with decent knowledge about fiance basics can learn,

Once upon a time..

..all villagers who hail from one of the intelligent part of country, gathered during evening hour, to discuss their day to day chaos.

The problem in hand today was that each of them had small money each day but did not know how to make best use of it. The money was so small individually that none of the scheme accepted that money as investment. The Panchayat decided to form a Group who would solve this problem.

The Solution

The Group immediately proposed the solution. Lets combine the money, and invest this money and return shall be divided as per the proportion of investment. Villagers hooted. Wow good solution, but where would you invest the money? The group had some knowledge that money could be invested in shares as but had a faint idea about it. Someone suggested lets lend the money to someone and earn interest on it. But overall no one had the knowledge, so they decided to contact a wise person in city who was well versed in the field of investments. So this, Wiseman accepted the challenge and came to the village.

But FEW VILLAGERS had some doubts on this idea. Firstly, who would keep a check on the learned person and how they know that their investment is making money or running loses. The concerns were genuine and again the Group started thinking. They came out with Rules on investing the money. The Wiseman had to take a prior approval from the group before investing and a few other rules on managing the money. But second concern still remained, which was solved by the wiseman himself. He said each day I would calculate & declare the value of investment at a fixed time.

Beginning of a New Era

The scheme was launched and the news spread to all parts of country. People from other villages were also allowed to join. Soon the group realized that they had to manage the record of so many people and solve their queries. They appointed a team of literate people and called it Record Team who would just keep the record of the investors. Now the learned man complained that his entire day into managing the investments, taking care of the investments or getting the investments to the village or to send the invested assets to the seller. Another team was appointed to assist him. This was called the Caretaker Team .

Up till now the group was managing this show on funds issued by the Panchayat. But, now Panchayat told the Group, since the scheme is a hit why dont you start charging fees from the investment and earn on your own. This was a good idea Group laid rules for charging the Fees on the investments. And through these Mutual efforts the villagers of this country had a prosperous life.

Why Mutual Fund Emerged

Actually through this analogy, we have just understood how a Mutual Fund works. As the name say, it is a mutual way of investing in Markets. They emerged because of two concerns faced by the Investors. First was the Quantum of investment, as people had small money to save on day to day or month on month basis(5 Reasons to invest Systematically ). Second was the knowledge part as each of us have different education and profession, so we find our selves ill equipped when it come to investment Markets. So each of us need the experts help during the investment process.

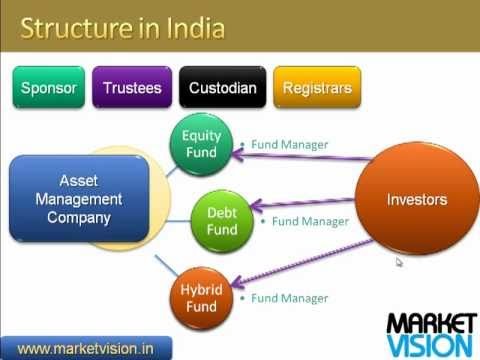

Organisation of a Mutual Fund

In the above story the villagers are each of us and the Group is the Asset Management Company(AMC). who runs the entire affairs of the mutual fund. Since this group is appointed and answerable to the Panchayat. the Panchayat is the Sponsor of this Mutual Fund. The Wiseman appointed, is the Fund Manager and his team who would take decisions in investing in different asset classes. The Rules laid are nothing but Objectives. which are set for each schemes and the basic guidelines about the investment made under the scheme(Fund). The Value of investment that the wise man is reporting is the Net Asset Value or the NAV. NAV is the unit value of the asset and is calculating by dividing the assets by the numbers of unit holders.

The Record Team is Registrar & Transfer Agent or R & T for short. They keep the record of the investors and take care of the queries of the units holders. And finally, the Care taker Team is the Custodian. who shoulders the responsibility of keeping records and possession of all the physical asset of the scheme. And Fees that the scheme is charging are called the Asset Management Fees. All villagers were Investors. Simple isnt it?

Now, through the picture you can very well correlate the working of the mutual fund.

Benefits of Mutual Funds

Now lets discuss the benefits of investing in mutual fund. The biggest advantage is the Diversification. Each units holder contributing in small proportion becomes the owner of a large portfolio comprising of different assets. He therefore minimizes his risk by dividing his investments in many securities. Other advantage are, though mutual fund you and expert managing your investment. Also you can invest in small amounts. Since this is a collective investment, the cost of management is very low and most important the liquidity aspect. Mutual Funds have schemes as per the time horizon of your investment. So you can get money back when the need arises.

In subsequent series, we shall learn more about Mutual Funds benefits, types and how to choose & invest in these schemes.

Please add your comments.