Warren Buffett Funds Global DonutBurger Behemoth

Post on: 15 Июль, 2015 No Comment

26 Aug 26, 2014 2:42 PM EDT

(Corrects footnote 2 for 2014 call in 2018 Burger King bonds.)

Burger King Worldwide and Tim Hortons announced their actual deal this morning. and it is a disappointment, insofar as each brand will be managed independently, so there will be no donut burgers, or at least that’s the official line for now. A new company will be formed, which does not currently have an official name but I will push on in assuming that it’s New Burger Tim, and it will be based in Canada, to profit from Canada’s lower and more territorial tax system. New Burger Tim will acquire Tim Hortons for a mix of cash and stock, and will acquire Burger King for a mix of stock and strangeness.

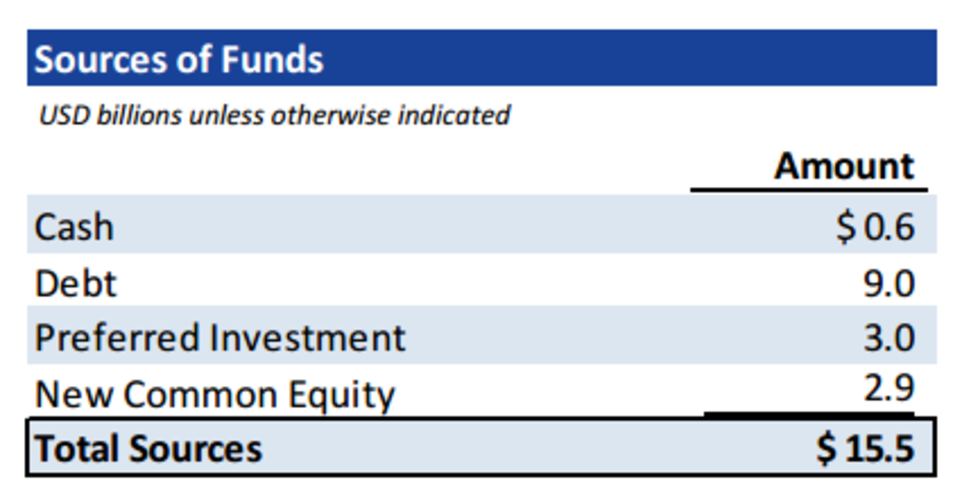

First, though, the cash: Of the $12 billion in financing for the deal, $3 billion will come from Warren Buffett’s investment in preferred stock of Burger Tim. 1 My toy model for 3G Capital. the Brazilian private equity firm beloved of Buffett that owns most of Burger King, is that it can do leveraged buyouts that are more leveraged than anyone else’s, because the extra leverage comes from Warren Buffett. So on today’s conference call executives said that Burger Tim will be have a leverage ratio (measured as the ratio of bank loans and bonds to earnings before interest, taxes, depreciation and amortization) of roughly 5 times, more or less in line with its franchise-restaurant peers. But it will be 7 times levered through the preferred stock, which only sort of counts as leverage.

I mean, it’s not leverage in the sense that it’s not debt: Burger Tim never has to pay it back, and doesn’t even really have to pay interest on it. (On the call, executives said that the preferred will pay or accrue at 9 percent, which suggests that it won’t always pay cash dividends.) But it is leverage. in the sense that it’s funding a portion of the deal at a fixed cost and leaving the upside to equity investors. So Burger King is paying a juicy price for Tim Hortons. and can afford to in part because of that extra Buffett leverage, available to 3G and its portfolio companies but not more broadly. If you or I were just doing a leveraged merger, we’d raise as much debt as we could, but if we then went out to the market to try to place $3 billion of preferred stock, we’d hear crickets. There’s just not that much demand for preferred stock, outside of Warren Buffett.

For 3G and Burger Tim, the advantages are obvious. For one thing, extra leverage. For another, there’s the Buffett halo, which should help Burger Tim to sell the $9 billion of debt it needs to get the deal done: Who wouldn’t want to buy debt that’s senior to Warren Buffett in the capital structure? But also, the preferred actually looks sort of cheap? Buffett will be getting a 9 percent dividend. which is more expensive than debt, but cheaper than, you know, private equity capital. Also frankly not that much more expensive than debt, either. 2

I’m less sure that I see the appeal for Buffett, who’s buying risky perpetual securities at sort of a generous rate, but there are some benefits. I mean, 9 percent is 9 percent, and in a low interest rate world I guess that’s attractive. Especially since Buffett’s risks on this deal are perhaps lower than they seem. He trusts 3G. for one thing; for another, if this thing does go south, 3G has every reason to protect Buffett because he’s such a big part of their other past and future deals. Also, unlike debt financing, Berkshire’s preferred stock is probably eligible for the dividends-received deduction. meaning that Berkshire’s tax rate on the preferred-stock income will be considerably lower than it would be on a straight debt investment.

