What are Emerging Markets what are their prospects and how to access them

Post on: 16 Март, 2015 No Comment

What are emerging markets?

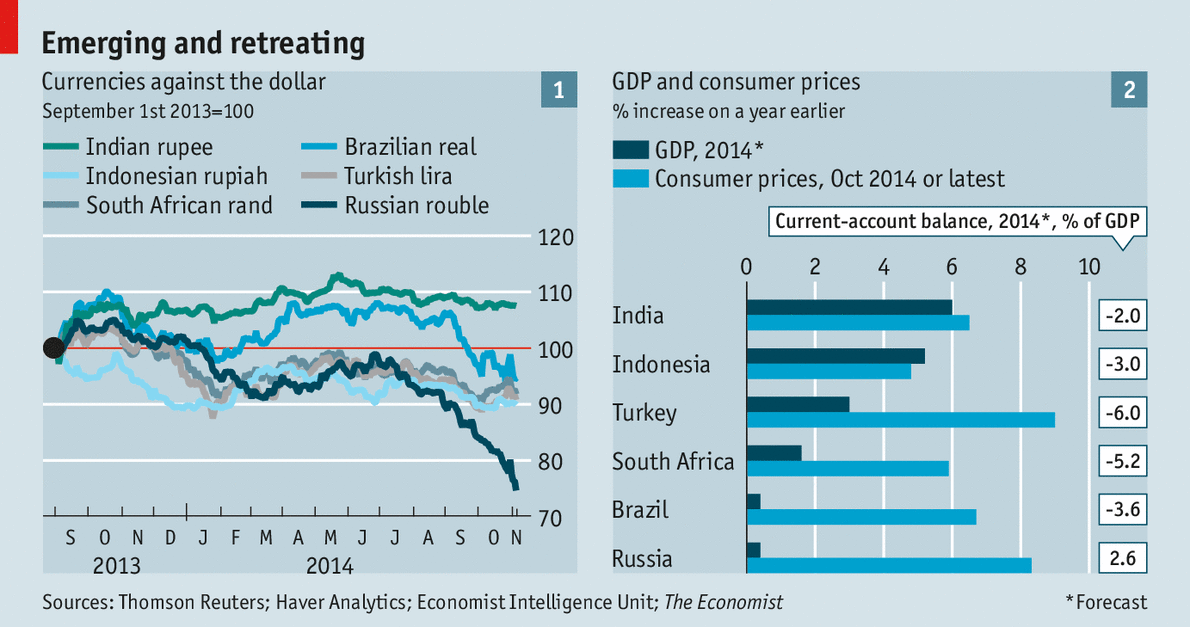

Global emerging markets offer big opportunities in trade, technology transfers, and foreign direct investment. The five biggest emerging markets according to the World Bank are China, India, Indonesia, Brazil and Russia. You may have heard of the BRIC economies – these are Brazil, Russia, India and China.

Other countries that are also considered as new emerging markets include Mexico, Argentina, South Africa, Poland, Turkey, and South Korea. Each of them is important as an individual market and the combined effect of this group as a whole will, at some point, change the face of global economics and politics.

What makes them different?

Emerging markets tend to have four major characteristics. First, they are regional economic powerhouses with large populations, large resource bases, and large markets. Second, they are transitional societies that are undertaking domestic economic and political reforms.

Third, they are the world’s fastest growing economies, contributing to a great deal of the world’s explosive growth of trade. By 2020, the five biggest emerging markets’ share of world output will double to 16.1 percent from 7.8 percent in 1992. They’ll also become more significant buyers of goods and services than industrialized countries. Fourth, they are critical participants in the world’s major political, economic, and social affairs. They are seeking a larger voice in international politics and a bigger slice of the global economic pie.

Of course this does not mean that they don’t have problems – they still have their old economic and political systems in place. However these should change with time as governments redefine their role. They may also have to contend with and overcome various forms of corruption.

Another challenging task is to undertake structural reforms with their financial, legal and political systems to guarantee a disciplined and stable economy that is relatively free of political disturbances and interference.

It is for these reasons, amongst others, that emerging markets are seen as high risk. So perhaps we can differentiate between stable emerging markets, such as BRIC and new emerging markets.

What are the prospects for emerging markets?

There is no doubt that emerging markets will be very important in the future growth of world trade and global financial stability, and will probably become critical players in global politics.

They have huge potential for world trade and also for stock market investors who wish to take some risk to see good returns. They just need to become politically and economically stable!

Probably the best way for ordinary investors to make an investment in global emerging markets is through an emerging market fund or perhaps an emerging market etf (exchange traded fund). Direct stock market investment is also possible as some of the larger companies in the emerging market will be listed on the major stock exchanges.