Wells Fargo Co and US Bancorp Slash Dividends

Post on: 8 Июнь, 2015 No Comment

Investment & Financial Knowledge For The Little Guy [Investing, Economics, & Financial topics explained]

Wells Fargo & Co and US Bancorp Slash Dividends

This week the US financial sector has been under extreme pressure, with additional government intervention to help Citibank and AIG, among other things. This week weve seen one of the two strongest and best managed big banks slash their common share dividends. Wells Fargo & Co (WFC ) and US Bancorp (USB ) both cut their dividend to 5 cents from 34 and 42 cents.

A mistake of most people who invested in these banks is they probably placed a really high importance and had a large expectation of receiving the dividend. If that was the case, they would be severely disappointed. My question to them would be, given the financial condition of the economy, why wouldnt you think that the dividend would not be cut if the economy tanks? The probability was pretty high that it could be cut. But for many people that thought never crossed their mind, simply because they assumed that the strongest banks would never need to.

In investing, never say never! You need to be realistic & accept the risks. Many Wells Fargo and US Bancorp common stock holders really should have purchased the preferred shares if their expectation was to receive dividends. At current levels the preferreds are yield around a hefty 8-9%. But the investor must realize that even with preferred shares, the dividend could also be halted, but conditions (depends on the specific preferred share) may stipulate missing payments would be cumulative. The investor must also consider that with preferred shares, they have less market price appreciation like common shares do, mainly due to redemption price and the dividend payments being fixed (they will never increase).

However, if the investor invested in Wells Fargo and US Bancorp because of their business prospects, then those investors have not been disappointed yet. Both Wells Fargo and US Bancorp have acquired many businesses in order to come out of the recession much more competitive than other banks. Wells Fargo has quietly acquired many insurance brokerages in the last year with little headlines in the news. Moves that I think are great. Their acquisition of Wachovia is another story, its too early to say whether gaining all that market share was worth the price they paid. When investing in stocks and other businesses, we have to be able trust the management team to make the right cost-benefit moves. Like Ive said before, it is like investing in a local small business, you need to be able to trust your partner if you arent working there. Considering that Wells Fargo is known to be careful and conservative, Im confident they made a good move. As a business minded investor I think that the move will payoff when the economy recovers.

US Bancorp, has made two significant bank operation acquisitions in Downey Savings & Loan Association, F.A. the primary subsidiary of Downey Financial Corp. and PFF Bank & Trust, a subsidiary of PFF Bancorp Inc. Their management team is much like Wells Fargos, so I am also confident they made a good business decision.

Ive addressed the issues of the current banking problems in my Investment & Economic Outlook 2009 article, so Ill quickly summarize that the problems now are fueled by good loans that are turning bad. Roughly 8 percent of all US jobs are in financial and insurance industries, which has already seen thousands of job cuts. Other sectors have experienced similar cuts. US unemployment is in the high single digits and likely to grow to the low double digit mark. Without a job, people cant make mortgage & loan payments. It should not come as a surprise, given that the economy is in a recession. I hope that other investors are not surprised that even good banks would face these types of difficulties. Even banks here in Canada are feeling the economic affects of the downturn, as they have increased their loan loss reserves significantly.

Remember all investments whether it be common shares, preferred shares, bonds, mutual funds, real estate, business ventures, etc are all tools. You need to know which tool is the right one for your intended purpose, how to use them, when to use them, for how long they should be used for, and what will affect their effectiveness at a given time. The tools used should also fit the problem solving plan (big picture), which brings up another issue. Most average investors dont even have a plan, so they end up using the investment tools in a way that doesnt achieve any particular goal.

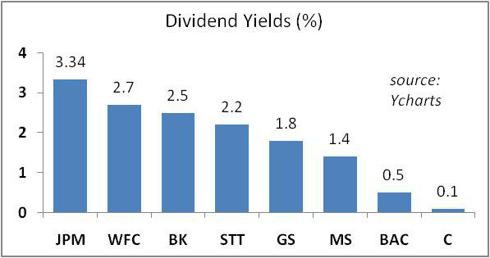

If you havent already, I suggest reading the Bank Valuation series, and particularly Bank Valuation III (October 2008) which is discusses metrics related to dividends. In that article, I mention the ratios & numbers to look at as well as issues that an investor would need to take into account which may affect dividend payouts. I also used the situations of Wells Fargo and Bank Of America as examples.

Feel free to post questions, comments, or topic suggestions.

Thanks & Happy Investing!

The Investment Blogger