What Are Load NoLoad NTF (No Transaction Fee) Mutual Funds

Post on: 10 Август, 2015 No Comment

What are NTF Mutual Funds and How Do They Work?

A mutual fund that is referred to as a “NTF,” simply means that there is no transaction fees associated with the purchase of the fund. They are most often available to investors through a brokerage house. These funds have no commission fees changed when transactions are put through, which is one reason they are popular with investors.

Investors like this type of fund because they can buy into the mutual fund and not incur any commission fees to buy or to sell them. It’s most often used by people who have limited funds to invest and gives them an advantage over other funds where commission fees are often high.

Large brokerages houses are usually the companies that offer NTF funds, and they receive remuneration from the mutual fund organization that manages the fund. This may also be referred to as marketing fees.

So how do NTF funds make money? Like all other mutual funds, these funds have expenses associated with owning them. They may also have different types of restrictions that can make them undesirable for the average investor. Sometime a no-load fund may be more beneficial to your portfolio due to lower expense ratios. Over the long term this may be a more cost effective alternative.

What’s A Difference Between Load and No Load Mutual Fund?

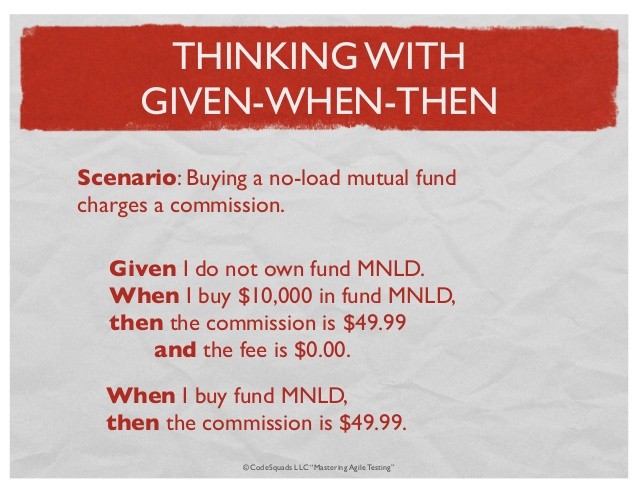

Before buying into any fund, it’s important for the investor to understand what a load and no load fund entails. No load mutual funds are funds that don’t charge customers a fee when they buy or sell them.

Funds that are referred to as load fund will have some aspect of a sales fee tied to the fund. It’s basically a sales charge that you must pay in order to buy the fund. Once you buy the fund you’ve immediately reduced your capital. Annual fees will most likely be low and in some cases, depending on the amount of capital you have in the fund, you may qualify for a reduction in fees.

Most financial advisors will not recommend these to their clients, especially if there are other options available where the investor could receive the same return without having to pay an upfront fee. A good advisor will help you look for a comparable fund without the front load fee. It’s important to remember that the advisor may not be as objective as you might like, due to the fact they are receiving a commission on the front load fund. If you feel this may be the case then it’s wise to get a second opinion. The front load fees may average 4%-8% of your investment. It’s important to remember that there are other options available to you as well as other advisors.

Front End, Back End, Level Loaded Mutual Funds

On the other end of the scale, there are funds that are back end loaded funds. They are like front load funds but the fee part comes when you go to sell the fund. The amount you will be charged may vary and with some funds, depending how long you have kept your money in the fund, there may be no charges at all. Minimum holding periods can vary from one fund to another. The longer you hold on to the fund the lower your fees may be. You will be assessed charges based on the amount of money in the fund when you go to withdraw from it. This also has a way of making investors think twice before removing money. This type of fund also has fees that are usually higher than front load fees. These fees are referred to as “Annual Asset Based Management Fees.”

There are ways to tell if a particular fund has sales charges. With mutual funds one can tell by the type of class they are in. Class A funds are normally front loaded, Class B are back loaded or deferred and Class C are referred to as level loaded funds.

In What Mutual Fund Should I Invest?

They type of fund you choose is going to depend to some extent on what your investment goals are, and how long you plan to be in a particular type of investment. Because there are so many variables, wise investors will usually hire an advisor, for a fee, and discuss their situation with them. In this case you don’t need to be concerned that the advisor has any other agenda, other than helping you to make the best investment decisions possible. Mutual funds are not complicated to understand but it’s important to note, that with thousands of funds available, investment advice is very beneficial.

This article was updated on 10/30/2015.