What are Exchange Traded Funds (ETFs)

Post on: 11 Июль, 2015 No Comment

Exchange traded funds (ETFs) are open-ended investment companies that own pools of securities that form the underlying value of the funds’ shares, and whose shares are traded like shares of common stock. These funds are usually, but not necessarily, designed to track specific indexes of stocks, bonds or commodities. Although ETFs are like mutual funds in that investors can buy shares of a pool of assets, the similarity stops there.

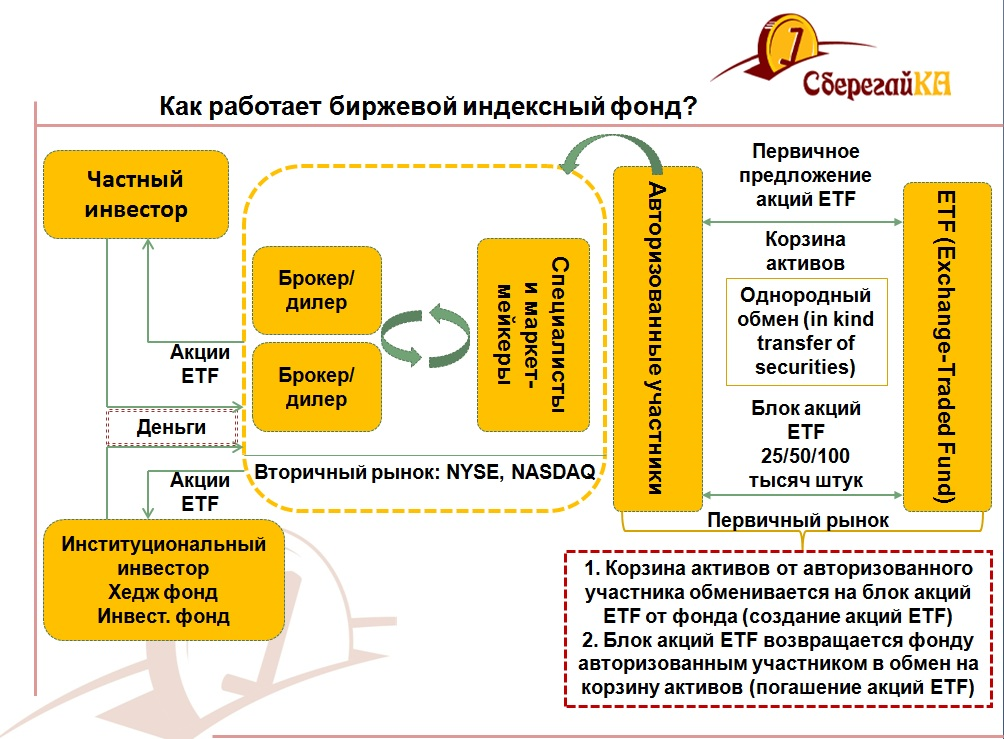

Large blocks of Exchange traded fund shares called creation units are sold to institutional investors in the primary market who in turn sell individual shares to other investors in the secondary markets. With the exception of large institutional investors, subsequent trading of the shares is done only through brokers, in contrast to mutual funds, whose shares can be purchased and redeemed by dealing directly with the mutual fund companies. In the secondary market, market makers create and redeem ETF shares in response to demand. Also, institutional investors can respond to increased demand by creating new creation units by purchasing shares of the underlying securities in proportion to the securities that comprise the underlying index and delivering those securities to the investment company in exchange for newly created ETF shares, thus expanding the pool of underlying securities as new units are created.

Exchange traded fund shares are traded throughout each trading day in the same manner as common stocks, that is, their price varies throughout the day rather than being computed at the end of each trading day, and, as with stocks, there is a bid/asked spread. The spread is a sales fee that compensates market makers for providing liquidity in the market, and investors also pay the brokerages transaction fees for their trades, thus adding a significant cost to the shares of ETFs. However, these costs will be offset by ETFs’ relatively low management fees if the shares are held for a sufficiently long period of time.

Although the number of shares of ETFs varies with demand for the shares, the mechanism for achieving equilibrium is different than that of mutual funds. Market makers can create and redeem shares in response to disparities between supply and demand, thus keeping share prices at or near NAV, which is necessary to ensure that the ETFs perform as expected, i.e. track their underlying indexes.

Exchange traded otes (ETNs) should not be confused with exchange traded funds, as they are entirely different instruments. ETNs are essentially debt securities issued by large financial institutions and as such, they must be evaluated with consideration to the issuing institutions’ creditworthiness, which is a major concern in times of financial and economic turmoil.

The primary advantages of exchange traded funds over regular mutual funds are that ETFs give investors more control over the timing of capital gains and, thus, the incurrence of the associated tax liability, facilitate taking short positions, and in some cases, leveraged positions. These advantages make ETFs an appropriate alternative to regular mutual funds for some investors.

1 2 3 4 5 6 7 8 9 10 11

Section Intro Next Section