Speaking of taxes! We all expected this deal to have some tax avoidance, but the nice surprise is that the avoidance is so comprehensive. From the press release (emphasis added):

Upon completion of the transaction, each outstanding common share of Burger King will be converted into 0.99 of a share of the parent company and 0.01 of a unit of a newly formed Ontario limited partnership controlled by the new parent company. however, holders of shares of Burger King common stock will be given the right to elect to receive only partnership units in lieu of common shares of the new parent company, subject to a limit on the maximum number of partnership units that can be issued.

Shares of the new parent company will be traded on the New York Stock Exchange and the Toronto Stock Exchange and units of the new partnership will be traded on the Toronto Stock Exchange. The partnership units will be convertible on a 1:1 basis into common shares of the new parent company, however, the units may not be exchanged for common shares for the first year following the closing of the transaction. Holders of partnership units will participate in the votes of shareholders of the new parent company on a pro-rata basis as though the units had been converted. 3G Capital has committed to elect to receive only partnership units .

The transaction is expected to be taxable, for U.S. federal income tax purposes, to the shareholders of Burger King, other than with respect to the partnership units received by them in the transaction.

Huh! As we discussed. this deal is a tax inversion: New Burger Tim will not be a U.S. corporation and will not owe U.S. taxes on its income earned abroad. One downside of inversions — explicitly put there by Congress to deter inversions — is that they are taxable to U.S. shareholders when they happen. Usually if you do a merger in which your shares remain outstanding, that’s not a taxable event until you sell them. But if that merger is an inversion, the gain on your shares is taxable immediately, because Inversions Are Bad.

Usually companies don’t care about this, because — as Steven Davidoff Solomon explains here — most of their shareholders tend to be mutual funds that are measured on pre-tax performance, so they don’t complain. Burger King, on the other hand, is majority owned by 3G, which is. well, a Cayman Islands private equity fund mostly owned by Brazilians? Apparently though it has enough American investors to care about tax efficiency. It’s planning to take only partnership units, Burger King has said explicitly that the purpose of the partnership structure was to defer taxation, though I cannot for the life of me figure out how it works. 3

U.S. shareholders of Burger King who are not 3G, on the other hand, can defer up to 1 percent of their taxes by electing partnership units, which seems somewhat ungenerous. (The stock has more than doubled in the last two years, so there are gains to be taxed.) But because 3G is getting only partnership units, and because 3G will own 51 percent of the combined company. the result is that Burger King will do an inversion where a majority of its U.S. shareholders won’t owe taxes.

It’s a nice coda to what we talked about yesterday. Burger King is doing an inversion that would be allowed even by the next generation of anti-inversion bills pending before Congress. But it’s also doing an inversion that gets around the penalties of the last generation of anti-inversion rules. It’s an immaculate inversion! No wonder Warren Buffett likes these Burger King guys. They know what they’re doing.

I ignore existing cash and New Common Equity (issued to Tim Hortons shareholders) as financing sources, though you could count them if you want. About $4.6 billion will go to repaying existing Tim Hortons ($1 billion) and Burger King ($3.6 billion) debt; the other $7.4 billion will be used for the cash merger consideration.

2 Some numbers: Burger King said on the call that the bank debt would price at around Libor plus 300 basis points, with the bonds a bit behind that. But, lo, Burger King has some bonds due in October 2018 (CUSIP 121207AA2) that trade and yield around 8 percent, or roughly 650 basis points over swaps. So. somewhere between 350 and 650 basis points over swaps then?

[Update: The 2018 bonds actually have a makewhole call on October 15, so that 8 percent yield to maturity is misleading; it’s really a much lower yield to two months from now. So they’re not particularly informative. Better to use the numbers mentioned on the call, that is, a bit back of Libor + 300.]

There aren’t a lot of burger-industry preferreds, but you can do some eyeballing. JPMorgan has preferreds that trade around a 6.3 percent yield. It also has bonds due May 2024 that trade around 3.4 percent. Figure Burger King’s bonds should trade at 350 basis points over swaps and then you get a hypothetical 10-year bond yield of around 6 percent; if the preferred should be some 300 basis points back of the bonds, then you get about a 9 percent fair yield on the preferred. [If you use the 8 percent four-year yield as a starting point then you get about a 12 percent preferred rate.]

Obviously, there’s a tax benefit to debt that you don’t get with preferred; at a 25 percent effective tax rate a 9 percent preferred coupon is equivalent to a 12 percent debt coupon. But why should that be Buffett’s problem?

3 I mean, the rule that requires U.S. taxpayers to recognize gain on inversions works by saying that the foreign corporation shall not, for purposes of determining the extent to which gain shall be recognized on such transfer, be considered to be a corporation, so just using a non-corporation in the first place is a pretty mysterious solution to the problem of gain.

To contact the writer of this article: Matt Levine at mlevine51@bloomberg.net.